GDP growth for the first quarter was hardly revised. Consumer confidence reached a 5-year high, explaining why household’ spending is holding up so well.

The advance estimate was pointing to GDP growing by a quarterly annualized rate of 2.5%. The second estimate draws a hardly different picture, as growth is now estimated to have been 2.4%. Most of the revisions were in the contributions from the inventory change (+0.7 points, from a preliminary +1.1 pts) and net exports (-0.2pts, from a preliminary -0.5 pts). The overall picture remains the same: business spending on investment was disappointing, government expenditures were once more markedly cut, while households were the driver of growth. Households’ demand indeed brought a 2.7 pts contribution to GDP growth, through dynamic consumption (+3.4%) and residential spending (+12.6%).

Such dynamism may be surprising as households suffered tax increases at the beginning of the year: the payroll tax rate was back to its normal level of 6.2% (up from 4.2% during the previous two years) and the highest bracket of the income tax was brought back to its pre-Bush Jr level. But those higher taxes came as the labour market was strengthening, and pre-tax labour income rose rapidly enough to offset the drag from higher taxes.

The May labour market report will be published next week, and it will be helpful in getting a clearer view on the 2013 Q2 performance. In April, consumption kept on holding up well. Thanks to a 0.1% m/m increase in their real disposable income, real consumption was up 0.1% (+3.3% on a 3-month annualised basis), leaving the saving ratio unchanged at 2.5%. As private consumption is the main component of demand, this augurs well for the second quarter: the job recovery, in supporting consumers’ confidence and income, fuels a steady growth in activity.

As for consumer confidence, the Conference Board Index highlights a sharp improvement, as it reached in May a 5-year high. The increase recorded over the last few months is not just large and steady, but also widespread as every sub-component contributed, with particularly bright readings for jobs and income indices. The reasons for optimism are indeed plenty. On top of the job market, households’ wealth is also well oriented, with both equity and home prices on the rise. In March, the latter were up by 10.9% y/y, the fastest rate in more than seven years, as measured by the S&P/Case-Shiller Index for the 20-largest metro area.

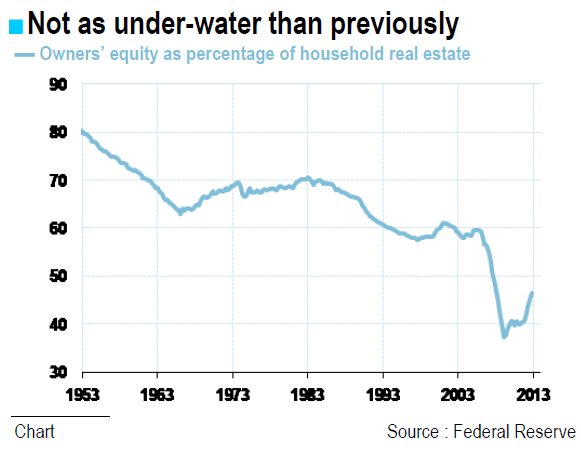

The renewed strength of the housing market is a big achievement. First, real estate remains the top component of households’ wealth. In 2012, those tangible assets represented 22% of total households’ assets and 27% of their net worth. Net of mortgages outstanding amount, real estate represented 14% of 2012 net worth. Second, as home prices are going up, the number of households “under-water” (i.e. facing a mortgage that is higher than the value of their home, meaning they are in negative equity) is decreasing. Owners’ equity as percentage of household real estate bounced back from an all-time low of 37.2% in early 2009 to 46.6% in late-2012.

Since the 2008-09 global recession and financial crisis was triggered by the burst of the US housing bubble, the increase in home prices could be seen as once more posing a threat. However, the current rates of growth in home prices are as impressive also because prices previously collapsed. The trough was reached in March 2012, and from peak, they were down 35%. The recent increase indeed only drove prices back to their summer-2010 levels. Second, this increase is not driven by growing debt, on the contrary: mortgage debt is constantly declining since it peaked in early-2008, and at the end of 2012 it was down a cumulative 11%. Third, home prices are pushed up by a lack of supply. This housing revival illustrates the effectiveness of the Fed’s policy. Trough purchases of MBS (Mortgage Backed Securities), the Fed allowed mortgage rates to fall markedly, supporting demand for homes.

Lately, yields on Treasuries and MBS went up, highlighting growing expectations that the Fed might get less accommodative. Several Fed members indeed declared that they would be ready to slow down monthly security purchases in a couple of meetings, were data to confirm the strengthening of the labour market. This is obvious that the US economy held up well, and better than most had expected, in early 2013, and additional accommodation might not be needed in the same quantity. Over the next few weeks, Fed members will try to be as pedagogic as possible. They definitely want to avoid interest rates to increase too fast, especially at a time of slower inflation. The deflator of personal consumption was indeed once more down in April, driving its y/y rate of growth to a low 0.7%. Excluding food and energy, prices are running faster, at +1.1%, which is however too slow for comfort.

BY Alexandra ESTIOT

Editor's Note: Learn how to profit from the Non-Farm Payrolls Report, one of June's biggest market-moving announcements. Watch expert Steve Ruffley trade the NFP in real time on June 7, 2013 via our Special Live Event. Ruffley has an astounding record of 25 consecutive, profitable sessions during this event, so don't miss this chance to learn how to trade during volatile periods. To find out more, click here.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Week In The U.S.: Confident Consumers

Published 05/31/2013, 07:29 AM

The Week In The U.S.: Confident Consumers

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.