Inflation continues to be relatively high. According to the Eurostat final estimate, inflation was 2.6% in September 2012, stable with respect to the previous month, but still well above the ECB ceiling target for price stability over the medium term (i.e. close but below 2%). Is there any risk that inflationary pressures will rise over the medium to longer term? An analysis by country and product component helps explain the recent dynamics of inflation.

In September, HICP inflation decreased in France and Germany (down by 0.1 percentage points in both countries), while increasing moderately in Italy (up by 0.2pp to 3.5%) and massively in Spain (up by 0.7pp to 3.5%). Fiscal consolidation measures are probably the main factors behind these differences. Germany does not need to consolidate its public finances and France has just disclosed its planned fiscal efforts for next year: for the moment, it is not considering VAT increases.

By contrast, Italy and Spain have already begun taking aggressive measures to correct their fiscal imbalances. In September 2012, Spain raised its standard VAT rate, which roughly applies to 60% of the HICP basket, by 3pp to 21%. This measure alone could increase Spanish HICP by as much as 1.5pp. As Spain accounts for more than 12% of eurozone HICP inflation, its impact on the inflation rate for the area as a whole may be about 0.18pp.

The Spanish authorities also have taken other measures which are likely to produce inflationary effects in the short run. Among them, the reduced VAT rate, which is levied mainly on products pertaining to food, health, passenger transportation, hotels and restaurants, was increased by 2pp to 10%. Lastly, administered prices (electricity rates, health care fees) have been raised since the start of the year, which is also driving up inflation.

Italy has implemented similar measures. During the year it has increased several administered prices and raised the fuel tax in January 2012. In September 2011, the Italian authorities raised the standard VAT rate by 1pp to 21%, and they plan to increase it by another 1pp to 22% in July 2013. Since Italy accounts for more than 15% of eurozone inflation, this measure alone could add up to 0.1pp to eurozone HICP inflation.

If these measures are not renewed after a year, they will produce only a slight hump in inflation. Inflation will automatically moderate again, once they disappear from the year-on-year comparison.

Fiscal tightening measures are not the only factor behind the recent increase in eurozone inflation. Commodity prices have played a non-negligible role as well. Oil prices are likely to remain high over the months ahead. Consequently, energy price inflation is expected to remain high in the near-term. Even so, it should decline next year after the current increase in oil prices disappears from the year-on-year comparison.

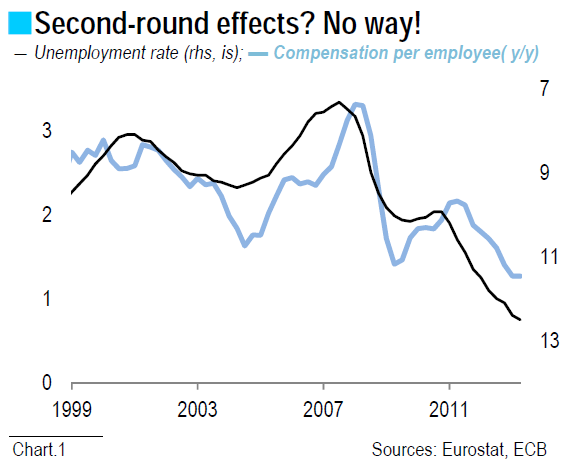

Will these spikes in inflation have an impact on monetary policy? Central banks normally react to shocks that might produce permanent price increases, thereby undermining inflationary expectations. This is why the ECB is so worried about the second-round effects of inflation shocks on wages and prices. If transitory increases in inflation are embedded in wage negotiations, they might become permanent. The ECB recently scaled up its rhetoric slightly on risks of second-round effects on wages. Yet the probability that these risks would materialise are very low if not zero.

The unemployment rate is extremely high in many member countries. At 11.4%, the eurozone unemployment rate is at the highest level since the launch of the euro, and it is expected to rise even further. Fears of unemployment combined with sluggish activity should moderate wage growth over the forecast horizon.

Germany, which has seen unemployment plunge to the lowest rate in over two decades, is the only country that might experience an upturn in wage inflation. This would be good news. A rise in German domestic demand could alleviate the pains that many peripheral countries are suffering due to the reduction in their internal and external imbalances.

All in all, inflation is expected to remain high in the short-term, driven up by rising VAT rates and administered prices in many countries as well as by high commodity prices. Yet these factors should have only a temporary impact on inflation. In 2013, inflation could fall below 2%, and is likely to decline even further in 2014.

By Clemente de Lucia

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Week In The Eurozone: Is Inflation Too High ?

Published 10/21/2012, 08:12 AM

Updated 03/09/2019, 08:30 AM

The Week In The Eurozone: Is Inflation Too High ?

Is inflation too high?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.