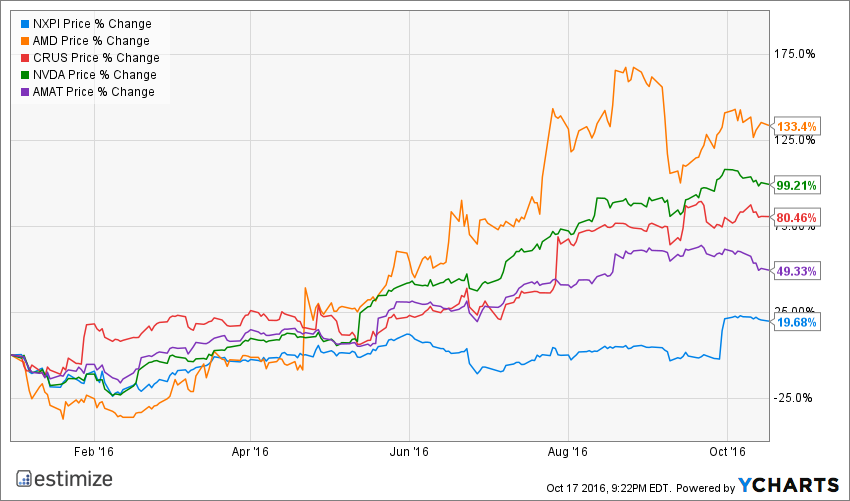

The current tech revolution has benefited many industries but none more so than semiconductors. These companies are producing chips in a variety of high-growth markets such as mobile computing, automotive, Internet of Things, virtual reality and servers and data centers. Shares of the iShares Semiconductor ETF (NASDAQ:SOXX), which tracks the performance of U.S. equities in the semiconductor sector, is up 21% year to date. Some of the individual equities like AMD are up closer to 150% this year thanks to increasing demand for new technologies.

It’s important that semiconductors build on their recent success this earnings season otherwise investors could be in store for a disappointment. The biggest names to watch this quarter include, NXP Semiconductor, AMD, Cirrus Logic, Nvidia and Applied Materials.

NXP Semiconductors (NASDAQ:NXPI) Information Technology – Semiconductors

It was recently rumored that Qualcomm (NASDAQ:QCOM) was in negotiations to acquire NXP Semiconductors in order to solidify its automotive and Internet of Things markets. NXP has seen massive growth in recent quarters thanks to strong adoption of tablets, smartphones, automotive electronics and wearable technologies, all of which contain NFC chips by NXP. As a result, shares are up nearly 500% in the past 5 years. Analysts expect NXP to build on its recent success with strong third-quarter results. The Estimize consensus is calling for earnings per share of $1.62 on $2.47 billion in revenue. Compared to a year earlier, that represents a 1% increase on the bottom line and 62% on the top. Historically, the stock performs its best immediately after the 30 days following an earnings report.

Advanced Micro Devices (NASDAQ:AMD) Information Technology – Semiconductors

AMD has been a true cinderella story in the semiconductor space. It had been one of the most beaten-down stocks for years, playing catch up to NVIDIA (NASDAQ:NVDA) and Intel (NASDAQ:INTC). Today, AMD is one of the fastest-growing companies and has closed the gap on its two biggest competitors. Shares are up 133% year to date and about 250% in the past 12 months. This comes largely due to increasing demand for its graphic cards and computer processors. AMD’s recent products, Polaris GPU and Zen processor, are expected to drive revenue this coming quarter. Meanwhile, AMD is emerging as a major player in other high-growth markets such as virtual reality. AMD recently signed a deal with Alibaba (NYSE:BABA) that will make it the sole provider of GPUs for its cloud services. These types of initiatives are what have led investors to this stock and why analysts are so high on earnings this quarter. The Estimize community is looking for earnings per share of 1 cent on $1.22 billion in revenue. Compared to a year earlier, that represents a 105% increase on the bottom line and 14% on the top.

Cirrus Logic (NASDAQ:CRUS) Information Technology – Semiconductors

The semiconductor industry is going through a broader resurgence this year as these companies either get acquired or continue to deliver strong earnings. The SPDR S&P Semiconductor ETF (NYSE:XSD) is up 16% this year thanks to this ongoing trend. One of the many standouts in the space has been Cirrus Logic. Shares of this little-known semiconductor are up a whopping 87% year to date, which should only get higher as earnings continue to improve. Last quarter, the company topped expectations on both the top and bottom-line while growth moved in the right direction. Expectations for the upcoming quarter are sky high due to the early success of the iPhone 7. A majority of Cirrus’ revenue is generated from chips found in Apple's (NASDAQ:AAPL) latest smartphone. The Estimize consensus is currently looking for earnings per share of $1.06 on revenue of $398.09 million for the third quarter. Both revenue and earnings estimates have increased by over 20% in the past 3 months.

Nvidia (NASDAQ:NVDA) Information Technology – Semiconductors

Similar to its peers, Nvidia is emerging in many high-growth markets, particularly automotive, professional visualization and data centers. While they have certainly found traction in these sectors, gaming is still the company’s bread and butter. This quarter the company released its first four Pascal GPUs, all of which have received rave reviews. More recently, Nvidia unveiled a new Xavier chip designed for use in self driving cars. Nvidia is also in competition with AMD to supply Apple (NASDAQ:AAPL) Macbooks and Samsung (OTC:SSNLF) phones with its chips. Significant upward revisions in the past 3 months suggests Nvidia is in store for a strong quarterly report. Analysts at Estimize are calling for earnings per share of 59 cents, up 22% from a year earlier. That estimate has increased 7% since Nvidia’s most recent report in August. Revenue for the period is estimated 25% higher to $1.68 billion, marking a second consecutive quarter of 20% gains.

Applied Materials (NASDAQ:AMAT) Information Technology – Semiconductors

Shares of Applied Materials are up 50% year to date and roughly 75% in the past 12 months. A recent string of strong reports have driven a large portion of these gains. The company’s strong pipeline of new products creates meaningful opportunities to make future gains. Meanwhile, its current position in OLED, 3D NAND and solar products continues to drive future orders. Early signs appear as though the fourth quarter is headed in the same direction. Analysts at Estimize are calling for earnings per share of 66 cents on $3.36 billion in revenue. Compared to the same period last year, that represents a 114% increase on the bottom line and 34% on the top. Both earnings and revenue estimates have increased over 15% in the past 3 months, indicating bullish analyst sentiment.

How do you think these names will report this week?