Data released this week were mixed, which is however not a cause for concern. More interestingly, many Fed officials gave speeches, with a common line. The Fed is clearly trying to manage expectations.

The final estimate for Q4 2012 GDP growth was not terribly newsworthy, with a few positives, however. GDP grew an annualised 0.4% in the final quarter of 2012, a reading that has been revised upwards from 0.1% (and from -0.1% according to the advance estimate). Business investment was substantially revised, up from a previously estimated 9.7% to 13.1%. The bulk of the revision was in structures investment, a sign that the recovery in the construction sector is not confined to the residential industry. As a result, final demand from the private domestic sector was up an annualised 3.7%, the strongest reading since Q4 2010.

The recovery in business equipment is likely to have keep going in early 2013, as both new orders and shipments for the capital goods industry (excluding defence and aircraft) were very solid in January and February. This latest set of data highlight an acceleration in shipments from 5.1% in December to 7.8% in February, while the respective rates of growth for new orders are 20.4% and 26%.

As for construction, the February decline in new home sales (-4.6%) should not be overestimated. First, this came following strong growth in January (+13.1%). Second, the market for existing homes is very dynamic. Third, real estate prices are on solid accelerating path. As measured by the S&P/Case-Shiller index, prices were up 8.1% y/y in January, with no sign of abatement. The decrease of home for sales relative to homes actually sold (currently at 3.4 for the overall residential market, relative to 4.4 in February 2012) is likely to result in a continuing improvement trend.

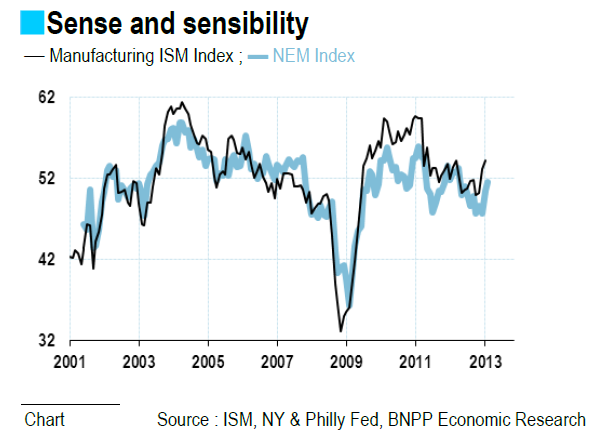

The drop recorded by the March Chicago PMI also has to be put into perspective. The recent improvement in manufacturing production was indeed partly driven by the auto industry, and the deterioration of sentiment in the car-driven Chicago could be a cause for concern. But surveys from the Feds of New York and Philadelphia, which manufacturing activities are way more diverse, sent positive signals sooner in the month. Our NEM Index (based on those two surveys with ISM-like readings) indeed increased markedly in February and March, the 3.9 points gain driving the index to its highest level since May 2012. Furthermore, the 6-month expectations index is even better oriented, with a reading of 57.9 in March.

For sure, the deterioration in consumer confidence is more worrying. The Conference Board Index for March was indeed down 8.3 points, a development that however follows a 9.6 points rise. Details show the March decline was mainly due to expectations, and more precisely the deteriorating prospects for jobs. It is rather difficult to extract any information, however, as the index has been very volatile as of lately. Furthermore, hard data for consumer spending are more comforting, as real private consumption grew an annualised 2.9% in February.

A very interesting development this week was the similarities within the speeches from several Fed officials, namely Narayana Kocherlakota (President of the Minneapolis Fed), Sandra Pianalto (Cleveland) and Eric Rosengren (Boston). The three of them heavily insisted on the fact that FOMC members, even if interested by current developments, are basing their monetary policy decisions on prospects for the labour market. Shifting the focus from actual to expected employment growth is, to our view, clearly a way to calm down expectations of a sooner-than-expected removal of accommodation. Over the last few months, Fed officials appear to have been surprised by the strength of the labour market report. Since both the pace of monthy security purchases and the future level of the Fed Fund Target have been said to be decided according to developments on the labour market, a better outcome could result in a premature rise in long-term interest rates. By clearly announcing that they will not over-react to current data, they try to avoid this rise.

Previously, both Ben Bernanke and Janet Yellen tried a similar move, telling that the focus was not just on one particular figure but on a whole set. This week, other Fed officials emphasised the importance of prospects, communicating on their own forecasts. Interestingly they all claimed to be slightly below the median forecasts of FOMC members… But the bolder dovish move definitely came from Mr Kocherlakota. This former hawk (he opposed Operation Twist in September 2011) said that were the Fed want to provide further accommodation, it could lower the intermediate objective for the unemployment rate from 6.5% to 5.5%. In a nutshell, he both said that further easing maybe required (the Fed is not about to tighten) and that the Fed would be happy to do it (the Fed is definitely not about to tighten). The newly converted are always the most active proselytes.

BY Alexandra ESTIOT

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Week In The US : The Flip-Flopper

Published 03/31/2013, 06:28 AM

Updated 03/09/2019, 08:30 AM

The Week In The US : The Flip-Flopper

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.