The Russell 2000 led the charge higher following the election. That will likely be the memory for many looking back at 2016. But it had a pretty good 9 month run before that. From the low in February it had already moved up 20%, including the October pullback. Another 20% move following the election makes for a spectacular year. Except for those first 3 weeks. The numbers say that pre-election the Russell 2000 was flat on the year, and that is one reason the focus will be on the move following it.

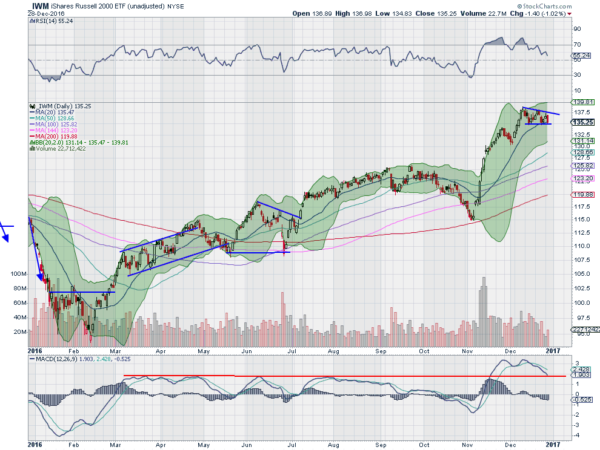

But if you want to understand trends and how they move it is important to drop those first 3 weeks and watch from the February low. From that point it moved up off of a double bottom and continued higher until September. Along the way it broke above the 200 day SMA in April. It touched it again in June and nearly again in November. This is the first bullish indicator to watch. As long as it is above the 200 day SMA things are good for the Russell.

What is special about the period after the election is how fast it moved. The momentum indicators shot from bearish oversold levels to bullish overbought in less than a week. The massive volume shows how that can happen. The RSI is now working off that overbought condition, but remains in the bullish range. The MACD had moved to extreme levels, above any other reading for the year during the push higher. This too has worked off the extreme and is back in that pre-election range.

And what has happened to the price during this momentum reset? So far nothing. All it has done is move sideways in consolidation. This is a sign of real strength. What would change that? Not a move back to the lower Bollinger Band® at 130 on the iShares Russell 2000 (NYSE:IWM), nor to the gap at 128 or prior high at 125. It would take a close under the 200 day SMA, at about 120, to shift this picture to bearish. Until then any pullback should be viewed as an opportunity to add.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.