Thermon Group Holdings, Inc. (NYSE:THR) recently announced that it has successfully completed the acquisition of 100% equity stake of CCI Thermal Technologies Inc. (CCI Thermal) and some related real estate assets. The deal was originally announced on Oct 4.

The buyout was carried out by the company’s subsidiary specially formed for this deal. Purchase consideration of CAD$258 million and CAD$2.3 million related to working capital adjustment were paid through cash and senior secured debt. Its net leverage is estimated to be approximately 3.4x.

As previously noted, Thermon Group will likely incur acquisition-related costs of $5.5 million in fiscal 2018 (ending Mar 31, 2018).

CCI Thermal Buyout: A Boon for Thermon Group

CCI Thermal manufactures engineered heating and filtration solutions for use in the energy, petrochemical, electrical distribution, power, transit and industrial end markets. Prime North American brands include Cata-Dyne, Ruffneck, Norseman, Caloritech, 3L Filters and Fastrax. It has five facilities for manufacturing and fabrication in Canada and the United States, providing employment to nearly 375 people.

With the addition of CCI Thermal to its portfolio, Thermon Group is now anticipated to become a leader in industrial process heating platform, with addressable market worth $2.3 billion. The company will enhance engineering and technological capabilities to leverage benefits from future growth opportunities.

Thermon Group anticipates realizing annualized run-rate cost synergies of CAD$2.4 million in fiscal 2019. Also, the acquired assets are anticipated to boost operating margins, free cash flow and GAAP earnings per share in fiscal 2019.

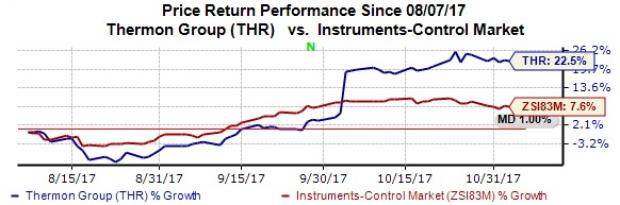

In the last three months, Thermon Group’s shares have yielded 22.5% return, outperforming 7.6% gain of the industry.

Zacks Rank & Other Stocks to Consider

With a market capitalization of nearly $692 million, Thermon Group currently carries a Zacks Rank #2 (Buy).

Thermon Group Holdings, Inc. Price and Consensus

Thermon Group Holdings, Inc. (THR): Free Stock Analysis Report

KLA-Tencor Corporation (KLAC): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post

Zacks Investment Research