This week was supposed to have many major events. On March 27th, Wednesday, there was supposed to be the huge China/US trade deal signing ceremony in Mar-a-Lago. Then, only two days later, Brexit was to become official.

In this new everything-gets-postponed-indefinitely world of ours, these events are not happening now. So let’s occupy ourselves by glancing at a few ETFs which, to my mind, seem vulnerable at their present price levels.

VanEck Vectors Gold Miners (NYSE:GDX)

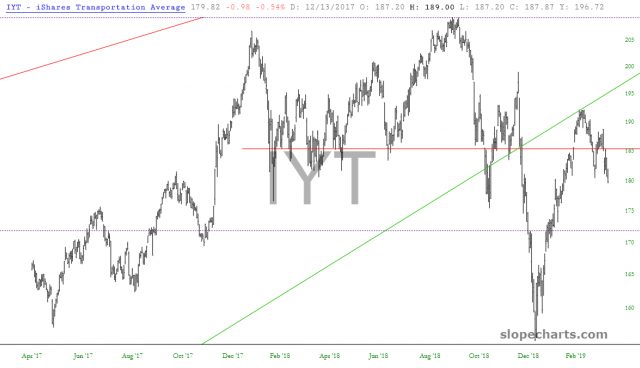

iShares Transportation Average (NYSE:IYT)

iShares Silver (NYSE:SLV)

Energy Select Sector SPDR (NYSE:XLE)

SPDR S&P Retail (NYSE:XRT)

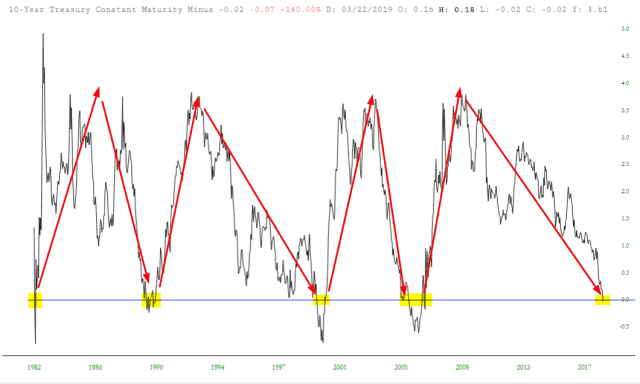

I also want to share the latest chart on the 10-Year minus 2-Year. There are plenty of folks who consider the business cycle to be dead, thanks to the heroic measures of the Federal Reserve. I hope that the chart below augmented modestly by yours truly, helps show this simply isn’t the case. We are precisely, exactly, and totally at the mark where recessions have historically been guaranteed to happen.