The Weekly Snapshot Top News Headlines

1. Terrorist attack in San Bernardino; 14 dead, 21 wounded. Husband and wife terrorist team killed in shootout. President Obama to address nation.

2. ISIS claims terrorists were supporters.

3. OPEC meets, no agreement on output.

4. Wild ride as US data and ECB roil markets.

Economic News

1. ECB cuts rates, extends QE, markets demand more.

2. Yellen testifies to Congress, rate hike looks likely.

3. Employment report comes in as expected, up 211K.

4. ISM manufacturing index drops below 50 indicating contraction.

5. Chicago PMI also below 50.

6. Imports/exports still contracting.

Random Thought Of The Week

The San Bernardino terrorist attack marks a change that I have feared since 9/11. I have no doubt that Homeland Security does a pretty good job of preventing coordinated terrorist attacks but there is almost no way to prevent what happened last week. I think we should expect more of these random attacks on soft targets. I can’t help but wonder how much this might further restrict our civil liberties.

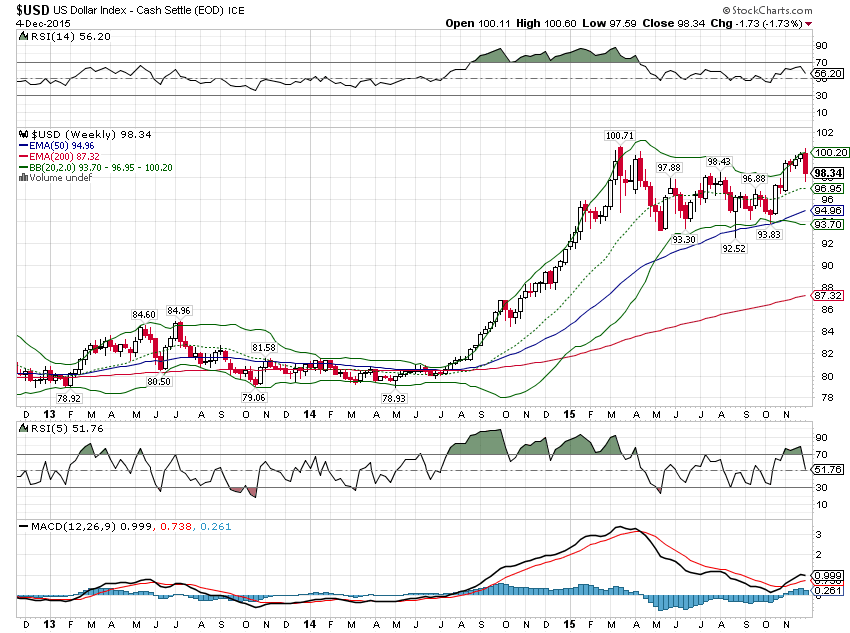

Chart Of The Week

Considering how the ECB action turned back the dollar index right at resistance, one wonders if that alone was the reason Draghi disappointed the market. We know that the BIS and IMF are concerned about the effect of a rising dollar on the global economy, especially emerging markets. We also know the Fed desperately wants to hike rates in December, an act that would tend to raise the value of the dollar and suppress inflation. Was there coordination between Yellen and Draghi on their public remarks last week? I wouldn’t go that far but it seems likely central bank actions are being coordinated to some degree.

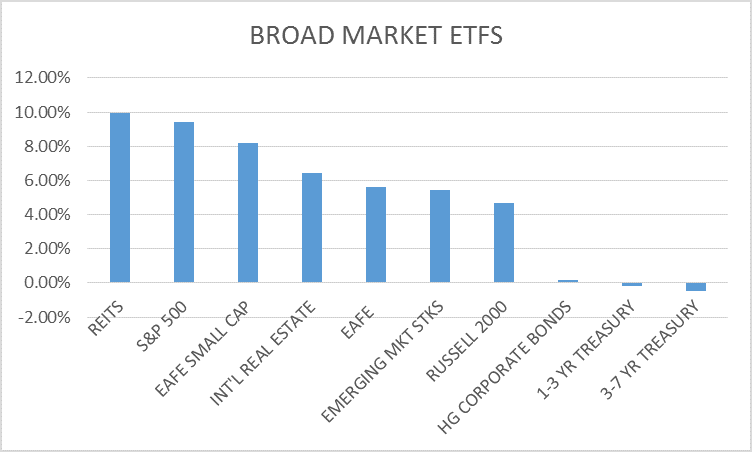

Broad Market – 3-month Returns

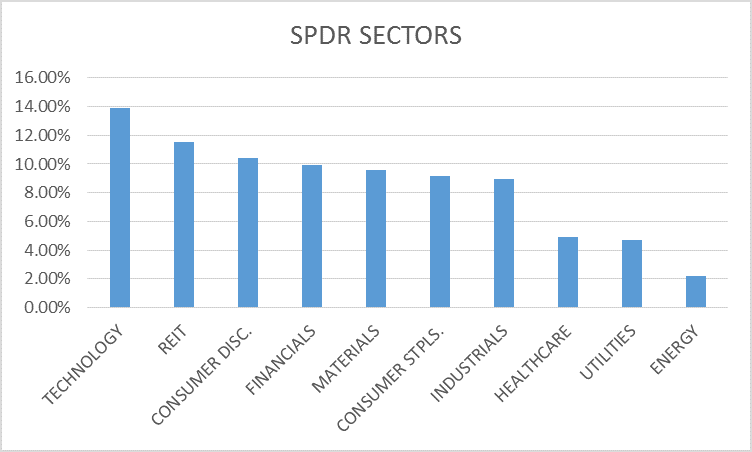

MOMENTUM ASSET ALLOCATION MODEL SPDR Sector Returns – 3 Month Returns

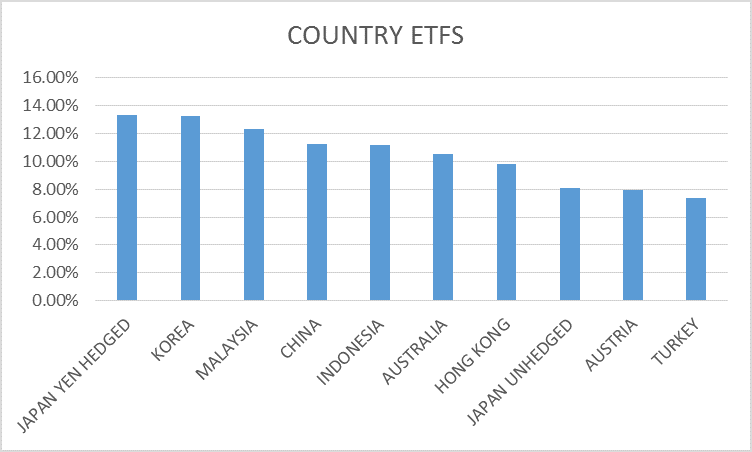

SPDR SECTOR ROTATION MODEL Country Returns Top 10 – 3 Month Returns

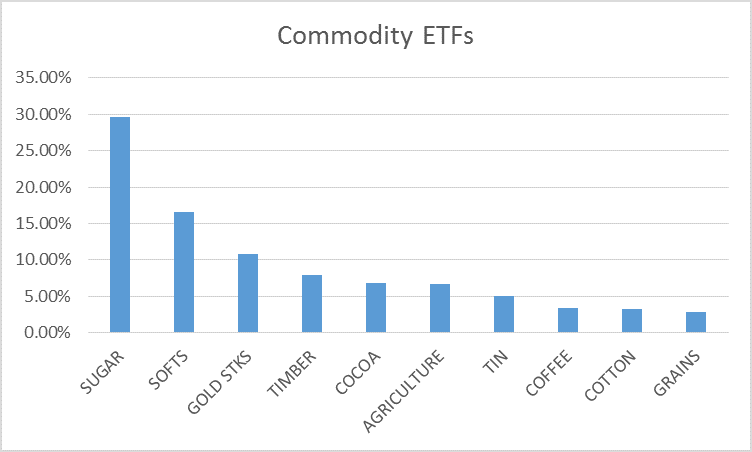

Commodity Returns Top 10 – 3 Month Returns

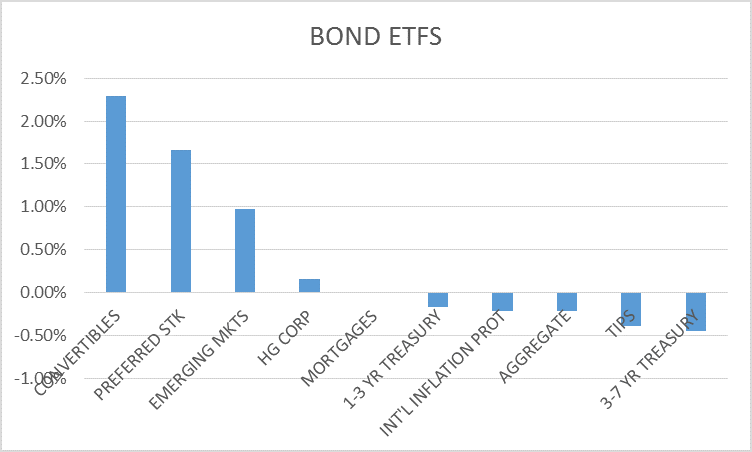

Bond Returns Top 10 – 3 Month Returns

Stock Valuation Update