Thin Film’s (THIN.OL) printable, rewritable, non-volatile memory is a key component of printed electronics. Due to the low cost of production, printed electronics (PE) has the potential to add intelligence to high volume, disposable items. The PE market is predicated on achieving high volumes to make ubiquitous computing a reality, but is currently highly fragmented. As the only pure-play listed PE company, we believe Thinfilm is well placed to take a leadership role in integrating the industry. Thinfilm’s relationships with global companies and licensing model provide scalable revenue opportunities and potential for significant share price upside.

Pioneering printable memory technology

Thinfilm’s technology enables memory to be produced using standard industrial roll-to-roll printing techniques and organic materials. The low cost to produce printed electronics compared to well-established silicon-based electronics opens up a substantial opportunity to develop low-value, high-volume applications (eg brand protection, sensor tags) and to accelerate the “Internet of things”. Thinfilm’s technology can already be used to make passive array memory and further development is underway to expand the number of logic components that can be printed to make more complex electronic products. Thinfilm’s strategy is to demonstrate what can be made by establishing in-house production capacity, before licensing the technology “copy-exact” to customers in target markets.

Commercial agreements prelude to production ramp

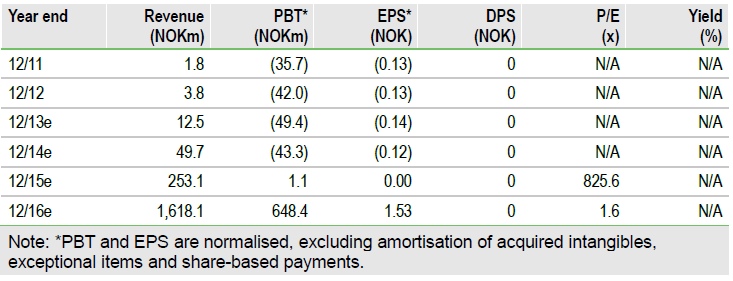

Thinfilm has signed several significant commercial contracts to develop products, including brand protection, smart labels and temperature sensor tags. We expect production to ramp from H213. Management expects to see the first licensing agreements in 2014, with 70% of volume from licensing partners by 2016. Key risks include scaling production, achieving targeted production yields, ability to access funds, and customer adoption and product roadmaps.

Valuation: Material upside if technology adopted

Based on management’s assumptions for adoption, a WACC of 15% and long-term growth of 3%, our DCF values the company at NOK18.5/share. Varying the WACC and long-term growth rate produces a valuation range of NOK10.1-52.2/share; varying the licence fee or materials cost a range of NOK7.3-24.2/share. Using a slower adoption and licensing scenario, we calculate a value of NOK6.9/share.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Thin Film Electronics: Upside If Technology Is Adopted

Published 06/26/2013, 08:10 AM

Updated 07/09/2023, 06:31 AM

Thin Film Electronics: Upside If Technology Is Adopted

Printing technology for disposable electronics

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.