Market pundits love giving stocks nicknames. Before the 21st century, there was the "Nifty Fifty" (not to be confused with the Indian market index of the same name), and then the "Dogs of the Dow."

Over the last decade, we had FANG (Facebook (NASDAQ:META), Amazon (NASDAQ:AMZN), Netflix (NASDAQ:NFLX), Google (NASDAQ:GOOGL)). Today, we have the "Magnificent Seven"—Meta Platforms, Amazon, Microsoft (NASDAQ:MSFT), Google, Nvidia (NASDAQ:NVDA), Apple (NASDAQ:AAPL), and Tesla (NASDAQ:TSLA).

Nothing strikes more fear into the hearts of small-cap value proponents than the dominant performance of these mega-cap growth stocks from the technology, consumer discretionary, and communication sectors.

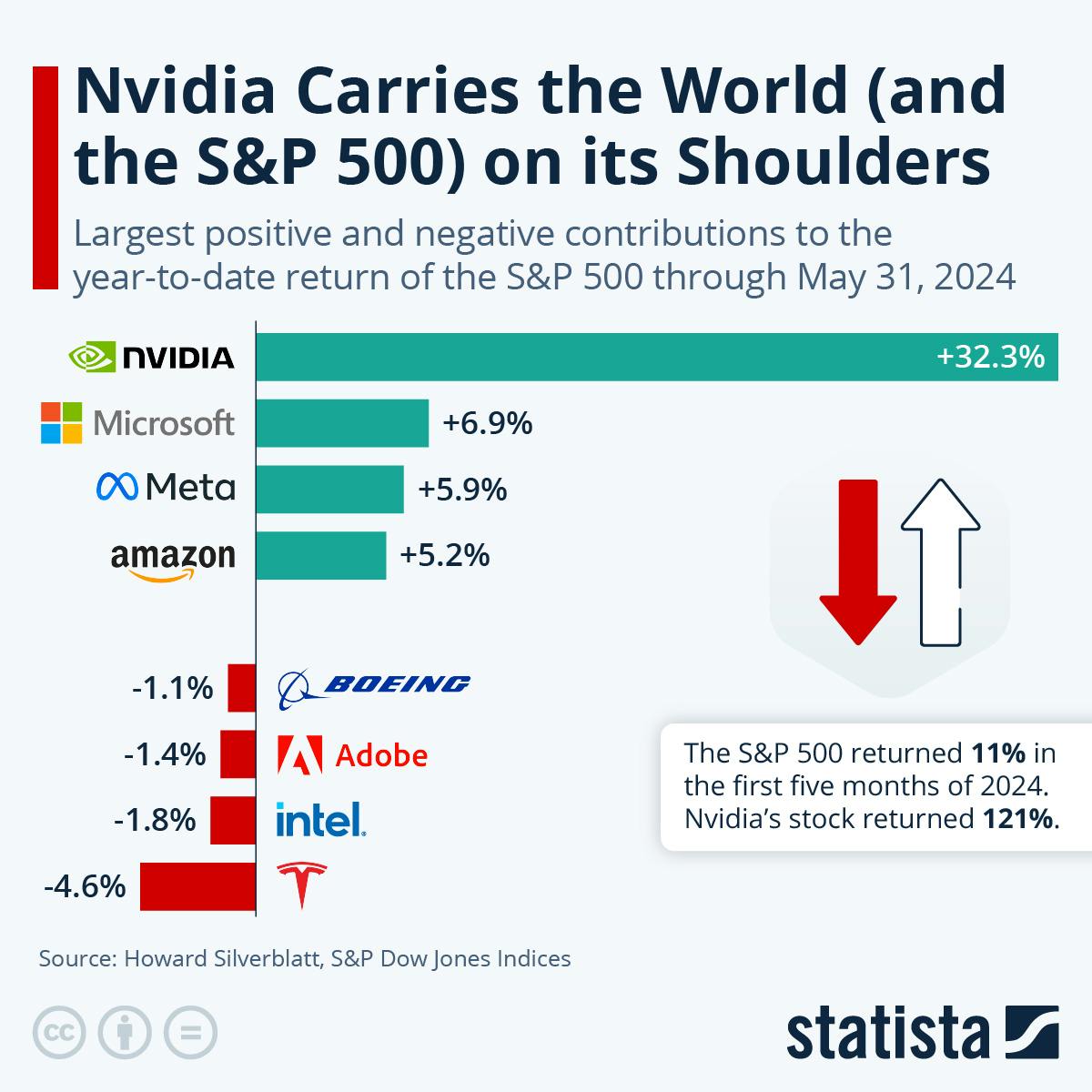

Just take a look at this chart from Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices, which shows just how much some of these companies (Nvidia in particular) have contributed to the S&P 500's YTD return as of May 31, 2024.

While you can gain exposure to the Magnificent Seven just by buying them directly, there are actually a few ETFs that can provide you with simplified or alternative exposure. Here are a few to watch.

Magnificent Seven ETF

Launched in April 2023, MAGS provides pure play exposure to all seven of the Magnificent Seven stocks in a single ticker. Over a year later, it has accumulated $420 million in assets under management (AUM).

If you're planning to go long on each of these stocks individually, you might consider paying Roundhill a 0.29% expense ratio to manage it on your behalf. This strategy can help you lose less to the bid-ask spread of multiple transactions.

The ETF is equally weighted every quarter, meaning it sells winners and buys losers. While this strategy can cap momentum, it also lowers concentration risk if one stock, like Nvidia, significantly pulls ahead.

YieldMax Magnificent 7 Fund of Option Income ETFs

The Magnificent Seven stocks aren't particularly known for their high dividend yields, as most of these companies prefer to reinvest their cash in research and development or keep it on hand. Apple, for example, is notorious for having a large cash balance.

However, if you're looking for exposure to the Magnificent Seven along with income, you can achieve this through options strategies such as selling calls and puts. The ETF to watch here is YMAG, an ETF of ETFs that holds seven other YieldMax single-stock ETFs, each corresponding to one of the Magnificent Seven stocks.

We've covered how the YieldMax ETFs work in a prior article—they use a synthetic covered call strategy. This strategy starts by combining a short put and a long call to simulate owning an actual stock, then selling a short call to generate income.

The goal of YMAG is to provide high monthly income. This strategy effectively offers embedded leverage and converts share price appreciation into options premiums, at the cost of capped upside and the usual exposure to downside risk.

As of June 17, YMAG is paying a 39.78% distribution rate. This rate is calculated by multiplying the ETF's distribution-per-share by twelve (12) and dividing the resulting amount by the ETF's most recent Net Asset Value (NAV).

Invesco S&P 500 Top 50 ETF

If the concentration in MAGS and YMAG is too much for you, there's a middle ground with XLG. This straightforward index ETF does exactly what its name suggests—holds the top 50 stocks in the S&P 500.

Given the size of the Magnificent Seven, this naturally results in a high weighting to these stocks. As of June 17, all except Tesla are among the top 10 holdings and collectively account for 54.42% of the ETF's weight.

This means you get significant exposure to the Magnificent Seven while also diversifying your investment across other leading companies in the S&P 500, all for a 0.20% expense ratio.

This content was originally published by our partners at ETF Central.