The Weekly VC Price Momentum Indicator

ETF’s, Futures Swing Trading Instructions 8/12/2016

Signals are automatically generated by integrating electronic prices and weekly statistics with proprietary algorithms.

WEEKLY SUMMARY

- TREND MOMENTUM: 45.83 Bearish

- PRICE MOMENTUM: 43.46 Bullish

- PRICE INDICATOR

- EXIT LONG:

- S2) 47.15

- S1) 45.82

EXIT SHORTS:

B1) 42.13

B2) 39.77

WEEKLY MOVING AVERAGES

The contract closed at 44.49 The market closing below the 9 SMA 45.83 is confirmation that the trend momentum is bearish. A close above the 9 SMA would negate the weekly bearish short-term trend to neutral.

WEEKLY MOMENTUM INDICATOR

With the market closing above The VC Weekly Price Momentum Indicator of 43.46 it confirms that the price momentum is bullish. A close below the VC Weekly, it would negate the bullish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 42.13 - 39.77 levels and go long on a weekly reversal stop. If long, use the 39.77 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 45.82 - 47.15 levels during the week.

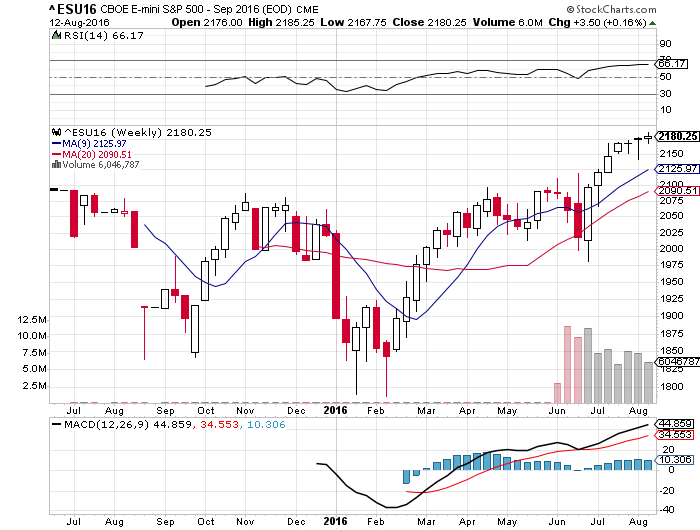

WEEKLY SUMMARY

- TREND MOMENTUM: 2126 Bullish

- PRICE MOMENTUM: 2178 Bullish

- PRICE INDICATOR

- EXIT LONGS:

- 2) 2195

- 1) 2188

EXIT SHORTS:

1) 2170

2) 2160

WEEKLY MOVING AVERAGES

The contract closed at 2180 The market closing above the 9 SMA 2126 is confirmation that the trend momentum is bullish. A close below the 9 SMA would negate the weekly bullish short-term trend to neutral.

WEEKLY MOMENTUM INDICATOR

With the market closing above The VC Weekly Price Momentum Indicator of 2178 it confirms that the price momentum is bullish. A close below the VC Weekly, it would negate the bullish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 2170 - 2160 levels and go long on a weekly reversal stop. If long, use the 2160 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 2188 - 2195 levels during the week.

First Mining Finance Corp (V:FF)

WEEKLY SUMMARY

- TREND MOMENTUM: 0.75 Bullish

- PRICE MOMENTUM: 0.84 Bearish

- PRICE INDICATOR

- EXIT LONGS:

- S2) 0.91

- S1) 0.87

EXIT SHORTS

B1) 0.80

B2) 0.77

WEEKLY MOVING AVERAGES

The contract closed at 0.83. The market closing above the 9 SMA 0.75 is confirmation that the trend momentum is bullish. A close below the 9 SMA would negate the weekly bullish short-term trend to neutral.

WEEKLY MOMENTUM INDICATOR

With the market closing below The VC Weekly Price Momentum Indicator of 0.84 it confirms that the price momentum is bearish. A close above the VC Weekly, it would negate the bearish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 0.80 - 0.77 levels and go long on a weekly reversal stop. If long, use the 0.77 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 0.87 - 0.91 levels during the week.

McEwen Mining Inc. (NYSE:MUX)

WEEKLY SUMMARY

- TREND MOMENTUM: 4.15 Bullish

- PRICE MOMENTUM: 4.37 Bearish

- PRICE INDICATOR

- EXIT LONGS:

- 2) 4.68

- 1) 4.52

EXIT SHORTS

- 4.21

4.06

WEEKLY MOVING AVERAGES

The contract closed at 4.36 The market closing above the 9 SMA 4.15 is confirmation that the trend momentum is bullish. A close below the 9 SMA would negate the weekly bullish short-term trend to neutral.

WEEKLY MOMENTUM INDICATOR

With the market closing below The VC Weekly Price Momentum Indicator of 4.37 it confirms that the price momentum is bearish. A close above the VC Weekly, it would negate the bearish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 4.21 - 4.06 levels and go long on a weekly reversal stop. If long, use the 4.06 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 4.52 - 4.68 levels during the week.

Direxion Daily Junior Gold Miners Bull 3X Shares (NYSE:JNUG)

WEEKLY SUMMARY

- TREND MOMENTUM: 254.35 Bullish

- PRICE MOMENTUM: 306 Bearish

- PRICE INDICATOR

- EXIT LONGS:

- 2) 362

- 1) 335

EXIT SHORTS:

- 279

- 249

WEEKLY MOVING AVERAGES

The contract closed at 307.7 The market closing above the 9 SMA 254.35 is confirmation that the trend momentum is bullish. A close below the 9 SMA would negate the weekly bullish short-term trend to neutral.

WEEKLY MOMENTUM INDICATOR

With the market closing above The VC Weekly Price Momentum Indicator of 306 it confirms that the price momentum is bullish. A close below the VC Weekly, it would negate the bullish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 279 - 249 levels and go long on a weekly reversal stop. If long, use the 249 as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 335 - 362 levels during the week.

Direxion Daily Gold Miners Bull 3X Shares (NYSE:NUGT)

WEEKLY SUMMARY

- TREND MOMENTUM: 145 Bullish

- PRICE MOMENTUM: 166 Bullish

- PRICE INDICATOR

- EXIT LONGS

- 2) 192.10

- 1) 179.54

EXIT SHORTS

- 1) 153.86

- 2) 140.74

WEEKLY MOVING AVERAGES

The contract closed at 166.98 The market closing above the 9 SMA 145 is confirmation that the trend momentum is bullish. A close below the 9 SMA would negate the weekly bullish short-term trend to neutral.

WEEKLY MOMENTUM INDICATOR

With the market closing above The VC Weekly Price Momentum Indicator of 166.42, it confirms that the price momentum is bullish. A close below the VC Weekly, it would negate the bullish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 153.86 - 140.74 levels and go long on a weekly reversal stop. If long, use the 140.74 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 179.54 - 192.10 levels during the week.

VelocityShares 3x Long Silver linked to S&P GSCI Silver ER Exp 14 Oct 2031 (NASDAQ:USLV)

WEEKLY SUMMARY

- TREND MOMENTUM: 24.12 Bullish

- PRICE MOMENTUM: 25.43 Bearish

- PRICE INDICATOR

- EXIT LONGS:

- 2) 28.13

- 1) 26.38

EXIT SHORTS

- 1) 23.68

- 2) 22.73

WEEKLY MOVING AVERAGES

The contract closed at 24.64. The market closing above the 9 SMA 24.12 is confirmation that the trend momentum is bullish. A close below the 9 SMA would negate the weekly bullish short-term trend to neutral.

WEEKLY MOMENTUM INDICATOR

With the market closing below The VC Weekly Price Momentum Indicator of 25.43, it confirms that the price momentum is bearish. A close above the VC Weekly, it would negate the bearish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 23.69 - 22.73 levels and go long on a weekly reversal stop. If long, use the 22.73 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 26.39 - 28.13 levels during the week.

ProShares Ultra Silver (NYSE:AGQ)

WEEKLY SUMMARY

- TREND MOMENTUM: 50.56 Bullish

- PRICE MOMENTUM: 52.45 Bearish

- PRICE INDICATOR:

- EXIT LONGS:

- 1) 56.33

- 1) 53.91

EXIT SHORTS

- 1) 50.03

- 2) 48.57

WEEKLY MOVING AVERAGES

The contract closed at 51.50. The market closing above the 9 SMA 50.56 is confirmation that the trend momentum is bullish. A close below the 9 SMA would negate the weekly bullish short-term trend to neutral.

WEEKLY MOMENTUM INDICATOR

With the market closing below The VC Weekly Price Momentum Indicator of 52.44, it confirms that the price momentum is bearish. A close above the VC Weekly, it would negate the bearish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 50.03 - 48.57 levels and go long on a weekly reversal stop. If long, use the 48.57 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 53.91 - 56.33 levels during the week.

*Disclaimer: The information in the Market Commentaries was obtained from sources believed to be reliable, but we do not guarantee its accuracy. Neither the information nor any opinion expressed herein constitutes a solicitation of the purchase or sale of any futures or options contracts.

Toll Free: 877-733-1511

Ph: 805-418-1744 Main

E-Fax: 310-281-6919

Email: support@EMA2Trade.com

Twitter: https://twitter.com/EMA2Trade

FaceBook: www.facebook.com/EMA2Trade

YouTube: Trading Talk

TRADING DERIVATIVES, FINANCIAL INSTRUMENTS AND PRECIOUS METALS INVOLVES SIGNIFICANT RISK OF LOSS AND IS NOT SUITABLE FOR EVERYONE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.