A number of ETFs hit new 52-week highs this week, which isn’t unexpected as the major indexes hit multiple all-time highs. Let’s take a look at some of the standouts amid the relentless bullish action.

As the markets continue to digest implications of the landmark OPEC oil production cut deal, SPDR S&P Oil & Gas Equipment & Services (NYSE:XES) — which tracks an index of oil and gas services companies — has really skyrocketed. The fund has added nearly 28% in value over the past month alone, largely due to a huge bounce beginning in late November. Another fund, ProShares Ultra Oil & Gas (NYSE:DIG), which offers leveraged exposure to the oil and gas industry, has also shined.

Our neighbors up north are seeing big gains as well, with iShares MSCI Canada (NYSE:EWC), the largest Canadian equities fund, hitting new highs. That action is likely tied to the recovery in oil and gas as well, considering many of the largest Canadian companies work in the energy industry.

Small caps, semiconductors, and just about every broad-based equities fund also hit new highs this week. The Trump Rally clearly has some real legs to it right now, and investors and portfolio managers alike are trying to position themselves for 2017 and beyond as we enter the final weeks of the year.

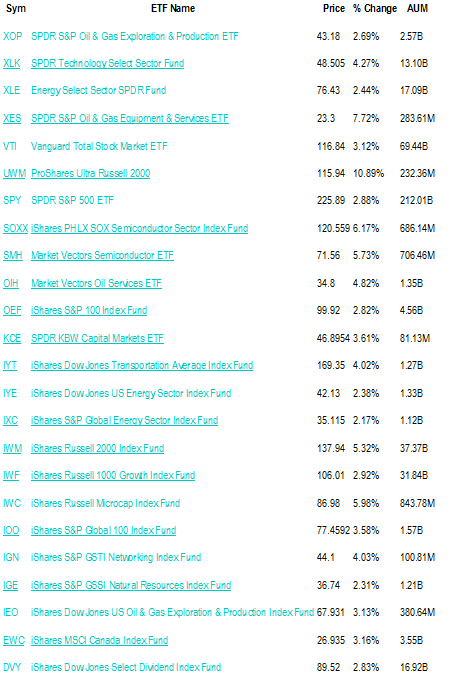

The complete list of ETFs hitting new highs today is below, with the 5-day percent change listed.