I thought it would be a good idea to show some examples of day charts previously posted for swing trade opportunities and the outcome. Harmonic patterns cannot be forced but can enforce risk management trades. I’m calling this the Then and Now Series.

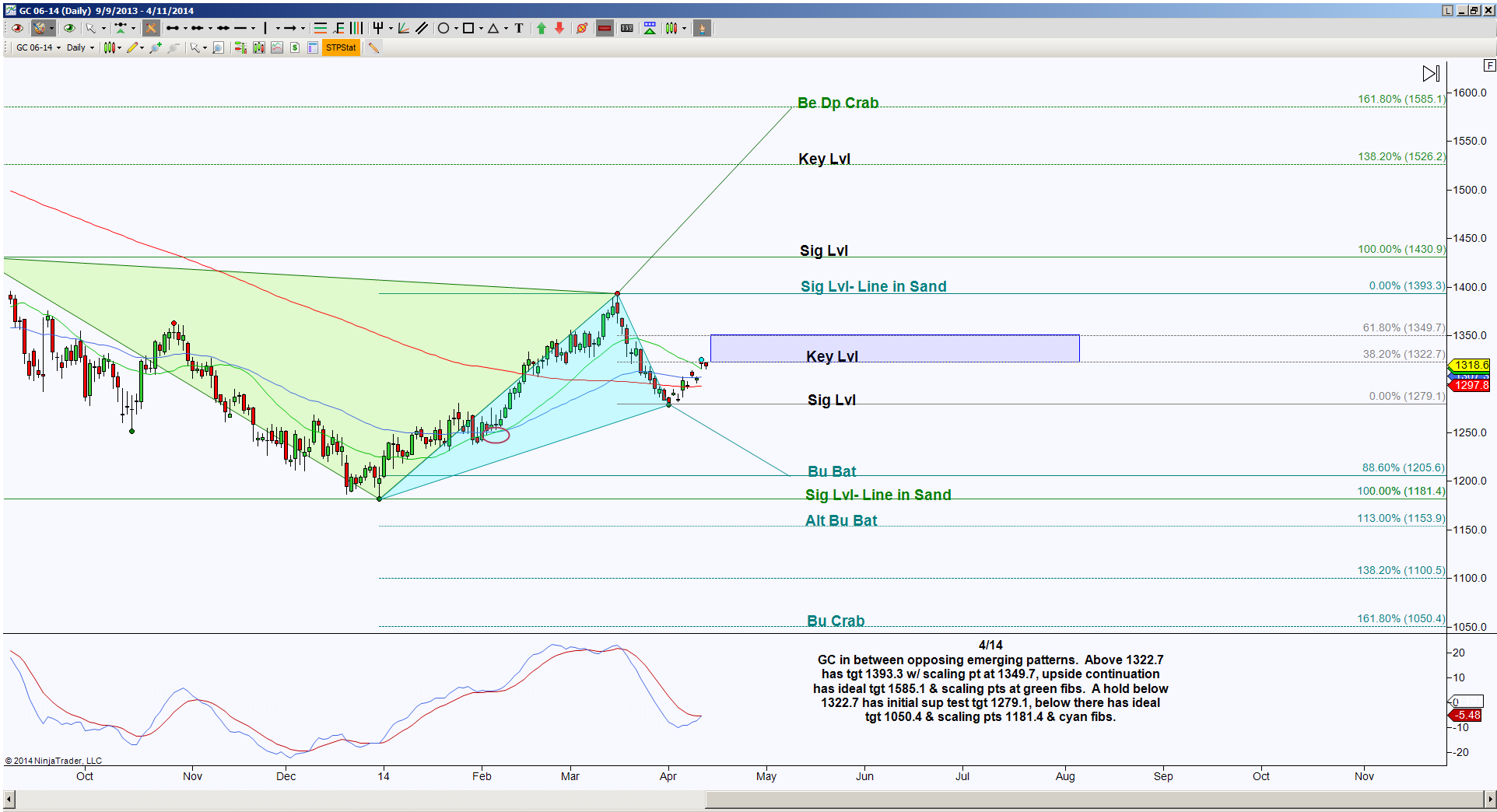

Here’s an example of Gold futures with the first chart analysis posted April 12, 2014 for the Monday April 14th analysis, in this chart I was focusing on whether the key level of 1322.7 would hold, and if so, the initial target would be 1279.1, followed by ideal target of 1205.6 for a completion of a harmonic pattern.

On April 22, 2014, I posted this GC day chart, and the 1322.7 resistance held as resistance and price is at the 1279.1 target, this was a short set up from 1322.7 to 1279.1 scaling point, still having the ideal target of 1205.6.

Today, the pattern is the same but the levels are different due to contract change. The pattern is in a wedge after a prominent downside move beginning in October 2012, and price is in between opposing patterns, this is indicative of consolidation. And as of yet, if a short was initiated at that hold below the June contract level 1322.7 (equivalent August contract level 1323.6), there was an opportunity to scale at 1279.1 and the completion of the pattern being the ideal target of 1205.6 in June contract and 1207.1 in August contract. Price stalled at the break down point and is currently attempting to test that level from below, so this sets up for another short opportunity with a hold below August contract 1280 keeping the ideal target at 1207.1, or to exit the short by locking in profits by placing a stop above August contract 1280, this would still be a profitable stop out if the trade was originated from the GRZ rejection (1322.7 Jun contract price).

If price holds above 1280, the opposing pattern that has upside bias could be prevalent and preventing the test of 1207.1 (August contract) and offers a long opportunity to test the wedge resistance, then 1394.2 and ideally 1591.5 and scaling points at the green fibs. Perhaps this will be another Then and Now update in the future.

BY Kathy Garber