Sonic (NASDAQ:SONC) made its debut in the Burger Portfolio™ in October along with Burger King, Jack In The Box (NASDAQ:JACK), Wendy's (NASDAQ:WEN) and Cracker Barrel (NASDAQ:CBRL) (yeah I know). Each of these stocks had a great run higher into early 2015 before rolling over and exiting.

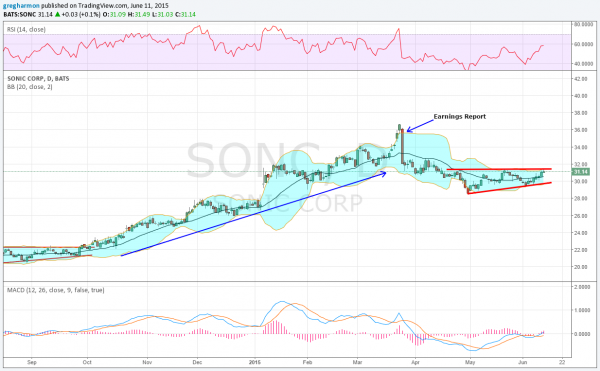

Sonic lasted until it reported earnings March 24th. With a supersonic run higher the few days prior to earnings and in between illiquid options strikes, so no way to protect it, we exited the stock ahead of earnings. Following the report, the stock plummeted and then proceeded to drift lower.

Since mid April though, the stock has been consolidating in a rounded bottoming pattern and against resistance at 31.40. Thursday marked the third touch at resistance and from a higher low, creating an ascending triangle. This is a bullish set up that would target a move to 34.50 on a break higher.

The momentum indicators are supportive of a move higher as well. The RSI is rising and about to cross into the bullish zone, while the MACD has crossed up and is rising too. The Bollinger Bands® are also hinting a shift to the upside.

When examining the options table, there is very large open interest for next week at the 35 Call Strike, another possible catalyst for a move. Burgers in general have come back in favor, and Sonic reports again on June 22nd after the market close. Keep an eye on this one for a break out higher and another supersonic run.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.