Top News Headlines

Obama sticks a fork in Keystone after company withdraws request.

Valeant (N:VRX) troubles continue; CEO sells stock after margin call. Bill Ackman having a very bad month.

DOJ ratchets up scrutiny of drug pricing. Seeking information from Merck & Company Inc (N:MRK), Eli Lilly and Company (N:LLY) and, of course, VRX.

Berkshire Hathaway's (N:BRKa) profit more than doubles; other earnings news last week was pretty poor.

Economic News

Jobs report much better than expected, avg. hourly earnings up too. Rate hike looking more certain.

Manufacturing data continues to be weak; ISM, Factory orders very weak.

Non Manufacturing survey much better than expected. Services still leading the economy.

Construction spending still showing strength.

Trade deficit improves but imports fall shows weak domestic economy.

Auto sales over 18 million annual rate.

Consumer credit surges most in history, up over $28 billion in September.

Random Thought Of The Week

You’re probably hearing a lot of talk right now about how an overwhelming majority of earnings are beating estimates this season. We always do of course. Companies reduce expectations to a point where they are stepping over a low bar so they look good relative to the lowered expectations they created. I don’t know why people still fall for it but you can be sure it will continue until it doesn’t work and probably even after. Call it the Lake Woebegone effect.

What you probably haven’t heard about is the quality of those earnings. When you hear the talking heads say that 70% of companies have beaten estimates they are referring to “operating earnings” or as I like to put it, “earnings after the company strips out all the bad things that they claim are one time but probably aren’t”. The other type of earnings are “reported earnings” which are the earnings the companies are forced to report because they are in accordance with GAAP and because the SEC makes them. If you look at the current quarter, only 42% of companies are beating estimates on reported earnings. This is typical late cycle behavior we see every cycle. As you get closer to recession operating and reported earnings diverge with reported looking a lot worse than operating. What that means is the companies get increasingly creative with earnings as they become harder to come by.

Chart Of The Week

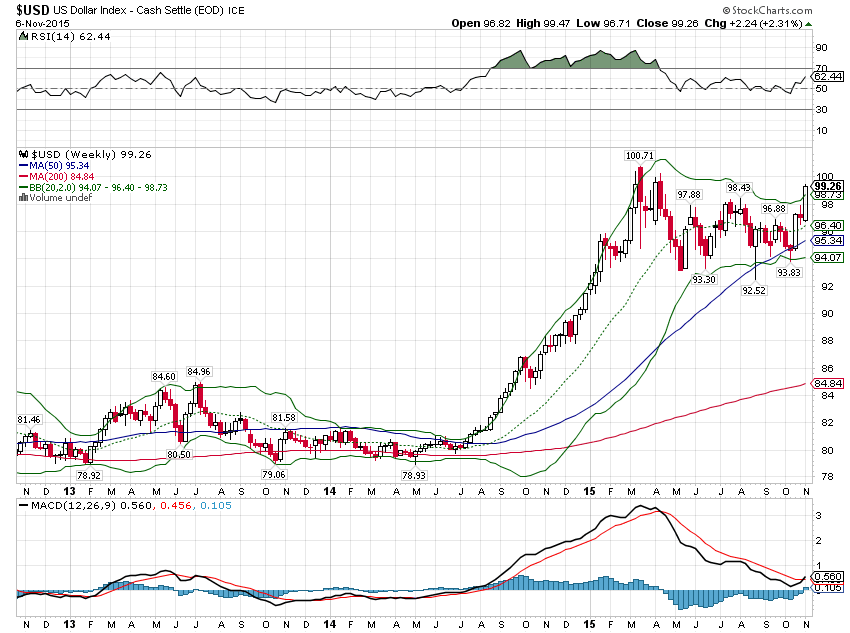

Good or bad? The dollar index appears to have completed its consolidation and is now taking another leg higher. There’s good and bad in that. A higher dollar means lower commodity prices, earnings pressure for US multinationals and capital flowing to the US chasing dollar returns. It also puts pressure on companies and countries with dollar debts which become harder to repay. In the long run we are better off with a strong, stable dollar but a relentlessly rising dollar – just as a relentlessly falling one – is difficult to deal with.

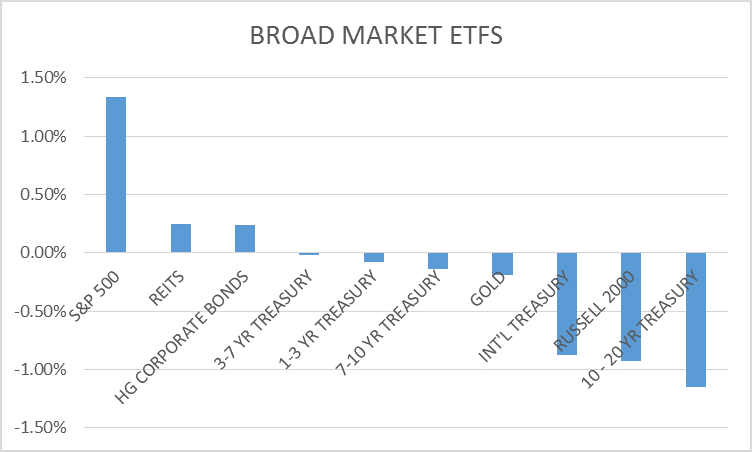

Broad Market Top 10 – 3 Month Returns

Starting to see a bit of a shift after the big stock rally of the last month. Surprisingly though – considering the magnitude of the stock rally and the bond selloff – bonds still dominate the list and gold is hanging in there too.

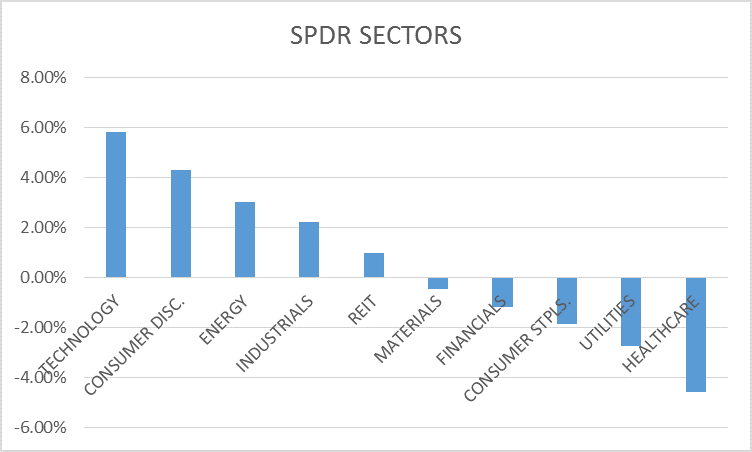

MOMENTUM ASSET ALLOCATION MODEL SPDR Sector Returns – 3 Month Returns

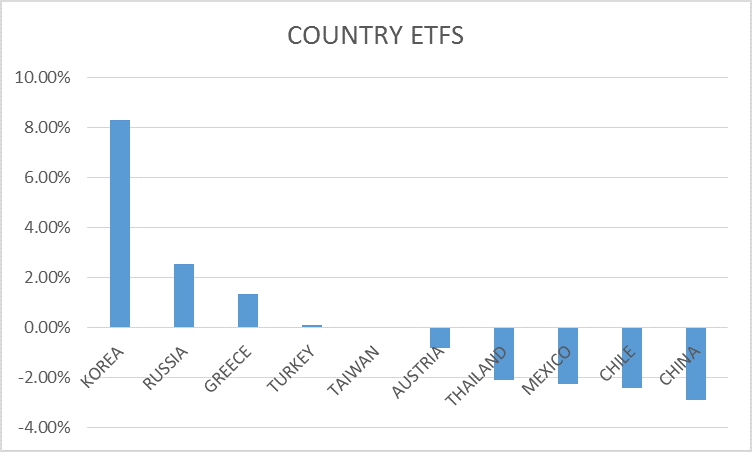

SPDR SECTOR ROTATION MODEL Country Returns Top 10 – 3 Month Returns

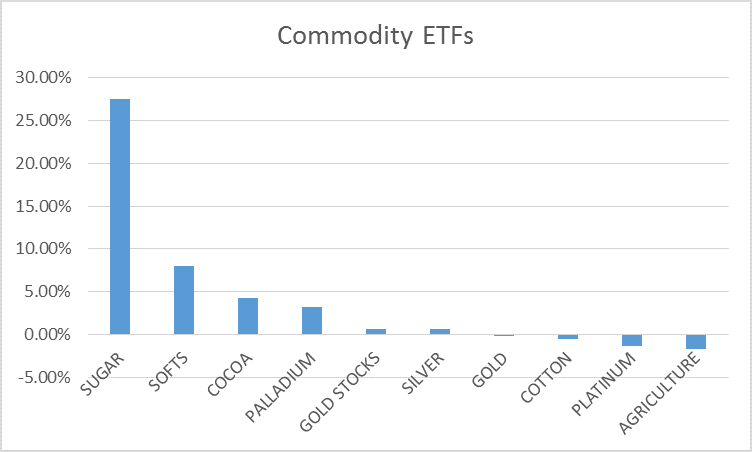

Commodity Returns Top 10 – 3 Month Returns

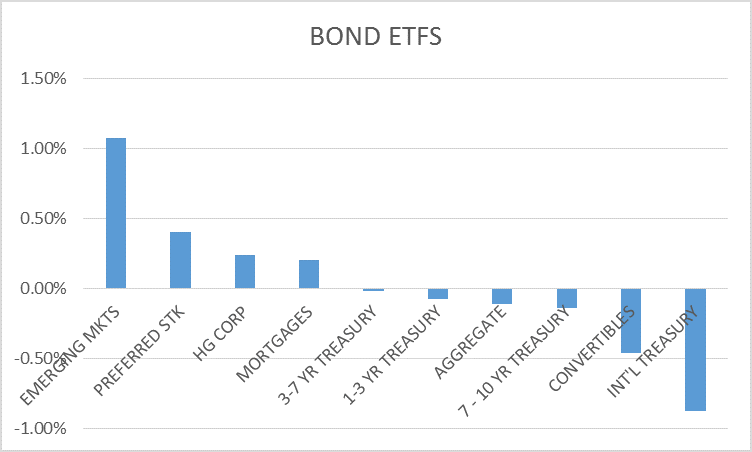

Bond Returns Top 10 – 3 Month Returns

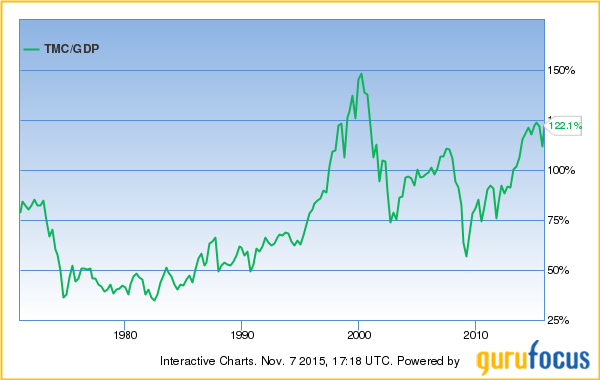

Stock Valuation Update