High-yield bonds have never paid less. Which is too bad, because let’s be honest—dividends are the reason we income investors wade in 'junk bond' waters in the first place.

Fortunately, by being selective rather than lamestream, we can double our existing high-yield bond dividends. Nothing fancy, either. We sell the unselective ETFs and buy the ones with proven bond investors at the helm.

Before starting, let me make one huge point. It is true that almost all actively-managed equity mutual funds aren’t worth the management fees investors pay. But some actively-managed bond funds most definitely are worth it.

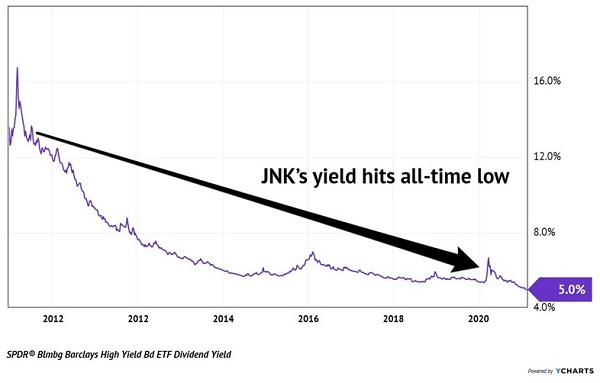

The ETFs we would be selling are the two most popular high-yield bond ETFs. Their dividends are at all-time lows today. The first, the SPDR® Bloomberg Barclays High Yield Bond ETF (NYSE:JNK), now pays only 5% on a trailing basis:

Yields in Low Places

But the past 12 months are likely to look generous when compared with the next 12! The fund’s SEC Yield, a more accurate estimate of what the fund will actually pay over the next year, is just 3.8%.

Three-point-eight per year to hold junk. Yikes. S&P, Bloomberg and Barclays (NYSE:BCS) get paid for that?

Our second ETF—the iShares iBoxx $ High Yield Corporate Bond ETF (NYSE:HYG)—has an even sadder yield. Regular readers may recognize the name because Fed Chair Jerome Powell himself began buying HYG for the Fed’s portfolio last year. That’s a money printing story for another day; today, we’ll note that HYG’s SEC Yield is a measly 3.4%.

Also, because it’s an ETF, HYG rarely trades at a “discount” to its net asset value (NAV, or the value of the bonds it owns minus leverage). As I write, HYG trades for about fair value—the curse of popularity and being Powell’s favored payout play! Same goes for JNK. No discounts here:

We’ll leave JNK and HYG to the basic bond investors on the first floor. You and I, meanwhile, should convene with the pros on floor two.

Here we’ll chat with the 'bond god' Jeffrey Gundlach, DoubleLine's CEO. He and his all-star team of fixed-income analysts buy bonds that you and I simply don’t have access to, such as those issued by a Brazilian financial-services firm paying 7% and a petrochemical firm in Luxembourg yielding 8.8%. This is the kind of expertise it’s worth paying for.

If these ideas sound esoteric, well, they are. That’s where the value is in Bondland. Without venturing around the globe, we’re stuck with high-yield US paper that pays a mere 3.4% or 3.8%. This is why we take the elevator to floor two and pay Gundlach and Co. the 'big bucks' management fee. (Plus, you’ll see we don’t even actually pay for it!)

'Big bucks' is tongue-in-cheek because when we buy one of DoubleLine’s closed-end funds (CEFs) at a discount, we essentially get our fees 'comped.' Fees come from NAV, and we’re paying 4% less than NAV today. We buy a dollar for 96 cents, giving us Gundlach’s fee for free. Our fee is 'comped!'

This 'discount window' is a phenomenon mostly confined to CEFs. These vehicles have fixed pools of shares, so their prices can wander above and below NAV. As value-focused contrarians, we of course prefer to purchase the funds when they trade at discounts.

(ETFs, on the other hand, tend to create new shares as demand warrants. It’s possible to see them at discounts, but uncommon and even then, the discounts are barely visible.)

Gundlach’s largest CEF bond fund is DoubleLine Income Solutions (NYSE:DSL). Not only does its 4% discount to NAV mean we’re able to buy it for just 96 cents on the dollar, but also it pays a 7.6% net annual yield as well. Yup, that’s roughly double the ETFs we picked on earlier!

Other CEF options from the bond god include DoubleLine Opportunistic Credit (NYSE:DBL) and DoubleLine Opportunities Fund (DLY). These are three excellent funds run by the same manager. Keep them in mind next time one of your basic bond buddies babbles baloney about JNK or HYG.

These are the types of monthly dividend payers that income investors can retire on. I’m talking about generous yields that annualize to 8% or more and show up in your account every 30 days.

Of course, the DoubleLine yields above are a bit light for my liking! I prefer a true '8% Monthly Payer Portfolio' that will turn $500K in capital into $40,000 in annual dividends. Or turn a $1 million nest egg into $80,000 per year in dividends alone.

And again, this cash shows up every month, so it is neatly aligned with the monthly bills. Contrast this schedule with the randomness of most dividend payers, which makes us wait 90 days, and it’s no contest.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."