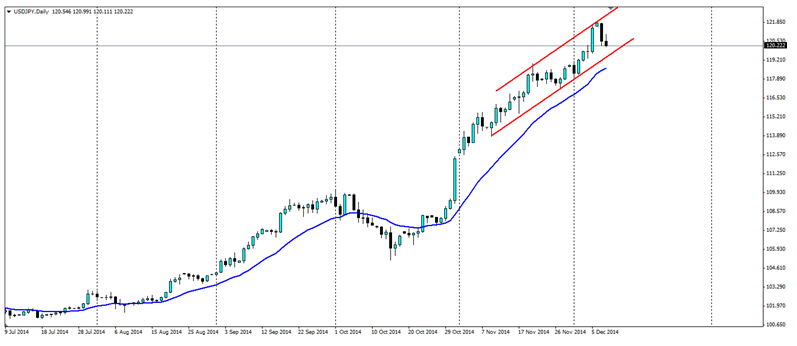

The Yen has depreciated a considerable amount over the past few months and with an election coming up this is unlikely to change. As the old adage goes “the trend is your friend” and this case is no different.

A weaker Yen is the result of the fundamental difference between the US and Japan at the moment. The US is looking stronger every month and the latest Nonfarm Payroll result paints the picture clearly. In November the US economy added 321,000 jobs, well above the expected 228,000. At the same time these figures were released, the figure from October was revised upwards from 214,000 to 243,000.

Japan is at an interesting point in their economic history. The massive stimulus put in place by Prime Minister Shinzo Abe has not quite had the effect many had hoped for. Figures released yesterday show GDP growth at -0.5% q/q, confirming fears of a recession. The Account balance was much higher than expected at ¥833.4b (vs ¥382.6b exp.) which may give some in the market hope that the policies are having some effect.

The continuation of the depreciating trend recently has been a result of the latest polls out of Japan. Abe called a snap election for the 14th December, a full two years before his term is up. What he saw was an opposition in disarray and no real threat. The Polls are actually showing him increasing his majority despite many of his policies being unpopular. At this stage it looks like we will have four more years of ‘Abenomics’. This means four more years of stimulus and four more years of a weaker yen.

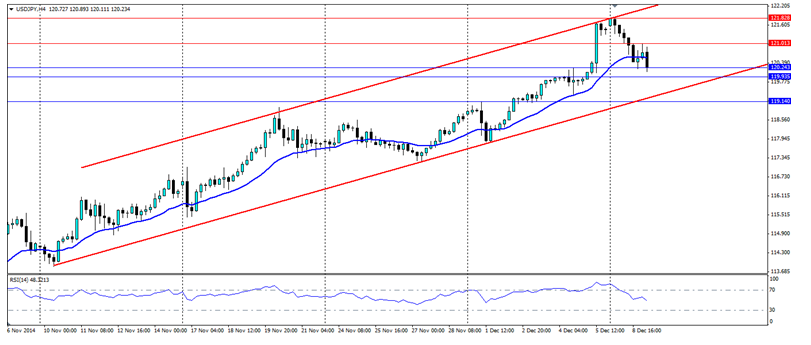

It is likely we will see the bullish channel on the USD/JPY H4 chart hold leading into the election. The RSI is currently trending back from overbought territory as the price corrects towards the lower end of the channel. It has found support at the current level of 120.243, with further support likely to be found at 119.935 and 119.140 with the bottom of the channel likely to act as dynamic support. Resistance for a movement higher is likely to be found at 121.013, 121.828 and 122.562 with the upper level of the channel acting as dynamic resistance as before.

The Yen will likely continue to respect the depreciating trend as we head into the Japanese general election on December 14th. Shinzo Abe is tipped to increase his majority which will see four more years of Abenomics, so we can expect the trend to hold for now.