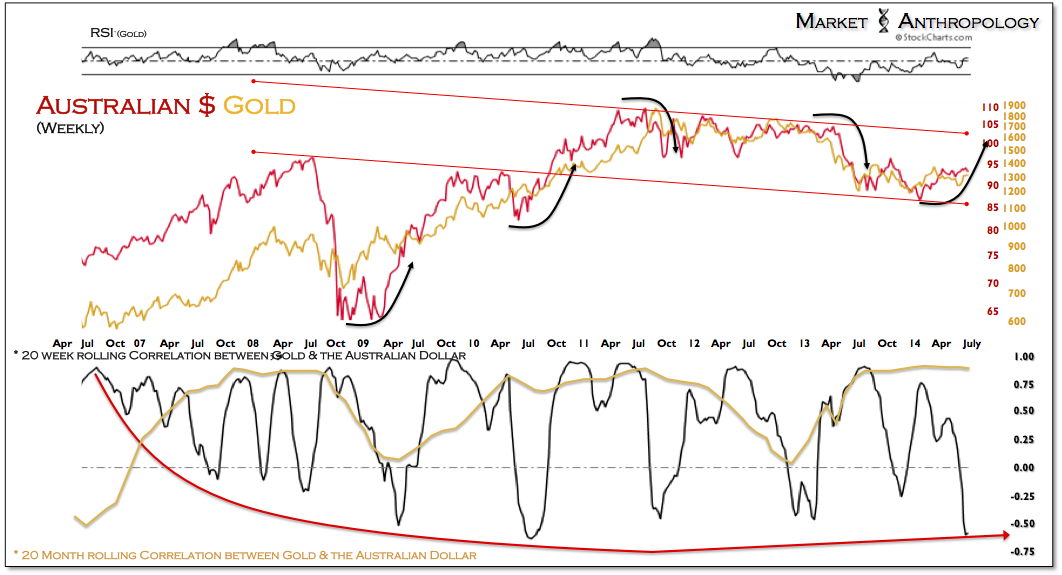

"When judged against current and likely future trends in the terms of trade, and Australia's still high costs of production relative to those elsewhere in the world, most measurements would say it is overvalued, and not by just a few cents.

...Nonetheless, we think that investors are under-estimating the likelihood of a significant fall in the Australian dollar at some point." - RBA Governor Glenn Stevens

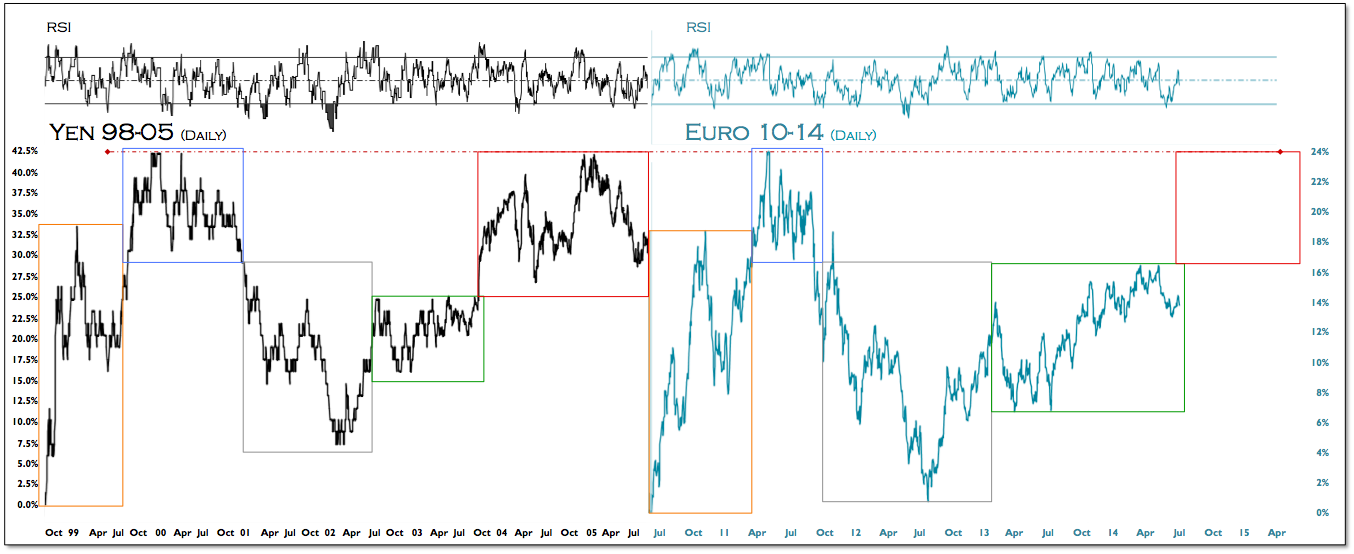

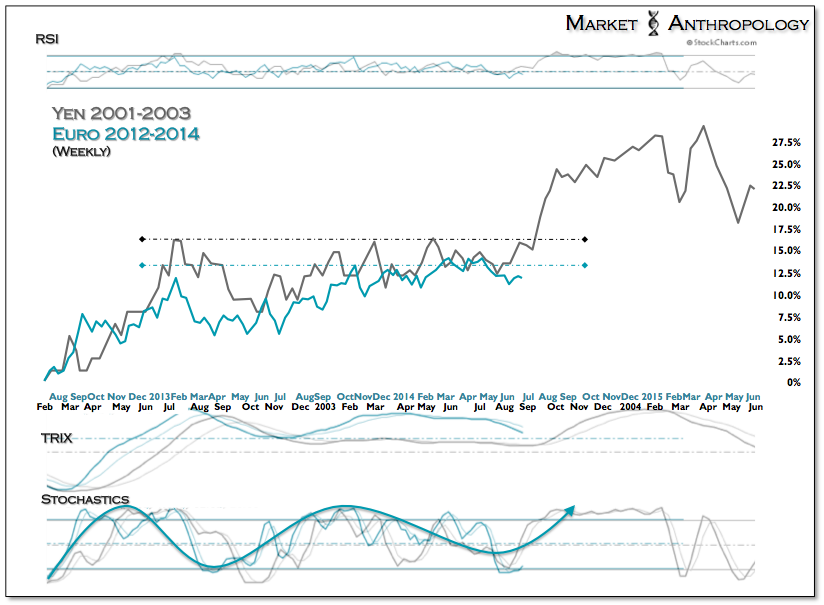

If managing the perceived imbalances placed on their economies were as easy as the short-term currency reflexes imparted from the monetary pulpits suggest -- the RBA and the ECB's jobs would be considerably less challenging. But, alas -- the currency markets are played out on a world stage, with an overarching federation still administered through a dominant US Dollar referee -- that appears to share the likeness and performance trajectory of the American World Cup team.

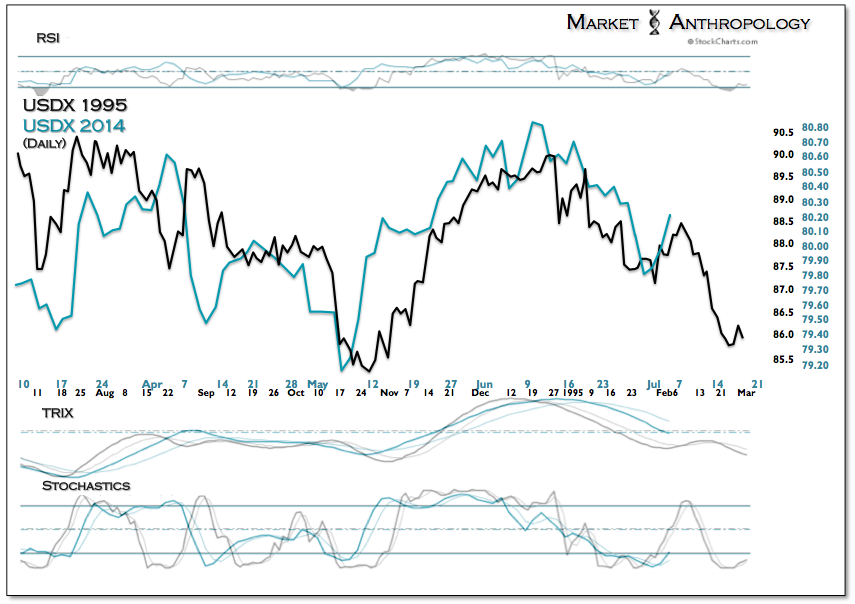

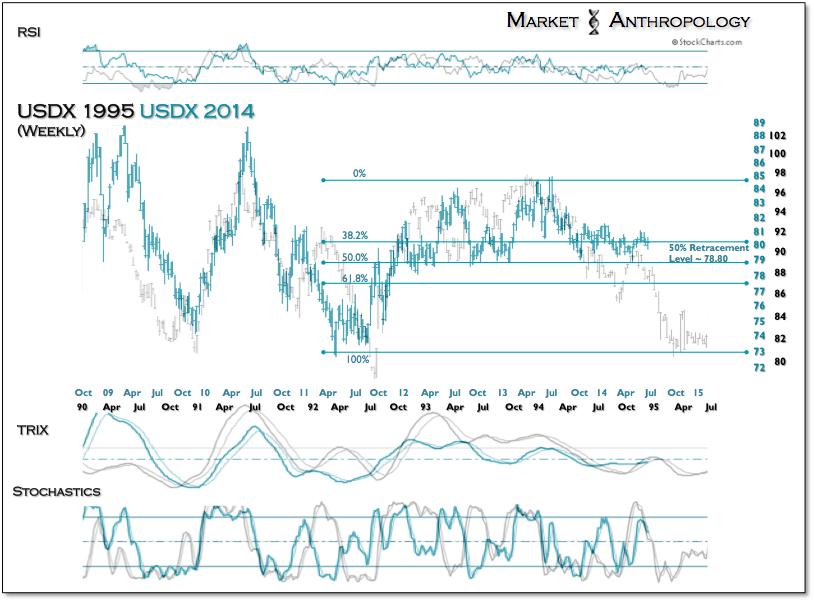

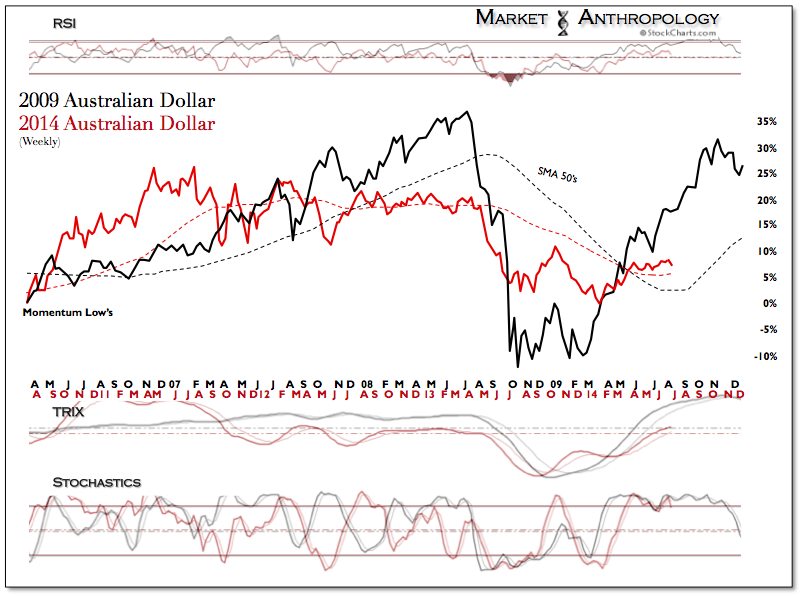

The long and short of things: Despite Draghi and Stevens's contractual agreements to persuade their respective currencies lower, until the US dollar materially strengthens -- the efficacy of their efforts will fail to find much lasting traction. From our perspective, the US dollar does not appear poised to cooperate with these coaches very best intentions. Conversely -- and likely apparent to both the RBA and ECB, the dollar still presents a rather weak disposition relative to the Aussie and the USD/EUR and a strong tendency to take a fall toward the bottom of its long-term range.