Preferred stocks are the little-known answer to the dividend question:

How do I juice meaningful 5% to 6% yields from my favorite blue-chip stocks?

“Common” blue chips stocks usually don’t pay 5% to 6%. Heck, the S&P 500’s current yield, at just 1.3%, is its lowest in decades.

But we can consider the exact same 505 companies in the popular index—names like JPMorgan Chase (NYSE:JPM), Broadcom (NASDAQ:AVGO) and NextEra Energy (NYSE:NEE)—and find yields from 4.2% to 6.9%.

If we’re talking about a million dollar retirement portfolio, this is the difference between $13,000 in annual dividend income and $42,000. Or, better yet, $69,000 per year with my top recommendation.

Most investors don’t know about this easy-to-find “dividend loophole” because most only buy “common” stock. Type AVGO into your brokerage account, and the quote that your machine spits back will be the common variety.

But many companies have another class of shares. This “preferred payout tier” delivers dividends that are far more generous.

Companies sometimes issue preferred stock rather than issuing bonds to raise cash. And these preferred dividends have a few benefits:

- They receive priority over dividends paid on common shares.

- Sometimes, preferred dividends are “cumulative”—if any dividends are missed, those dividends still have to be paid out before dividends can be paid to any other shareholders.

- They’re typically far juicier than the modest dividends paid out on common stock. A company whose commons yield 1% or 2% might still distribute 5% to 7% to preferred shareholders.

But it’s not all gravy.

Preferreds Have One Clear Weakness

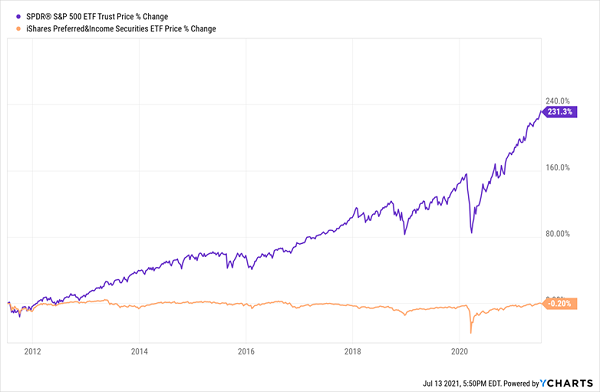

You’ll sometimes hear investors call preferreds “hybrid” securities. That’s because they act like a part-stock, part-bond holding. The way they resemble bonds is how they trade around a par value over time, so while preferreds can deliver price upside, they don’t tend to deliver much—hence the flat price action you see above.

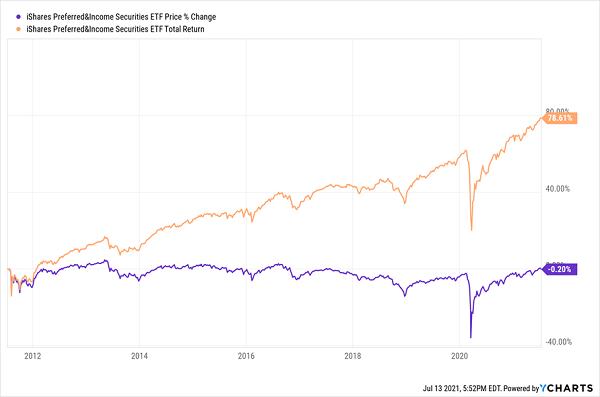

No, the point of preferreds is income and safety. Let’s look at this preferred fund’s returns once dividends are included (orange line below):

A Steady Source of Cash

Now, we could go out and buy individual preferreds, but there’s precious little research out there allowing us to make a truly informed decision about any one company’s preferreds. Instead, we’re usually going to be better off buying preferred funds.

But which preferred funds make the cut? Let’s look at some of the most popular options, delivering anywhere between 4.2% to 6.9% at the moment.

Wall Street’s Two Largest Preferred ETFs

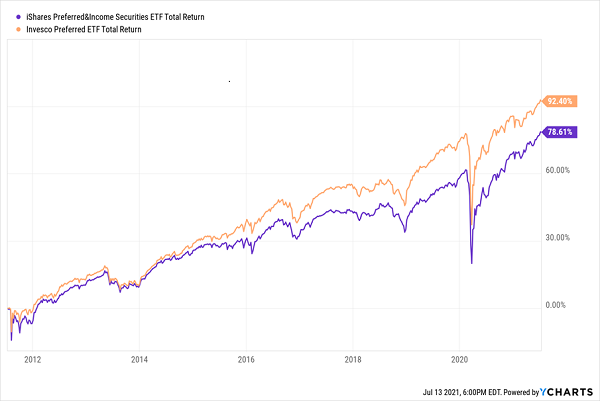

I want to start with the iShares Preferred and Income Securities (PFF, 4.2% yield) and Invesco Preferred ETF (PGX, 4.5%). These are the two largest preferred-stock ETFs on the market, collectively accounting for some $27 billion in funds under management.

On the surface, they’re pretty similar in nature. Both invest in a few hundred preferred stocks. Both have a majority of their holdings in the financial sector (PFF 60%, PGX 67%). Both offer affordable fees given their specialty (PFF 0.46%, PGX 0.52%).

There are a few notable differences, however. PGX has a better credit profile, with 54% of its preferreds in BBB-rated (investment-grade debt) and another 38% in BB, the highest level of “junk.” PFF has just 48% in BBB-graded preferreds and 22% in BBs; nearly a quarter of its portfolio isn’t rated.

Also, the Invesco fund spreads around its non-financial allocation to more sectors: utilities, real estate, communication services, consumer discretionary, energy, industrials and materials. Meanwhile, iShares’ PFF only boasts industrial and utility preferreds in addition to its massive financial-sector base.

PGX: Better Quality, Better Returns

PGX might have the edge on PFF (purple line in the chart above), but both funds are limited by their plain-vanilla, indexed nature.

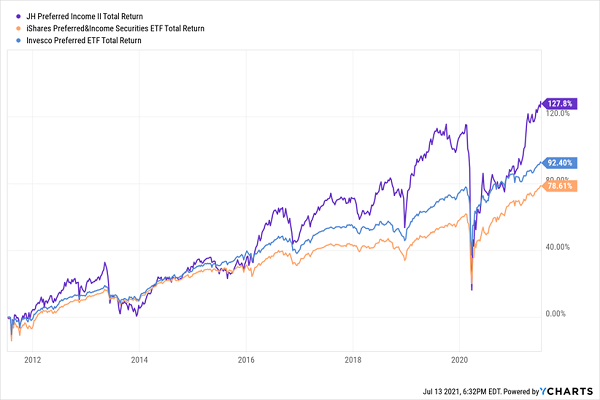

That’s why, when it comes to preferreds, I typically look to closed-end funds.

Closed-End Preferred Funds

CEFs offer a few perks that allow us to make the most out of this asset class.

For one, most preferred ETFs are indexed, but all preferred CEFs are actively managed. That’s a big advantage in preferred stocks, where skilled pickers can take advantage of deep values and quick changes in the preferred markets, while index funds must simply wait until their next rebalancing to jump in.

Closed-end funds also allow for the use of debt to amplify their investments, both in yield and performance. Should the manager want, CEFs can also use options or other tools to further juice returns.

And they often pay out their fatter dividends every month!

Take John Hancock Preferred Income Fund II (HPF, 6.9% yield), for example. It’s a tighter portfolio than PFF or PGX, at just under 120 holdings from the likes of U.S. Cellular (NYSE:USM) and Wells Fargo (NYSE:WFC).

Manager discretion means a lot here. That is, HPF doesn’t just invest in preferreds, which are 70% of assets. It also has 22% invested in corporate bonds, another 4% or so in common stock, and trace holdings of foreign stock, U.S. government agency debt and cash. And it has a whopping 32% debt leverage ratio that really helps prop up the yield and provide better returns (though at the cost of a bumpier ride).

A Clear Step Up in Total Returns, But Watch Out for Those Dips

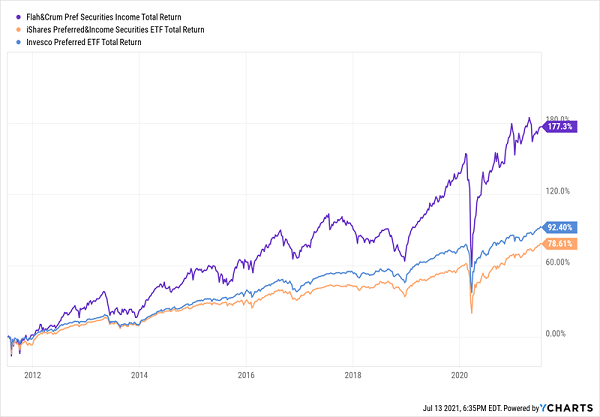

You have a similar situation with Flaherty & Crumrine Preferred and Income Securities Fund (FFC, 6.7%).

Here, you’re wading deep into the financial sector at nearly 80% exposure, with decent-sized holdings in utilities (7%) and energy (7%). Credit quality is roughly in between PFF and PGX, with 44% BBB, 37% BB and 19% unrated.

Nonetheless, smart management selection (and a healthy 31% in debt leverage) has led to far better, albeit noisier, returns than its indexed competitors.

FFC: It Might Give You Fits, But It Delivers

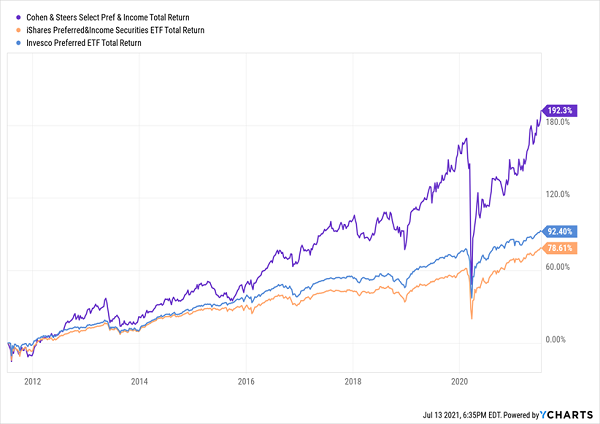

The Cohen & Steers Select Preferred and Income Fund (PSF, 6.0%) is about as pure a play as you could want in preferreds.

And it’s also a pure performer.

This Preferred Fund Has Nearly Tripled in a Decade

PSF is 100% invested in preferred stock (well, more like 128% if you count debt leverage), and actually breaks out its preferreds into institutionals that trade over-the-counter (83%), retail preferreds that trade on an exchange (16%) and floating-rate preferreds that trade OTC or on exchanges (1%).

Like any other preferred fund, you’re heavily invested in the financial sector at nearly 73%. But you do get geographic diversification, as only a little more than half of PSF’s assets are invested in the U.S. Other well-represented countries include the U.K. (13%), Canada (7%) and France (6%).

What’s not to love?

Mysterious “Stamford Secret” Dividend Plan Exposed

Well… for now, the price.

The one drawback of CEFs is that they can occasionally trade at premiums to their underlying assets. In the case of HPF and FFC, you’re looking at an additional 5 or 6 cents on the dollar at present. But PSF has really gotten ahead of itself of late, trading at a lofty 16% premium at the moment—and that’s really unusual, given that this fund has averaged a mere 4% premium over the past five years.

That’s OK. They’re still good funds. They’re just giving off a momentary caution signal that they’re not quite ripe for new money at the moment.

But if you’re looking to upgrade your retirement plan right here, right now, one 6.5%-yielding fund is priced just right, and flashing a big, green light at investors.

I’ve found a fund with a killer edge its competition can only dream of—its managers, an unsung duo from sleepy Stamford, Connecticut, get first crack whenever a new stock comes on the market!

An advantage like that could literally be like buying Microsoft (NASDAQ:MSFT) before its IPO! Or IBM (NYSE:IBM). Or even Apple (NASDAQ:AAPL).

No wonder this low-key duo ALWAYS beat their benchmark. An “automated” ETF simply can’t keep up with these “ultimate insiders.”

Powered by this hidden advantage, their fund throws off a massive 6.5% dividend that dwarfs the payout on common stocks:

Huge “Stamford Secret” Dividend Reigns Supreme

This terrific fund is a “must own” for anyone looking for inflation-proof income, whether you’re in retirement or still building your nest egg.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."