The Yen is, as always, polarising traders and markets with its movements and nowhere is this more apparent than with the Euro currencies,where stark uptrends and bullish movements are the flavour of the month. Currently, the Pound, Euro and Swiss Franc are all gaining ground against the Yen and this trend looks unlikely to stop in the near term, as all the currencies experience a resurgence in economic growth in their respective economies, and a boost in market optimism. EUR/JPY Daily" title="EUR/JPY Daily" height="425" width="854">

EUR/JPY Daily" title="EUR/JPY Daily" height="425" width="854">

The EUR/JPY pair is currently pushing aggressively upwards and looking to break 142 as market sentiment lifts heavily in favour of the Euro currency. Overnight, we saw a slight pull back but in reality, market sentiment is aggressively vying to push it higher. This is reinforced by very strong buying pressure still being prevalent, coupled with the fact that it has not touched on its recent trend line and still looks capable of going higher.  GBP/JPY Daily" title="GBP/JPY Daily" height="425" width="854">

GBP/JPY Daily" title="GBP/JPY Daily" height="425" width="854">

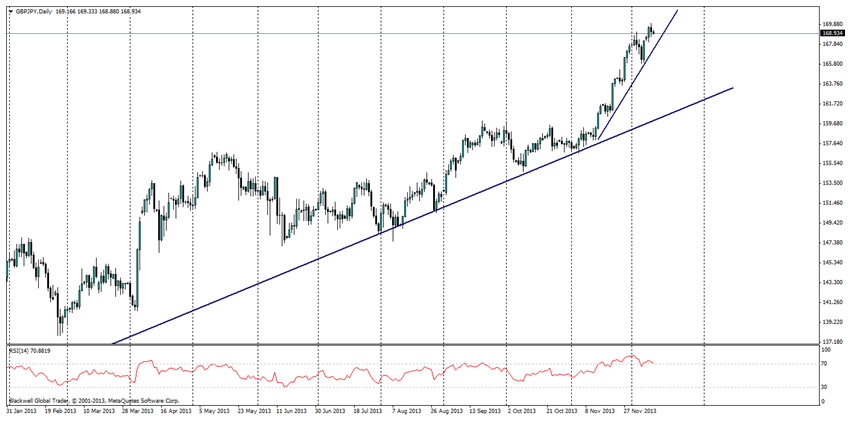

The GBP/JPY pair looks very similar to the EUR/JPY pair and rightfully so, as both currencies are going through a resurgence, though one could easily argue that the pound has been doing better than the Euro and in some parts helped push it higher. However, once again a slight pullback but still not touching the trend line currently in play. The RSI also shows that despite pressure weakening, there is certainly still pressure there and the market is keen to buy.  EUR/JPY- GBP/JPY" title="EUR/JPY- GBP/JPY" height="425" width="854">

EUR/JPY- GBP/JPY" title="EUR/JPY- GBP/JPY" height="425" width="854">

Overall though, we can certainly see that the two pairs are very closely related and that any movement in one is likely to affect the other. With this in mind, it's clear that news for one zone is clearly likely to affect the other and then when trading either the EURJPY or GBPJPY, it’s important to note economic news from all 3 zones for the currencies.

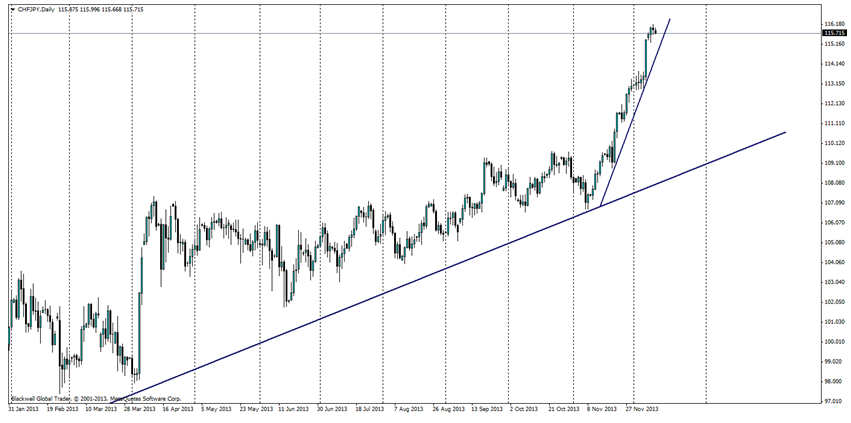

I have also noted the CHF/JPY pair in my introduction..

However, the Swiss Franc is currently still pegged to the Euro and so any movement in the EUR/JPY is essentially replicated by the CHF/JPY; otherwise arbitrage takes over and brings it in line regardless. I believe that yes, you can trade this pair, but in reality,movements in the EUR/JPY pair are much greater so the opportunity is certainly there for greater profitably in the long run.

Overall though, there is certainly aggressive upward trends in the works, and at the current moment, markets are looking to see if these uptrends can continue. If they can, we will know by the end of this week. If they can’t, we might find out shortly as it crashes through its current bullish uptrend and looks to pressure downwards to its weekly trend line for both pairs. Either way, both of these major pairs replicate each other and are still providing opportunities for traders to take advantage of and are certainly interesting to watch.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Yen Is Still Your Friend

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.