Street Calls of the Week

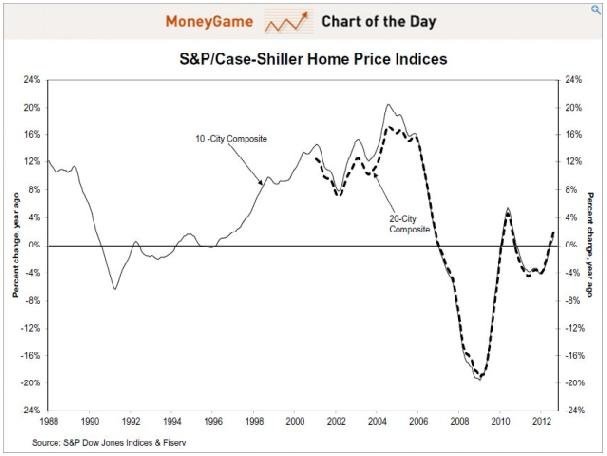

Friday’s US unemployment number and nonfarm payrolls could have an important impact on next Tuesday’s presidential poll. Economists are expecting gains of 125,000 in the payroll numbers, but are cautious about the unemployment rate following last month’s unexpectedly large drop from 8.1% to 7.8%: 7.9% is this month’s consensus estimate. Thursday’s ISM manufacturing numbers came in slightly better than expected, as did the ADP employment report and jobless claims. Rising home prices are also lending some comfort to the bulls (chart courtesy of Business Insider).

Of course, eurozone woes continue to hang on markets like a bad odour, with reports that Greek stocks are heading for their biggest weekly loss in two-and-a-half years after the government released figures showing that it’s falling behind its deficit reduction targets. On top of this, a Greek court ruling holds that planned pension cuts may be “unconstitutional.” As a result the EUR/USD slipped back under $1.29, while the yield on the 10-year Greek government bond rose 40 basis points Thursday.

Gold, silver and platinum were performing well during Wednesday afternoon and Thursday morning, but were hurt following the release of the ADP numbers (palladium doing better than the other metals though, on account of its wholly industrial investment profile).

Uncertainty continues to be the dominant theme in all markets ahead of next Tuesday’s poll. But looking slightly further ahead, the “fiscal cliff” that looms December 31 carries ominous implications as far as the economy is concerned: the austerity mix of tax rises and spending cuts that are scheduled to take place from this date look certain to hurt the US economy – and by extension, economies elsewhere. Of course, tax rises and spending cuts are arguably what is needed in terms of reducing the federal government’s $1 trillion+ deficit.

If enacted as many expect, these measures will pile even more pressure on the Federal Reserve to keep up its extraordinarily loose monetary policies – and perhaps even force it into even greater attempts to devalue the dollar.