Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

AEO And DKS Bounce From Historically Bullish Trendlines

Retail stocks have put in an impressive performance in recent months, with the SPDR S&P Retail ETF (XRT) up more than 21% from its early April lows near $43. What's more, shares of the exchange-traded fund (ETF) topped out at a record high of $52.96 on Aug. 22, thanks to a round of strong retail earnings. And while the fund has since pulled back to trade at $51.79, there's a fairly good chance it could challenge its all-time peak next month.

Specifically, retail has been one of the best sectors to own in September, according to data from Schaeffer's Senior Quantitative Analyst Rocky White. Over the last 10 years, XRT has averaged a monthly gain of 1.53% -- the most of any ETF we track. Another move of this magnitude would put the shares at $52.58, based on their current perch.

American Eagle, Dick's Sporting Goods Near Key Trendlines

Among two specific XRT components that could present potential bullish trading ideas are American Eagle Outfitters (NYSE:AEO) and Dick’s Sporting Goods (NYSE:DKS), considering both are trading near trendlines that have marked attractive entry points in the past. Plus, with implied volatilities deflated after earnings, short-term options on the retail stocks are relatively cheap at the moment.

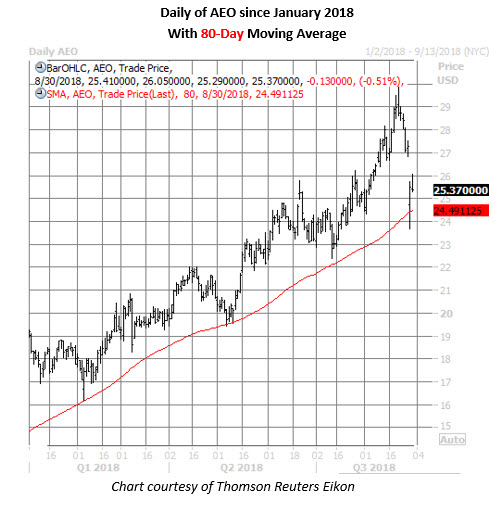

Diving deeper, AEO stock fell 6.5% yesterday after the company gave a weak current-quarter profit forecast, but found support at its 80-day moving average. Over the past three years, there have been six prior instances of AEO pulling back to its 80-day trendline after trading north of it for 60% of the time within the previous two months, resulting in a one-month average return of 8.4%, per White, with 83% of those returns positive.

Based on its current perch at $25.37, another move of this magnitude would put American Eagle stock back near $27.50 -- within striking distance of its 11-year high of $29.88 from Aug. 22. Longer term, AEO shares are up an impressive 35% year-to-date, and are pacing for their seventh straight monthly gain, the longest such streak since 2012.

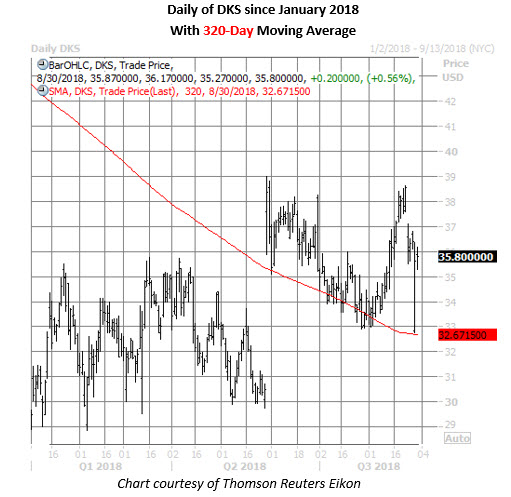

Dick's Sporting Goods, meanwhile, pared most of its intraday losses on Tuesday to close down 2.2%, after the retailer reported disappointing same-store sales. DKS is now trading within one standard deviation of its 320-day trendline after a lengthy stretch above it. In the two other times this signal has flashed since 2015, the security was up 4.03%, on average, one month later.

Today, the retail stock is up 1.3% at $35.80, and another 4% rally from here would have DKS trading at $37.50 near the end of next month. The shares are still boasting a month-to-date positive return of 5.7%, and have maintained a steady foothold atop their 320-day moving average since a late-May bull gap.