Top News Headlines

Paris terrorists dispatched; hostage crisis in Mali ends with 27 dead.

Stocks have a big week, up over 3%. Fed minutes are dovishly hawk-like.

United Health says losing millions on Obamacare, may pull out of exchanges next year.

Israeli spy Jonathan Pollard released from US prison.

Square (N:SQ) prices IPO at half off last private funding round giving lucky IPO buyers a windfall.

Economic News

Fed minutes confuse everyone. Some parts dovish long term, mostly hawkish short term.

ECB hints again at more easing in December.

Yield curve flattening again as short rates anticipate rate hike.

Credit spreads resume widening, stocks oblivious.

Economic data mostly disappoints, market could not possibly care less.

Random Thought Of The Week

The political left is happy to see people cross borders but would happily restrict the flow of capital and goods. The political right is happy to see capital and goods cross borders but would happily build a fence to restrict the flow of people. I’m afraid that the compromise might be to restrict people, capital and goods.

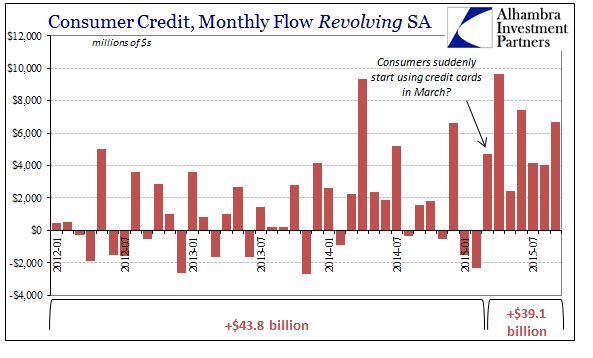

Chart Of The Week

Economics is messy, rarely offering up a clear view of the economy. The chart below shows that Americans have taken on more revolving debt (credit cards basically) since March than they did the previous three years combined. This could be a positive or a negative and we won’t know until some time in the future. It could be a reflection of confident consumers, readily taking on debt in an improving economy. Or it could be that consumers are using their credit cards because they don’t have cash and this is a precursor to recession. That’s what happened in 2000 and 2007 but pointing that out these days gets you labeled a perma-bear. That might be a clue as to how one ought to interpret the data….but maybe not.

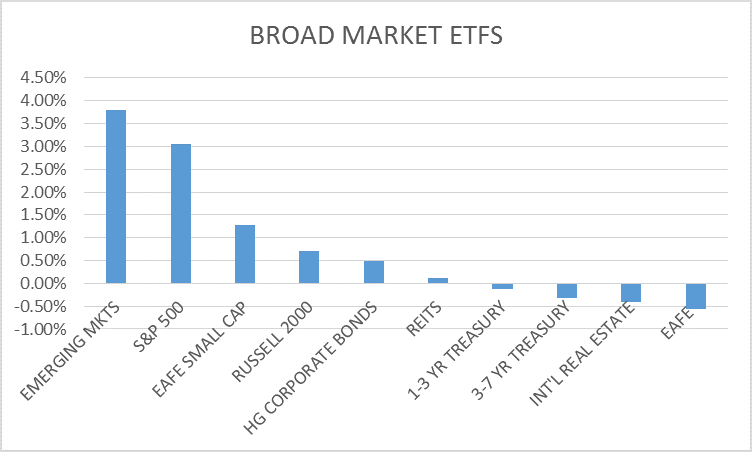

Broad Market Top 10 – 3 Month Returns

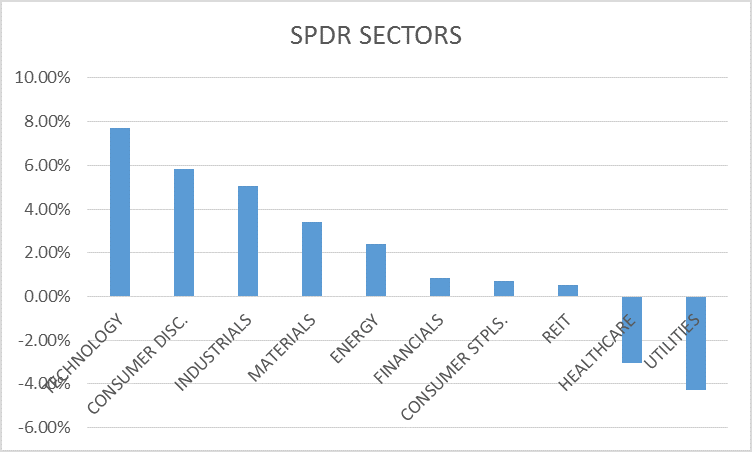

MOMENTUM ASSET ALLOCATION MODEL SPDR Sector Returns – 3 Month Returns

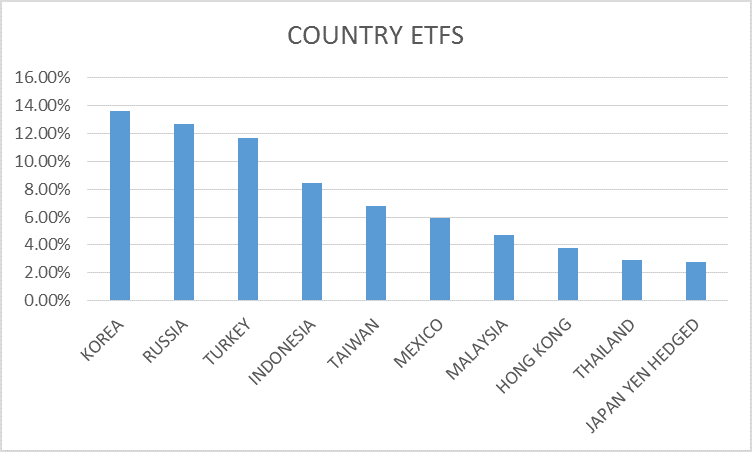

SPDR SECTOR ROTATION MODEL Country Returns Top 10 – 3 Month Returns

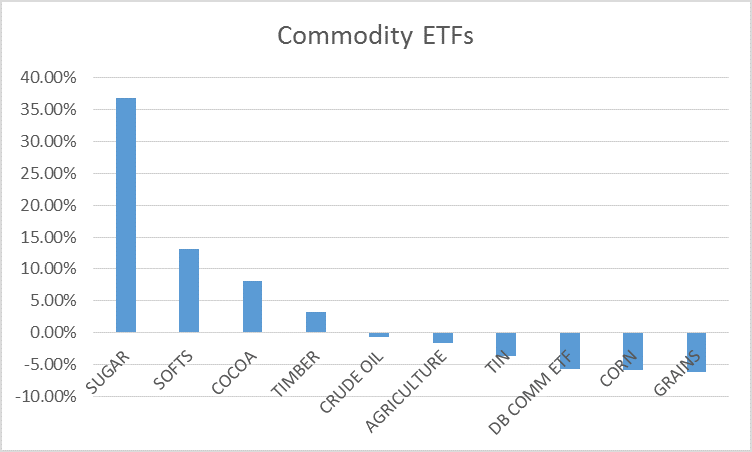

Commodity Returns Top 10 – 3 Month Returns

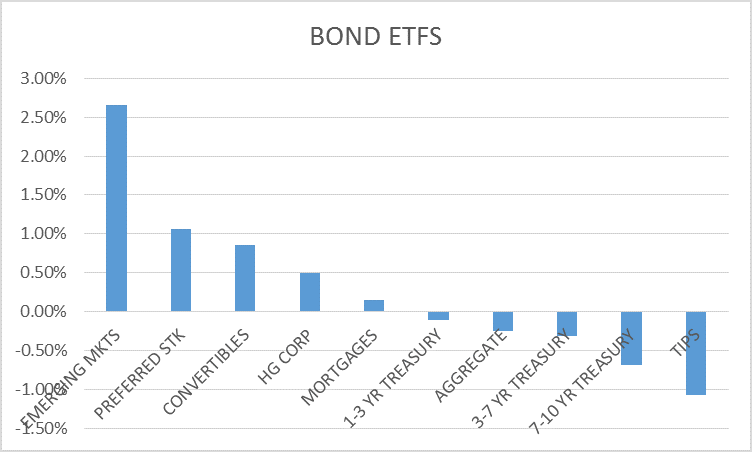

Bond Returns Top 10 – 3 Month Returns

Stock Valuation Update

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.