- Peering over a cliff can give vertigo and this is what seems to be happening to the US economy. Growth stateside is set to decelerate sharply in Q4 partly due to the damage caused by storm Sandy, but mostly because of the uncertainty brought by the fiscal cliff. We suspect that risk aversion could make a comeback as markets price-in a higher probability of a US recession. The US dollar can therefore rebound over the next few months at the expense of the euro and commodity currencies.

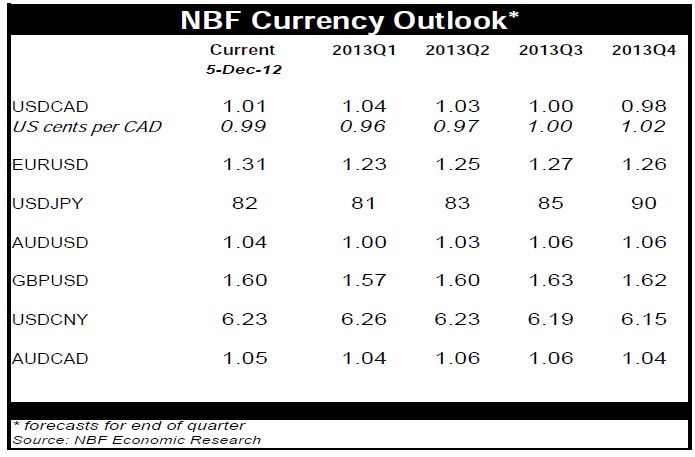

- While we expect a temporary depreciation of the Canadian dollar (we’re maintaining our end-of-Q1 target of 1.04), we expect the loonie to strengthen again towards the end of 2013. Foreign demand for our securities should remain strong given our AAA rating and solid fiscal footing, attributes that are becoming harder to find these days among sovereigns.

The higher the climb, the harder the fall for the euro

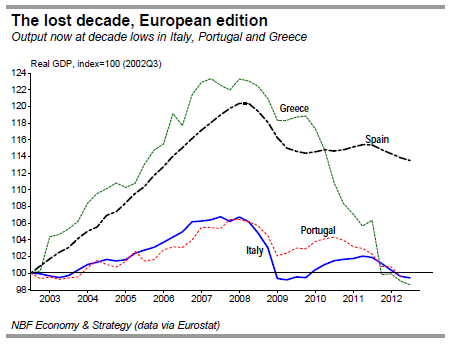

The return of risk-taking in recent weeks may have injected new life into the euro but that hasn’t changed the crooked fundamentals for the common currency. The zone remained stuck in recession in the third quarter as real GDP contracted again (-0.2% annualized), taking output to decade lows for some of the zone’s southern members.

Spain’s output may not yet be at a decade low but like Greece, its unemployment rate of over 25% screams Depression. The bad news for Spain and the rest of the zone is that Q4 isn’t looking much better with PMI’s well below 50 so far in the quarter and retail volumes plunging to an 8-year low in October.

The ongoing real estate meltdown, sovereign haircuts and recession are weighing on an already fragile banking sector, and in many cases depriving the real economy of the credit it needs to flourish. In October, year-on-year eurozone loan growth to the non-financial sector contracted 1.8%, the worst in over two years.

The outlook for next year isn’t bullish either. In addition to a likely extension of the recession through early 2013, expect old problems to resurface (political inertia, sovereign and banking woes, ect…). Structural problems like trade imbalances and labour market inflexibility haven’t been dealt with and those remain ticking time bombs. We are maintaining our call for the common currency to drop to USD 1.23 by end of Q1 with limited upside potential after that.

To Read the Entire Report Please Click on the pdf File Below.