Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

This morning, we heard from the Bureau of Labor Statistics (BLS) about the jobs market situation in the U.S. economy. It said the unemployment rate in the U.S. was 7.3% in October, compared to 7.2% in September. In October, 204,000 jobs were added to the U.S. economy. (Source: Bureau of Labor Statistics, November 8, 2013.)

Finally, a month in which more than 200,000 jobs were created! But not so fast…

The underemployment rate (which includes people who have given up looking for work and people who have part-time jobs but want full-time jobs) actually jumped in October to 13.8%—it stood at 13.6% in September!

And, as we have become accustomed to, in the jobs market report, we see low-wage-paying jobs accounted for most of the new jobs in the U.S. economy in October: 44,000 jobs were created in the retail trade, 53,000 jobs in the leisure and hospitality sector, and 15,000 jobs in health care. Combined, these low-paying jobs made up 55% of all the jobs created in October!

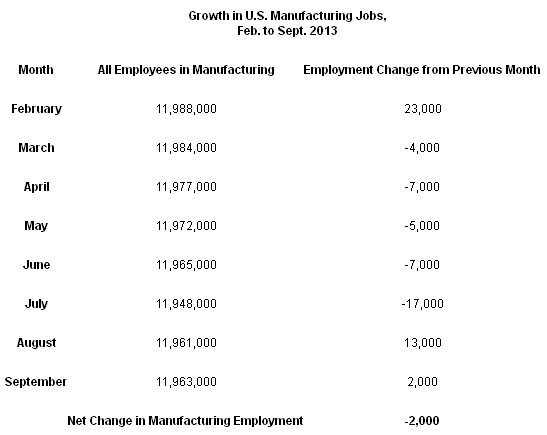

Jobs which provide a decent salary didn’t see much growth from what we can see in the October jobs market report. Jobs in the traditional high-paying construction, mining/logging, wholesale trade, transportation/warehousing, information, and financial sectors lagged and showed next to no change in growth in October.

The final troubling fact about the U.S. jobs market that no one wants to talk about is that in October, the civilian labor force (all workers in the U.S. economy) declined by 720,000! The labor force participation rate declined by 0.4% and stood at 62.8%. This is troublesome at the very core; it shows less and less Americans are working.

Dear reader, the jobs market report for October has strengthened my argument that the U.S. economy is far from seeing any economic growth. Looking at this jobs market report, which I’m sure the Federal Reserve is analyzing very closely, it only makes the Fed’s decision not to start tapering (not to pull back on monthly paper money printing) even stronger.

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and analysis. The opinions in this e-newsletter are just that, opinions of the authors. Information contained herein, while believed to be correct, is not guaranteed as accurate. Warning: Investing often involves high risks and you can lose a lot of money. Please do not invest with money you cannot afford to lose.

Original post