If you needed any further proof that patents are invaluable, we got it on Monday.

In one of the biggest tech mergers of the year, Japan’s SoftBank Group Corp. (OTC:SFTBY) announced that it’s acquiring British chip designer ARM Holdings (LON:ARM).

As my colleague Greg Miller detailed yesterday, the $32 billion tie-up makes eminent sense and is notable for the validation it brings to the burgeoning Internet of Things (IoT) mega-trend.

But stop and think for a moment: What is SoftBank actually buying here?

After all, ARM doesn’t make a single product.

It doesn’t even market a single product.

Heck, ask any man on the street if he’s ever heard of the company and you’ll likely get a blank stare in response.

And yet, without ARM’s technology, that man’s mobile device (or two) wouldn’t work.

How can that be?

It’s simple, really.

ARM doesn’t make products. It specializes in product know-how and information.

The company designs chips and then licenses its blueprints to all the bigs – including Apple Inc (NASDAQ:AAPL), Samsung (KS:005930), and QUALCOMM Incorporated (NASDAQ:QCOM).

Its technical expertise is undisputed, given its treasure trove of over 4,500 granted or pending worldwide patents.

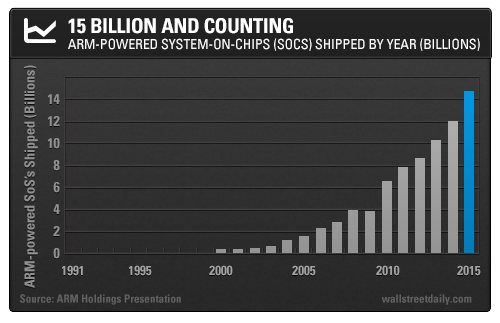

And the fact that ARM’s designs can now be found in almost 15 billion mobile devices testifies to the relevance and desperate commercial need for that expertise.

This chart illustrates the most important takeaway for investors.

The Next Paradigm Shift

A shift is underway in the technology sector.

Mobile devices – namely smartphones – are peaking.

Case in point: IDC estimates that smartphone shipments will only grow by 3% this year. That’s way down from the 10.5% growth rate last year.

And as market saturation sets in, all attention is focused on identifying “the next big thing.”

The consensus bet? The IoT, whereby all manner of physical devices, systems, networks, and appliances become connected to the internet.

I’ve outlined the astronomical projections for the IoT here before. But to recap:

- Gartner says the number of connected “things” will surge by 30% year over year to 6.4 billion in 2016. And by 2020, the research firm estimates there will be 20.8 billion connected devices.

- Cisco Systems Inc (NASDAQ:CSCO) cranks its projection way higher. It expects 50 billion connected devices by 2020. And Intel Corp (NASDAQ:INTC) is uber-bullish, forecasting the number to balloon to 200 billion devices over the same period.

- In total dollar amounts, we’re talking about a market that will be worth more than $1.7 trillion by 2020, according to IDC’s latest estimates.

Against that backdrop, SoftBank’s CEO, Masayoshi Son’s statement at a company conference in 2014 doesn’t seem so far-fetched anymore.

Back then, he declared, “Each individual, on average, will have more than 1,000 devices that are connected to the internet by 2040.”

ARM Leads the Arms Race

ARM’s intellectual property promises to play a large role in this emerging reality, as its chip designs are increasingly applicable to smart cars, TVs, servers, wearables, drones, and smart homes.

Hence, SoftBank’s acquisition. As Greg Miller mentioned yesterday, the company is positioning itself to profit handsomely from the next wave of “mobile” devices.

Make no mistake, though… there are other formidable patent holders in the IoT space.

For example, in May, I revealed that QUALCOMM reigned supreme in terms of IoT patent filing activity.

“Not only does the company hold the most patent grants and applications in the space – 724 compared to nearest competitors Intel (688) and ZTE (351) – it also holds the most valuable patents, based on LexInnova’s analysis.”

Back then, I also singled out InterDigital Inc (NASDAQ:IDCC) as a major contender in the IoT industry, given that the company ranks in the top 10 in terms of total IoT patents, in the top five for patent strength, and, like QUALCOMM, it’s also trading at a discount to the market and its long-term averages.

On the heels of the huge premium that SoftBank paid for ARM’s patents, both QUALCOMM and InterDigital represent even more compelling investments.

Or as The Verge’s Vlad Savov wrote, “The information age is defined by companies like ARM, whose assets are intangible.”

Indeed.

Simply put, I’ll reiterate what I said last week: “Patents matter more than ever in our global economy – both for businesses and investors alike.”

So invest accordingly.