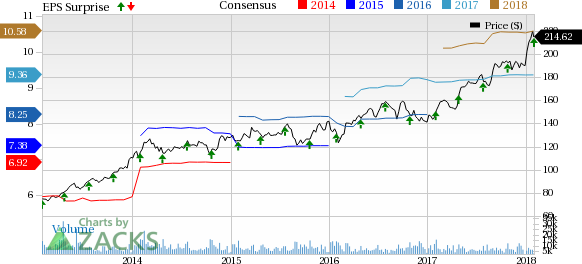

Thermo Fisher Scientific Inc. (NYSE:TMO) reported better-than-expected performance in fourth-quarter 2017. Adjusted EPS came in at $2.79, beating the Zacks Consensus Estimate by 4.9% and the year-ago quarter figure by 15.8%.

On a reported basis, fourth-quarter EPS of $1.30 marked an 18.2% decline year over year. The bottom-line figure includes a one-time tax provision associated with the recent enactment of tax reform legislation in the United States.

For the full year, adjusted EPS came in at $9.49, up 15% from the year-ago period and ahead of the Zacks Consensus Estimate of $9.36 by 1.4%. The quarter's EPS also exceeds the company-provided guidance at a range of $9.29-$9.38.

Revenues in the quarter came in at $6.05 billion, up 22.1% year over year. The top line also outpaced the Zacks Consensus Estimate of $5.69 billion by 6.3%.

Full-year revenues of $20.92 billion were up 14% from the year-ago period, surpassing the Zacks Consensus Estimate of $20.59 billion. Moreover, the revenue count stands above the company’s guided band of $20.50-$20.66 billion.

Quarter in Detail

Organic revenues in the fourth quarter grew 8% year over year while acquisitions increased revenues by 11%. Currency translation positively impacted total revenues by 3%.

Thermo Fisher currently operates under four business segments: Life Sciences Solutions, Analytical Instruments, Specialty Diagnostics plus Laboratory Products and Services.

Revenues at the Life Sciences Solutions segment (28.6% of total revenues) improved 11% year over year to $1.58 billion while Analytical Instruments Segment sales (24.6%) rose 16% to $1.41 billion, representing the acquisition of FEI Company.

Revenues at the Laboratory Products and Services segment (33.9%) surged 43% to $1.40 billion, reflecting the buyout of Patheon in August 2017. The Specialty Diagnostics segment (16.8%) recorded a 10% rise to $0.91 billion.

Gross margin of 46.3% during the fourth quarter was down 234 basis points (bps) year over year, despite a 16.2% improvement in gross profits. Adjusted operating margin contracted 59 bps to 23.2% on a 14.4% rise in selling, general and administrative expenses and a 9.4% increase in research and development expenses.

The company exited the year 2017 with cash and cash equivalents of $4 billion compared with $3.25 billion at the end of 2016. Full-year net cash provided by operating activities was $2.13 billion compared with $3.25 billion in the year-ago period.

2018 Guidance

The company will provide 2018 financial outlook on its earnings conference call.

Bottom Line

Thermo Fisher ended the fourth quarter on a promising note with both adjusted earnings and revenues beating the Zacks Consensus Estimate.

We are encouraged by the company’s solid international performance with strong year-over-year growth in the Asia-Pacific and the emerging markets like China, South Korea and the Middle East.

Also, a series of product launches along with major progress in precision medicine initiatives benefited the company’s performance. Thermo Fisher’s acquisition of FEI Company has already started to boost its analytical instruments portfolio. Also in 2017, the company deployed $7.8 billion on strategic acquisitions, adding leading biopharma contract development and manufacturing services through Patheon.

Significantly, enhancing the company’s value proposition for biopharma customers, Patheon has started to contribute to the company’s laboratory products and services segment.

Zacks Rank & Key Picks

Thermo Fisher has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader medical sector are ResMed (NYSE:RMD) , PerkinElmer (NYSE:PKI) and Accuray (NASDAQ:ARAY) , all three carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ResMed posted second-quarter fiscal 2018 adjusted earnings of $1, up 36.9% from the prior-year quarter. Revenues in the reported quarter increased 13.4% year over year (up 11% at constant exchange rate or CER) to $601.3 million.

PerkinElmer released fourth-quarter 2017 adjusted earnings of 97 cents. The company reported adjusted revenues of approximately $641.6 million, topping the year-ago quarter’s $567 million.

Accuray announced a loss of 6 cents in the second quarter of fiscal 2018, 5 cents narrower than the year-ago figure. Total revenues gained 15% year over year to $100.3 million.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Thermo Fisher Scientific Inc (TMO): Free Stock Analysis Report

PerkinElmer, Inc. (PKI): Free Stock Analysis Report

Accuray Incorporated (ARAY): Free Stock Analysis Report

ResMed Inc. (RMD): Free Stock Analysis Report

Original post

Zacks Investment Research