A stock’s yield is only as good as its cash flow because, after all, a dividend is nothing more than a promise from a company.

CenturyLink (NYSE:CTL) recently reminded us of this. Its promised $0.54 per share dividend exceeded its ability to pay. The firm’s payout ratio of 130% – the percentage of profits that it was paying as dividends – was an absurd overpromise that couldn’t last forever:

CenturyLink’s Payout Promise Was Always on Borrowed Time

CEO Jeffrey Storey insisted his team remained “committed to and confident in our ability to maintain the dividend.” I understood the commitment, but questioned the confidence–taking on debt to pay dividends is a losing game. But then again, what else is the guy going to say?!

As recently as February 8, I warned investors that CenturyLink was a high yield trap. It was inevitable that its lack of cash would topple any commitment and confidence. Sure enough, just six days later, Jeff and the boys made me look good by slashing their payout by a cool 54%.

The “all-knowing” market sniffed out some of Jeff’s BS beforehand, but not the full extent of it. CTL topped in late August and has spiraled downwards since. Shares are down 45% in just six months:

A 54% Dividend Cut = A 45% Price Cut (and Counting)

As we’ve discussed time and again, dividends are “magnets” that drag their share prices along. This is great when dividends are growing, but disastrous when they are slashed!

With CTL’s latest payout cut now in the rearview mirror, my publisher patted me on the back–and tasked me with finding eight more dividends likely to drop! Luckily for me, we have access to Blockforce Capital’s “DIVCON” system.

Macy’s (NYSE:M) (M)

Dividend Yield: 5.9%

DIVCON Score: 2

While Macy’s (NYSE:M) (M) DIVCON score of 2 suggests the retailer is “likely to decrease/cut their dividends in the next 12 months,” I think the timeline is a bit longer than that. At the moment, Macy’s is paying out only 36% of its adjusted profits as earnings, and it generates enough free cash to pay its dividends more than twice over

That’s the nicest thing I can say about this dinosaur.

Macy’s operations are in terminal decline. Back in 2016, roughly 100 of the retailer’s locations were performing so poorly that the company said it would just shut their doors as their leases expired rather than spend the money to turn things around.

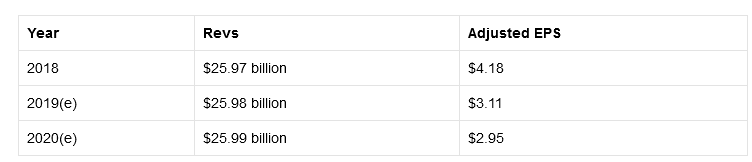

Shares have plunged roughly two-thirds from their 2015 peak as revenues have waned and profits have waffled. And it’s not going to get better. A quick look at what the analysts see going forward:

Those numbers are troubling in so many ways:

- Wall Street’s typically optimistic-leaning analysts think that Macy’s is going to improve its sales by a rounding error for the next two years.

- These same analysts think that Macy’s is going to have an increasingly difficult time making a profit off those sales.

- Based on these projections, Macy’s payout ratio would jump from 36% to 51% without touching its dividend.

That dividend isn’t growing, either. The writing was on the wall in early 2017 when Macy’s failed to announce its usual increase; its quarterly dole has been stuck at 37.75 cents for three years now. If Macy’s does adjust its dividend, DIVCON’s analysts suggests it would be to cut or eliminate it.

International Game Technology (NYSE:IGT)

Dividend Yield: 5.8%

DIVCON Score: 1

When you think of casino stocks, you think of the glitzy, glamorous resort companies: MGM Resorts International (NYSE:MGM) (MGM), Las Vegas Sands Corp (NYSE:LVS) (LVS) and Wynn Resorts Limited (NASDAQ:WYNN) (WYNN).

International Game Technology (IGT) is what you find when you pop open the hood.

IGT is a multinational gaming company that produces video slot games such as Wheel of Fortune Cash Link and Fuzzy’s Fortune. But more importantly, they also have developed various systems for sports betting, lottery, even casino rewards. If you’ve been in a casino, there’s a decent chance that IGT has in some way shaped your experience.

Despite its breadth of products and global reach, IGT has hit a plateau. Revenues declined in 2018 for the second consecutive year, and the company has posted losses in three of the past four years. The company’s 20-cent-per-share quarterly dividend has remained flat since 2015, and has been fully funded by profits just one year during that time. Negative free cash flow is a regular occurrence.

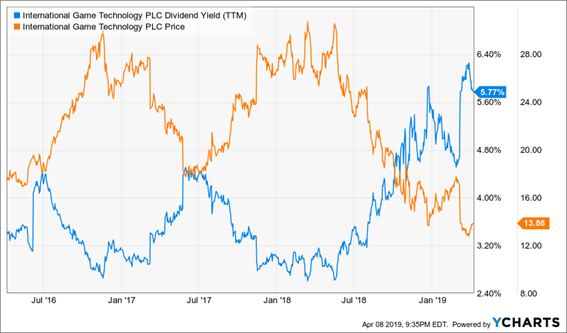

The only reason the yield keeps going up is because the stock keeps sinking. IGT shares plunged 12% in a single day this March after the company posted adjusted earnings of 24 cents per share that were well short of expectations for 33 cents.

That was the company’s sixth quarterly miss in two years.

DIVCON gives IGT its lowest score, and it’s well-deserved. Profits and cash are sparse, and management can’t even manage analyst expectations. Don’t keep sinking your dollars into this money hole.

Don’t Be Lured In by IGT’s Inflated Yield

Kraft Heinz (NASDAQ:KHC)

Dividend Yield: 4.8%

DIVCON Score: 1

In February 2019, Kraft Heinz (KHC)–the consumer staples Frankenstein backed by Warren Buffett’s Berkshire Hathaway (NYSE:BRKa) (BRK.B) and 3G Capital–said it would pay a 40-cent quarterly dividend.

The problem? That was 36% less than it paid the prior quarter.

Kraft’s Dividend Cut: A Symptom, Not the Sickness

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."