This year – 2018 – has been plagued by brutal market sell-offs. We’ve seen Emerging Markets implode and now it’s spreading onto Developed Market shores.

China’s slowing down – the E.U.’s a mess – and the stimulating effects of Trump’s 2017 Tax Cuts are finally wearing off. . .

Things aren’t looking exactly great.

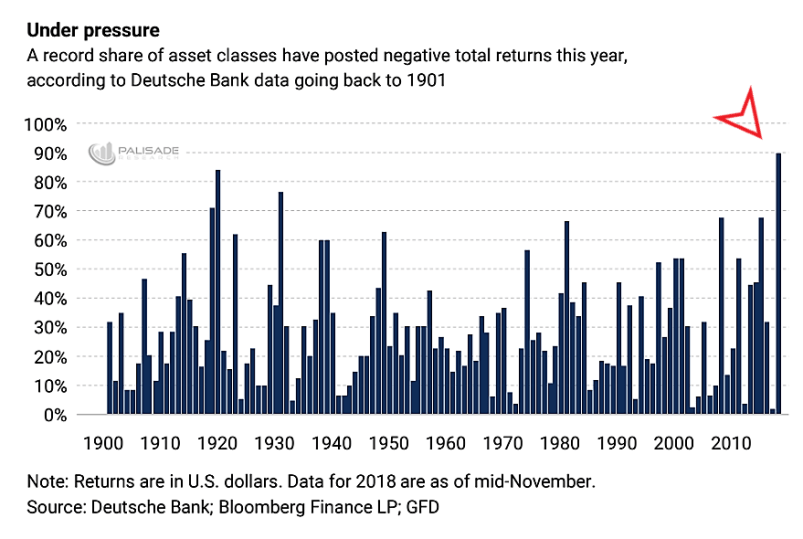

And putting it all into perspective – according to Deutsche Bank – almost all (90%) of the asset classes they track have had negative returns in 2018. . .

The last time things were this bad was in 1920 when 84% of the 37 asset classes were down. And giving you some context: last year – 2017 – only 1% of asset classes suffered negative returns for the year.

That’s a massive cumulative change over 24 months. Making matters worse, Blackrock warns that stocks and bonds could both finish the year lower for the first time in at least twenty-five years.

With ‘real’ (adjusted for inflation) rates rising – led by the Fed’s tightening via rate hikes and Quantitative Tightening (selling bonds) – there’s been an increase of global ‘tail risks’. Specifically due to the global dollar shortage (more here).

But most importantly of all is the strengthening U.S. dollar that’s been the true problem. Putting it simply – when the dollar gets stronger, it’s deflationary (aka asset prices fall).

Think of it this way – you’re selling commodities or assets and buying dollars in return. And since the U.S. dollar’s the global reserve currency and all commodities are priced in dollars – when it gets stronger, all else gets weaker (generally).

Therefore it’s no surprise that during last year in 2017 – while the dollar dropped 15% – roughly 99% of asset classes (according to Deutsche Bank’s model above) posted positive returns. But this year – when the dollar strengthened over 7% – Deutsche Bank reported 90% of the same asset classes posted negative returns.

Thus I’ve said it once, and I’ll say it again – don’t fight the dollar. Now – with the strong dollar killing asset classes, no wonder James Powell – The Federal Reserve Chairman – recently ‘blinked’ from his aggressive tightening path.

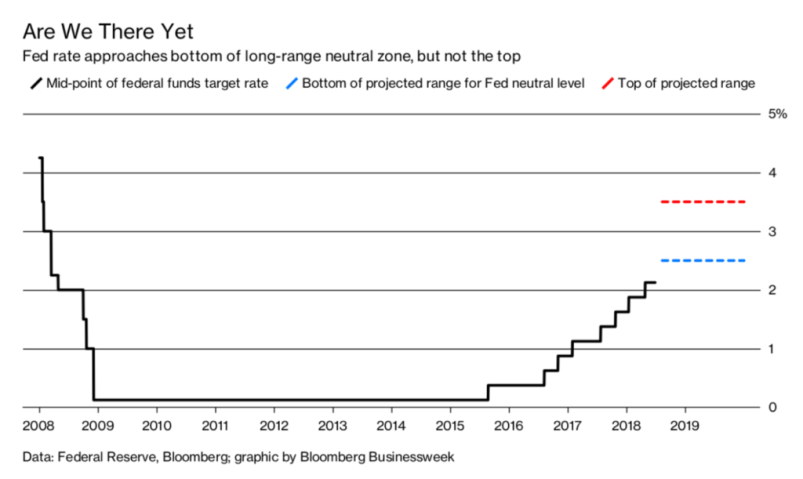

For instance: early in October – Powell remarked that the U.S. was a “long way” from reaching the neutral rate of interest. But two days ago – Powell instead said that the U.S. was now “just below” the neutral rate.

That’s a complete change in his tone – or as Wall Street likes to say, “he went from hawkish to dovish” (I should also mention that his brief comments sent stocks soaring and the dollar tumbling). That’s why we need to ask ourselves – has the Fed just put a floor under asset prices (aka was the ‘Powell Put’ just born)?

I refuse to believe that the Fed doesn’t know exactly what their words mean.

If stocks take a big hit over a few days – they’ll just sound more ‘dovish’ than usual (with the intention of calming markets). And if things don’t quite settle down, they’ll simply continue ‘doing the rounds’ in the media – increasing their dovish tone.

Then once the market bites and asset price begin climbing back up – they’ll continue their ‘hawkish’ tone.

Don’t forget that they’re trying to hike as much as they can get away with so that they have ‘ammo’ for the next recession. Meaning they need to have rates higher than 3% so that in the next slowdown they can cut rates by atleast 3%.

Why 3%? Because economic studies show that there needs to be a 3% cut minimum to get any economic stimulus.

For example: if the U.S. economy slid into a recession today – and they had to cut 3% – it would push rates negative (currently rates are at 2.25%). I’ve written more extensively on this topic before – read here.

So – this is why we need to pay close attention to the Fed over the coming months. Because if the Fed’s going to turn dovish and pause their hiking – it’s time to rotate from a strong dollar portfolio and into a weak dollar portfolio (aka heavy commodities).

I believe the Fed will hike in December 2018. Which will put the Fed Funds Rate around the bottom of the projected neutral rate of interest.

And after that – I don’t expect them to hike many more times. Especially if U.S. growth continues declining and inflation expectations go down with it – which I expect.

Remember: these things take time to manifest. And like I’ve shared with you before – the inflation and growth numbers we see are looking into the past.

So by the time we get the data showing we’re in a recession – it’s already well underway. . .

I don’t like forecasting because the future holds countless outcomes. And it’s always worse than we expect. Thus I don’t want to get ahead of myself. But these are just my thoughts for what’s possibly happening over the next few months.

So please take with a grain of salt. . .

– I believe that U.S. GDP in Q4/2018 will be much lower than the market expects (it could even be in the mid-1% range).

– I also believe that inflation (the CPI) cycle has peaked and will continue lower (which it has lately) – especially with oil prices collapsing.

– Then because of slowing growth and dropping inflation – I expect the long-end of the yield curve to continue rallying (which means yields come down). This will put the yield curve flat – and possibly invert (read more here).

– And since the Fed’s data-dependent, the lower inflation numbers and slowing growth will trigger them to turn from hawkish (tightening) to dovish (easing).

– Once the Fed turns dovish – the dollar will sell off as the market tries to ‘front-run’ them (markets price in the future expectations today (more here).

– This will be bullish for commodities – especially gold – and foreign currencies.

I’ll touch base on these things in the coming months and see how things turned out.

In the meantime – I’ll be releasing a new macro-play soon as a way to capture the upside from the Fed’s ‘rotating’. . .

Also – in other news:

I also have a new book I’ve been reading that I think speculators will find beneficial. . .

It’s ‘Thinking in Bets’ by Annie Duke.

Annie’s a famous poker player. And this book sheds insight about her career and the tools she’s used to become so successful.

Why does this matter? Because I think investing is a lot like poker. It’s a game of odds, finding an edge, and placing bets.

For instance – thinking in probabilities and betting big when you have the odds in your favor is cornerstone to poker (as well as investing).

Not to mention – when someone wins, someone loses.

Many investment books talk about portfolio set ups and what stocks, assets, etc look attractive – but many don’t teach you about position sizing (aka how much of your capital to invest per trade).

One of my favorite economists – Michael Mauboussin – wrote an outstanding white-paper (read here) on how traders and bettors need to understand how to scale their positions for the odds given.

He also goes into one of the best tools for speculation around – the Kelly Criterion (I’ll be writing more about this in a later piece).

Now, the Kelly-Criterion’s a messy math formula, but putting it simply – it looks like this. . .

Edge/Odds = Fraction of your total capital to invest

I always weigh the odds the market (or in betting – ‘the house’) offers against the probability of success. So if the odds are attractive enough and I view the probability of success high enough – I bet big. Of course these opportunities don’t show themselves often. But when they do – you need to capitalize on them. Like Mohnish Pabrai – value investor and author of the Dhando Investor – says, “few bets, big bets, infrequent bets.” More on this later – but make sure if you can to check out Anne Dukes book and Mauboussin’s white-paper (linked above).

It’s well worth it. .