It’s a somewhat universally held truth these days – that wherever Bitcoin goes, the rest of the cryptocurrency markets tend to follow. And with over 50% market dominance (meaning that over half of the $218 billion in crypto is being held in Bitcoin), it’s no wonder that so many investors feel this way.

Whenever Bitcoin rises, altcoins (cryptocurrencies that aren’t Bitcoin) usually shoot up the charts as well, often orders of magnitude larger than Bitcoin’s gain on the given day or week that an uptrend develops.

Similarly, when Bitcoin is getting sold-off en masse by weak hands, altcoins will sink sharply as well. Again, they’ll usually plunge more than Bitcoin does during a downtrend.

However, some altcoins in particular are prone to absolutely explosive growth. We saw it happen with a handful of them (out of the thousands available) in late 2017 during Bitcoin’s historic run, and millions of investors are waiting for the next Bitcoin surge before jumping into those same key altcoins again.

It sounds like a great plan, doesn’t it?

Sadly, due to Bitcoin’s somewhat consistent downtrend that started back in January of this year, those traders sitting on the sidelines have had to wait a very, very long time. There were definitely glimmers of hope in April and August that allowed a few savvy investors (and our members enrolled in Crypto Profit Alert) to capture short-term, high yield profits.

And as great as those stopgap months were for keenly-sensed traders, with their ears firmly planted to the street, most investors didn’t see any reason to jump into Bitcoin (and crypto) just quite yet.

But that’s okay – because even though 2018 hasn’t been the best year for crypto, this last week we’ve seen some extremely encouraging data which suggests that Bitcoin may have touched its lowest point for the year, and that a breakout is indeed imminent – just like in late 2017.

So, let me show you why we could be just weeks away from crypto’s next “watershed moment”, and explain what that could do for the markets once Bitcoin is back on the rise:

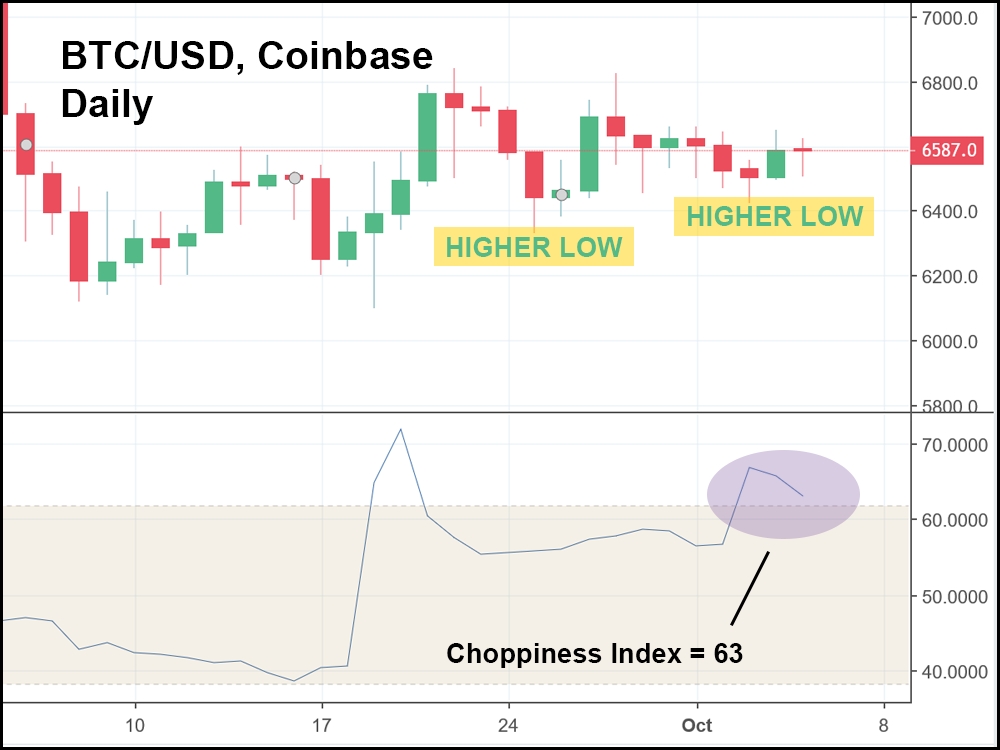

One of the more lesser-known indicators is the aptly titled choppiness index, which in the daily candlestick chart above measures how “choppy” Bitcoin’s price action has been. The index goes from 0 – 100, and a choppiness index value of at least 61.8 means that whatever its measuring is officially considered “choppy” – or moving up and down rapidly within a tight range of prices.

Incidentally, a high choppiness index value typically precedes a breakout, which Bitcoin seems ready for – especially when you consider that it has now just set a new higher low (another strong uptrend signal) just this last week.

Whenever a security has a choppiness index hovering around the 61.8 level, it’s always a good idea to see if that value crosses below the 61.8 line. In this case, Bitcoin’s choppiness index sits at roughly 63 and is trending downwards.

A cross below 61.8 for Bitcoin, coupled with the continued setting of higher lows, looks likely to kickstart a major breakout in the next few weeks. We saw a cross below 61.8 in late September that didn’t seem to stick, but now that Bitcoin has logged a few more weeks of upwards movement, the next cross down could finally start the trend reversal that everyone has been waiting for.

And when that happens, several altcoins will skyrocket – outperforming Bitcoin by a wide margin once the market sentiment has finally flipped. So, while it was a quiet week for cryptocurrency headlines (which usually results in positive movement), we were given some very encouraging signals from a few indicators that will be worth watching in the weeks to come.