Last week marked the release of the first data after hurricane Sandy hit the Northern East coast of the US. Both industrial production and retail sales suffered, while weekly initial jobless claims surged.

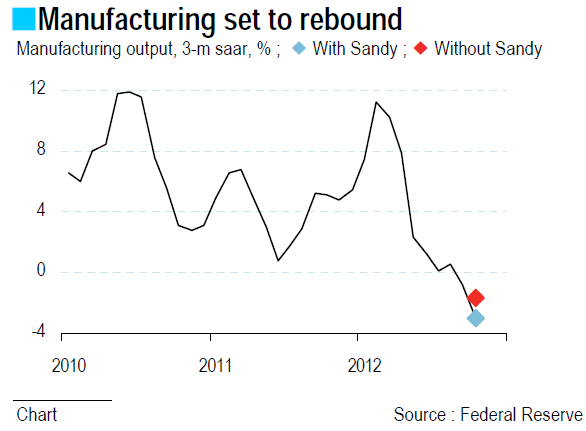

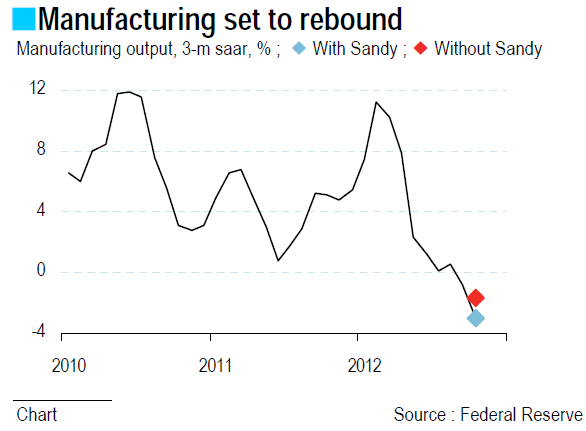

In its press release, the Fed noted that “hurricane Sandy […] is estimated to have reduced the rate of change in total output by nearly 1 percentage point” in October, the largest effects being felt by utilities, chemicals, food, transportation equipment, and of computers and electronic products industries.

The good piece of news is that production capacities just marginally suffered, as they kept their recent trend growth of +0.1% a month: the cut in October production was more about disruption than destruction. Indeed, the rate of capacity utilisation dropped from September to October, from 78.2% to 77.8% for the overall industrial sector, and from 77.3% to 76.6% in the sole manufacturing industries. This means that production that failed to occur in October will be caught up in November, leaving the Q4 level un-impacted.

While the Department of Commerce did not provide with estimates of the effects of hurricane Sandy on October retail sales, they were obvious. Gasoline sales increased 1.4% m/m over the month despite a 2.7% drop in retail prices, meaning sale volumes jumped as many Americans stocked up oil before the storm hit. The same can be said of food supplies, which sales gained 0.8% m/m in October. On the contrary, sales of clothes (-0.1% m/m), cars (-1.6%) and other durable goods (-1.5%) dropped over the month.

Last but not least, weekly initial jobless claims jumped over the week following hurricane Sandy. From one week to the other, weekly data gained 90,000 to 451k (the highest reading since April 2011) and fell back by just 41,000 the following week. The weekly change in the numbers for continuing claims net of initial claims recorded over the same week, which is a pretty good gauge of the number of people moving from unemployment to employment, dropped from a 4-week average of 394k in the week prior to Sandy to just 168k to then rebound to 481k over the week after Sandy.

As reckoned y the US Bureau of Labor Statistics, the impact of hurricane Sandy on the labour market will take months to be fully estimated. It is potentially quite large as the affected area represents a large part of national non-farm payrolls: 7.6% (2011 average). In short, the November labour market report, to be published on December 7th, is likely to highlight a marked slowdown in job creations.

However, taking into account the fact that, according to industrial activity data, capacities were apparently left rather unaffected, which seems to be confirmed by the jump in the number of people moving from unemployment to employment, the effects of hurricane Sandy on overall economic activity are probably temporary and limited. On top of that comes the necessary reconstruction of residential structures, which appear to have been the most affected, which will help support growth in the construction sector.

This is an additional reason to expect the housing recovery to keep going. Data released this week were very positive, with another improvement in the Housing Market Index from the NAHB (National Association of Home Builders). The index has been increasing from one month to the other for seven months in a row, lifting it to the highest reading since May 2006. New home authorised, even if slightly down between September and October, are growing fast: their 12-month moving average reached a 4-year high, which represents a 61% since they bottomed out in May 2009, with 43% since they began a sustained reacceleration in May 2011.

Finally, existing home sales grew just short of 10% y/y in October. All this begins to have positive effects on real estate prices. As measured by the S&P/Case-Shiller index for the 20 largest US cities, home prices were up for the sixth month in a row in August. More strikingly, as compared with the trend in disposable income per households, prices are once more increasing. This development was just initiated, but still provides with cheering prospects for next year.

A very powerful brake is currently being lifted, however, the housing market is not to be as powerful an engine it once was. Between 2002 and 2005, residential contributed to overall GDP growth by an average 0.5 point. But since its share in final demand dropped since, to contribute that much would mean that it has to grow as fast as 20% a year. That may prove impossible, which is no bad news: over-investment is not the cure to past collapse.

By Alexandra ESTIOT

In its press release, the Fed noted that “hurricane Sandy […] is estimated to have reduced the rate of change in total output by nearly 1 percentage point” in October, the largest effects being felt by utilities, chemicals, food, transportation equipment, and of computers and electronic products industries.

The good piece of news is that production capacities just marginally suffered, as they kept their recent trend growth of +0.1% a month: the cut in October production was more about disruption than destruction. Indeed, the rate of capacity utilisation dropped from September to October, from 78.2% to 77.8% for the overall industrial sector, and from 77.3% to 76.6% in the sole manufacturing industries. This means that production that failed to occur in October will be caught up in November, leaving the Q4 level un-impacted.

While the Department of Commerce did not provide with estimates of the effects of hurricane Sandy on October retail sales, they were obvious. Gasoline sales increased 1.4% m/m over the month despite a 2.7% drop in retail prices, meaning sale volumes jumped as many Americans stocked up oil before the storm hit. The same can be said of food supplies, which sales gained 0.8% m/m in October. On the contrary, sales of clothes (-0.1% m/m), cars (-1.6%) and other durable goods (-1.5%) dropped over the month.

Last but not least, weekly initial jobless claims jumped over the week following hurricane Sandy. From one week to the other, weekly data gained 90,000 to 451k (the highest reading since April 2011) and fell back by just 41,000 the following week. The weekly change in the numbers for continuing claims net of initial claims recorded over the same week, which is a pretty good gauge of the number of people moving from unemployment to employment, dropped from a 4-week average of 394k in the week prior to Sandy to just 168k to then rebound to 481k over the week after Sandy.

As reckoned y the US Bureau of Labor Statistics, the impact of hurricane Sandy on the labour market will take months to be fully estimated. It is potentially quite large as the affected area represents a large part of national non-farm payrolls: 7.6% (2011 average). In short, the November labour market report, to be published on December 7th, is likely to highlight a marked slowdown in job creations.

However, taking into account the fact that, according to industrial activity data, capacities were apparently left rather unaffected, which seems to be confirmed by the jump in the number of people moving from unemployment to employment, the effects of hurricane Sandy on overall economic activity are probably temporary and limited. On top of that comes the necessary reconstruction of residential structures, which appear to have been the most affected, which will help support growth in the construction sector.

This is an additional reason to expect the housing recovery to keep going. Data released this week were very positive, with another improvement in the Housing Market Index from the NAHB (National Association of Home Builders). The index has been increasing from one month to the other for seven months in a row, lifting it to the highest reading since May 2006. New home authorised, even if slightly down between September and October, are growing fast: their 12-month moving average reached a 4-year high, which represents a 61% since they bottomed out in May 2009, with 43% since they began a sustained reacceleration in May 2011.

Finally, existing home sales grew just short of 10% y/y in October. All this begins to have positive effects on real estate prices. As measured by the S&P/Case-Shiller index for the 20 largest US cities, home prices were up for the sixth month in a row in August. More strikingly, as compared with the trend in disposable income per households, prices are once more increasing. This development was just initiated, but still provides with cheering prospects for next year.

A very powerful brake is currently being lifted, however, the housing market is not to be as powerful an engine it once was. Between 2002 and 2005, residential contributed to overall GDP growth by an average 0.5 point. But since its share in final demand dropped since, to contribute that much would mean that it has to grow as fast as 20% a year. That may prove impossible, which is no bad news: over-investment is not the cure to past collapse.

By Alexandra ESTIOT