Highlights

- Market Movers: Weekly Technical Outlook

- Fed and BOJ Keep the Central Bank Party Rolling

- Look Ahead: Stocks

- Look Ahead: Commodities

- Global Data Highlights

Market Movers: Weekly Technical Outlook

Technical Developments to Watch:

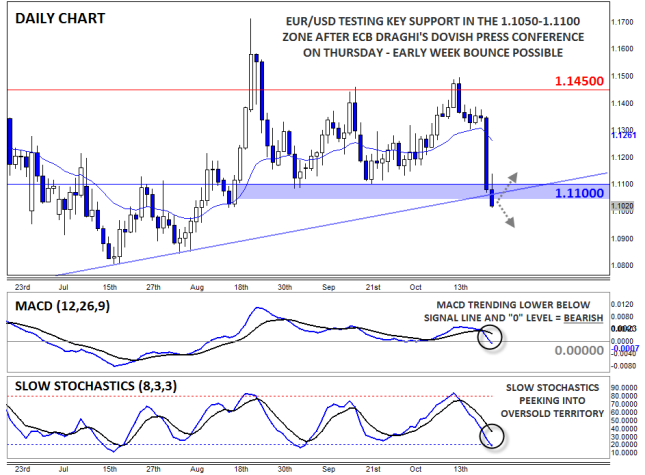

- EUR/USD testing converging support in the 1.1050-1.1100 zone

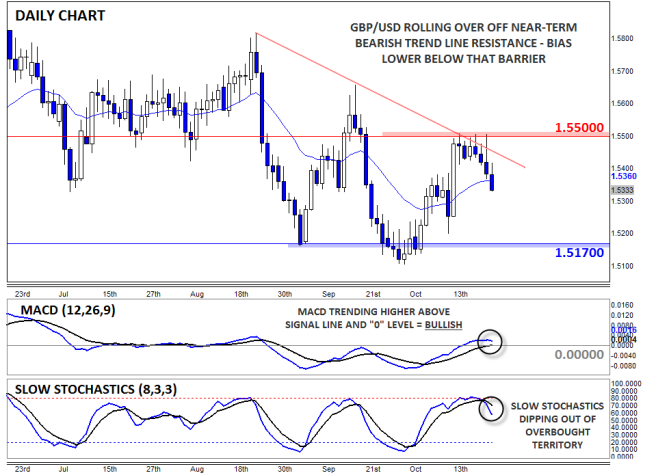

- GBP/USD bias remains lower beneath trend line resistance at 1.5400

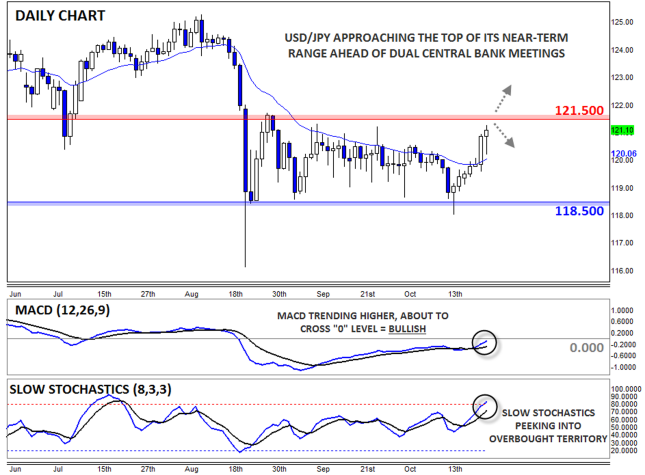

- USD/JPY edging up to range top near 121.50 ahead of BOJ and Fed

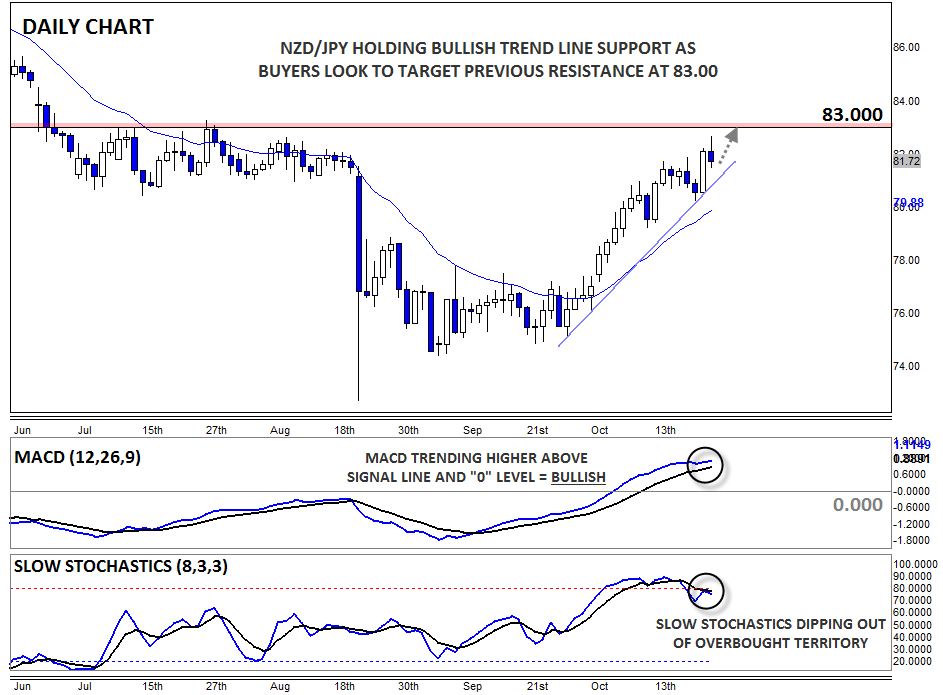

- NZD/JPY in play, trending higher toward 83.00 resistance

* Bias determined by the relationship between price and various EMAs. The following system determines bias (numbers represent how many EMAs the price closed the week above): 0 = Strongly Bearish, 1 = Slightly Bearish, 2 = Neutral, 3 = Slightly Bullish, 4 = Strongly Bullish.

** All data and comments in this report as of Friday afternoon **

EUR/USD

- EUR/USD collapsed after Draghi struck a dovish tone on Thursday

- MACD signaling strong bearish momentum, but Slow Stochastics oversold

- Key support sits in the 1.1050-1.1100 support zone

EUR/USD consolidated early last week before collapsing all the way down to test converging support in the 1.1050-1.1100 zone in the wake of Thursday’s dovish ECB press conference. As of writing, the pair is peeking below that support level, but there is still the prospect for a short-covering bounce ahead of the close or early in the coming week. While the medium-term outlook has turned definitively to the downside, more conservative traders may prefer to fade short-term bounces rather than sell at the current low levels, especially with the Slow Stochastics indicator peeking into oversold territory.

Source: FOREX.com

GBP/USD

- GBP/USD edged lower last week after stalling out around 1.5500

- Slow Stochastics rolling over from overbought territory

- Medium-term bias remains lower beneath resistance in the 1.5500 zone

GBP/USD rolled over off 1.5500 resistance last week, dragged down by weakness in the rest of the European currencies. While there was no major pound-negative data last week, the pair put in its 4th consecutive lower high, confirming the longer-term rounded top pattern. For this week, we continue to favor more downside, especially as long as the unit remains below bearish trend line resistance at 1.5400.

Source: FOREX.com

USD/JPY

- USD/JPY traded consistently higher after bottoming at 118.50 the previous week

- Slow Stochastics in overbought territory

- All eyes on central bank meetings as both the Fed and BOJ make decisions

As we go to press, USD/JPY is working on its 7th consecutive bullish day and rates are nearing the top of the two-month range at 121.50. On a technical basis, rates are now overbought, but any near-term technical indicators are likely to be overwhelmed by the top-tier fundamental events this week, including central bank meetings from both the BOJ and Fed. See the “Fed and BOJ Keep the Central Bank Party Rolling” section above for more information.

Source: FOREX.com

NZD/JPY

- NZD/JPY rallied on Thursday to hit a 2-month high around 82.00

- MACD trending higher, but Slow Stochastics in overbought territory

- Bias remains higher above bullish trend line support

NZD/JPY is our currency pair in play due to a number of high-impact economic reports out of the New Zealand and Japan this week (see the “Global Data Highlights” section below for more). The pair rallied to a 2-month high to hit 82.00 on Thursday, though rates are edging lower as of writing on Friday afternoon. More broadly, the pair is showing bullish momentum (MACD trending higher above signal line and “0” level) and remains in an upward trend, so traders may want to favor long trades as long as trend line support at 81.00 holds.

Source: FOREX.com

Fed and BOJ Keep the Central Bank Party Rolling

Last week featured two relatively important central bank meetings, with both the Bank of Canada and the European Central bank coming off as relatively dovish relative to the market’s expectations. As we look ahead to central bank action in the coming week, the Federal Reserve and Bank of Japan are looking increasingly likely to sing a similar tune.

Focusing in the Federal Reserve’s Wednesday monetary policy meeting first, traders have low expectations of any earth-shattering revelations. Despite Fed Chair Janet Yellen’s protestations to the contrary, the meeting will likely not be “live,” as the Fed prefers to act at its quarterly meetings that feature a press conference and updated economic forecasts (e.g. the upcoming December 15-16 meeting). Indeed, futures traders pricing in only a 6% probability of a rate hike, according to the CME group’s FedWatch tool.

US economic data has been anything but encouraging since the Fed met last month. The headline non-farm payroll report showed a disappointing 142k rise in jobs (as well as flat wage growth month-over-month) and the other top-tier reports have been equally downbeat with both PMI surveys and retail sales also missing expectations this month. Indeed, the only bright spot has been the initial jobless claims figures, which continue to show 40+ year lows in new unemployed Americans, but that will hardly be enough for the Fed to act. Traders will closely scrutinize the Fed’s statement for any changes, but there’s a risk that the lack of substance will lead to a disappointingly small market reaction.

Pivoting to the BOJ, traders are split over whether the bank will look to increase its ongoing quantitative easing program. Policymakers, including Finance Minister Taro Aso, have recently downplayed the likelihood of a larger QE program, but we still believe such an action remains on the table. In the past, the BOJ has argued that “surprise” is a critical element of effective monetary policy and from that perspective, Aso’s comments could be seen as an intentional attempt to eliminate speculation about further easing, therefore increasing its impact if the bank does opt to expand QE.

Recent economic figures present a compelling case for more easing from the BOJ. Industrial Production fell to a two-year low in August, and it looks likely that the Japanese economy contracted in Q3, meaning that it is in a technical recession (two consecutive quarters of falling GDP). Meanwhile, the yen has actually strengthened over the last four months, with USD/JPY falling from above 125.00 down to a low near 118.00 last week (rates have since bounced back to 120 as of writing).

If the BOJ does surprise traders by expanding QE, USD/JPY could surge to a new 2-month high above 1.2200 and potentially retest its multi-year low around 125.00 in time. That said, if the central bank opts to keep its powder dry once again, we could see a move back toward the bottom of the recent range around 118.50.

Look Ahead: Stocks

The European markets, which absolutely surged higher on Thursday, sharply extended their gains on Friday. First Super Mario (Draghi) came to the rescue and then the People’s Bank of China at the end of this week. On Friday, the PBOC eased its policy further, cutting its reserve requirement ratio by 0.5% and the benchmark deposit and lending rates by 0.25%. This was music to the ears of the stock market bulls, who were already rejoicing at the news of a potentially beefed-up QE package from the ECB the day before. In addition to the central bank support, latecomers joined the rally and the sellers continued to (forcefully or willing) abandon their positions as key technical resistance levels broke down across the major indices. In FX, the EUR/USD broke a major support and trend line at around 1.1070 before extending its decline. The weaker euro further boosted the equity markets as it raised the attractiveness of European exporting companies. Meanwhile, Eurozone government bond yields dropped to fresh record lows with yields on two-year debt falling below zero for nearly the entire Eurozone. Yield-seeking investors were thus forced to move their funds into assets that pay higher yields, such as stocks. This theme is likely to support the markets for the foreseeable future, especially in Europe.

Although there have been some concerns about the profitability of US companies this earnings season, most of the major tech giants have lived up to and surpassed the expectations. Google (O:GOOGL), Amazon (O:AMZN) and Microsoft (O:MSFT), for example, all beat their earnings expectations on Thursday evening, which helped to push US indices further higher. Apple (O:AAPL) reports next week and Facebook (O:FB) the following week. So there’s plenty of micro stimulus there to give further direction for the markets. In addition to earnings, the economic calendar looks quite busy next week too with German Ifo and CPI, UK GDP, and US Consumer Confidence and Advance GDP being among the data highlights. On top of this, there will be more central bank policy decisions to look forward to as well from the Fed, BOJ and RBNZ.

Stocks are likely to react positively if next week’s economic data releases surprise to the downside as this will re-affirm the view that the major central banks will remain dovish or expand their easing policies further. The ECB president was of course super dovish on Thursday as he said that a whole menu of measures may be necessary to achieve the inflation target. He said that the bond buying program is set to last until September 2016 or beyond if needed. It could be adjusted in size, composition and duration. In our view, more gains should be seen for the stock markets now as investors move back into higher yielding assets.

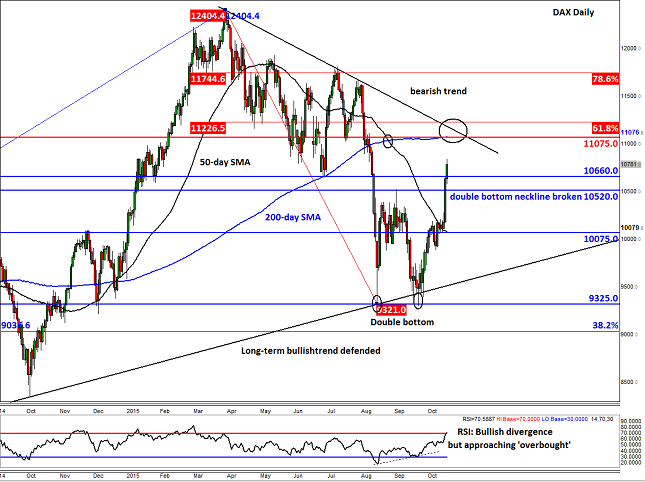

Indeed, the German DAX index has not only reached but it has now clearly broken the double bottom neckline at around 10500/20 and it has taken out further resistance at 10660. These levels could turn into support upon re-test. There is not much further resistance to be seen in the immediate near-term, but potential headwinds to keep an eye on are around the 11075 to 11225 region (circled on the chart). This is where a bearish trend line meets the 200-day average and the 61.8% Fibonacci retracement level of the down move from the record high. If and when this area is cleared then a run towards the all-time highs would be a possibility. But the market may be a bit overbought, suggests the RSI indicator. So, the short-term bullish speculators may wish to proceed with a degree of caution from here.

Source: FOREX.com. Please note this product is not available to US traders.

Look Ahead: Commodities

The global supply glut has been a major force on the oil price falls throughout this and much of last year. Traders are concerned that the global excess will still be in place for much of 2016 as potential increases of Iranian supplies and elsewhere will simply offset the expected falls in US oil output. In addition to supply concerns, some of the bullish demand forecasts from the leading oil agencies are starting to look a little bit questionable as economic growth in China and elsewhere slows. But we wonder how much of all this negativity is already priced in and as such we don’t envisage there to be further vicious drops in oil prices. So we may see some consolidation around the current levels until we see more evidence that US oil production is indeed going to be reduced in a meaningful way. Even so, the potential gains could be limited.

As far as this week was concerned, at various moments it looked like the buyers were back in the game as oil prices managed decent intra-day bounces. However those proved to be merely short-covering rallies and the sellers grew in confidence after the US commercial oil inventories rose surprisingly sharply for a second straight week, reminding some hopeful bullish speculators that the excessive supply of the stuff is still a big factor weighing on sentiment. In fact, at this time of the year, commercial inventories should be rising due to the usual end-of-the summer driving season. Indeed, given that the officially-reported 8.0 million-barrel-increase was only slightly higher than the 7.1 million build reported by the API the day before this wasn’t a good enough reason for speculators to expand their bearish bets significantly. The devil was in the detail of the report which showed sharp falls in stocks of crude products, like gasoline and distillates. However, there was no concrete reason for the bullish speculators to step back in – at least not in a meaningful way anyway – so oil is was pushed around by short-side profit-taking and short-term speculative trades for much of the week. In addition to the sharp oil inventories build, the dollar stormed back to life thanks in part to Draghi’s promise of more ECB support which caused the EUR/USD to tank. The firmer dollar has weighed on the buck-denominated black – and indeed yellow – gold. What’s more, China’s latest easing measures, announced on Friday, have further reinforced concerns that growth at the world’s second largest economy is slowing down, as authorities there are at least acknowledging this fact (some would argue that they probably know that the situation may be a lot worse than the macro pointers suggest.)

Next week will see the release of some key macro pointers; the most important for oil speculators will be those concerning the US and European economies, as these will provide further direction for the EUR/USD currency pair, which in turn could have implications for commodities priced in the US dollar. Speculators should also watch the latest US oil stocks reports in midweek closely because if they show any bullish signs, oil prices could bounce back from these oversold levels.

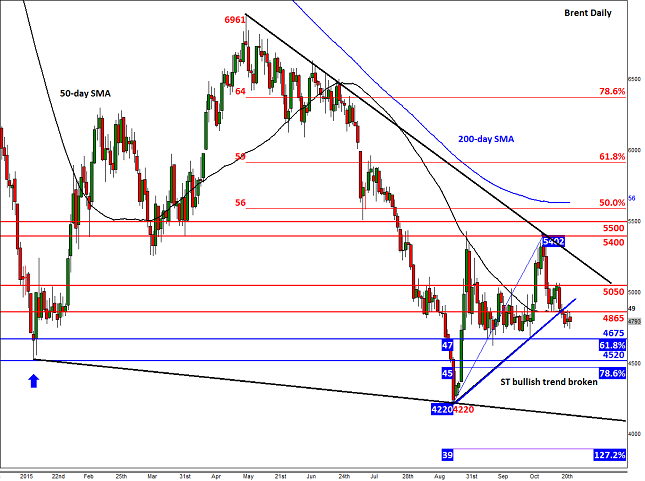

That being said, the technical outlook is again looking somewhat bearish for oil. Take the Brent contract as an example. As can be seen from the daily chart below, a short-term bullish trend line has now been broken. This suggests that the path of least resistance is to the downside – until proven wrong. But oil is still holding above the pivotal $45 level, which resides in between the 61.8 and 78.6 Fibonacci retracement levels of the last notable rally. If Brent breaks below $45 decisively then this year’s low of $45.20 could be revisited and potentially breached. On the upside, short-term resistance comes in at around $48.65, this being a previously support and resistance level and ties in with the 50-day SMA. Beyond here, $50.50 is the next resistance level and then there’s nothing significant until the bearish trend line.

Source: FOREX.com. Please note this product is not available to US clients

Global Data Highlights

Monday, October 26

1000 GMT – German IFO Business Climate Index

This broad-based survey of manufacturers, builders, wholesalers, and retailers provides a crucial current measure of on-the-ground business activity in the Eurozone’s most important economy. The release has beat expectations each of the last three months, and after the big selloff last week, EUR/USD could be poised for an early week bounce if we see another strong reading.

Tuesday, October 27

1030 GMT – UK Preliminary GDP

This represents the first look at overall UK in the third quarter and as such, could be a big market mover for the pound and other UK assets. Barring a few outliers, quarter-over-quarter growth has been generally steady in the 0.5-0.7% range for the past couple of years. In addition to the headline reading, traders will also key in to any revisions to past GDP reports.

1230 GMT – US Durable Goods Orders

Durable goods are products that are expected to last for more than three years, including automobiles, computers, and airplanes. Purchases of these goods tend to signal consumers’ long-term confidence in the economy, but we would warn readers not to overreact to the figure, as it tends to be volatile on a month-by-month basis.

Wednesday October 28

0030 GMT – AU CPI

Inflation remains subdued everywhere, and Australia is no exception. Prices rose by 0.7% last quarter, but the previous two readings were more downbeat at just 0.2% q/q. If we see another weak inflation reading (a definite possibility given the weakness in key commodity prices), it would increase the likelihood of another interest rate cut by the RBA and potentially drive the Aussie lower.

1800 GMT – Federal Reserve Monetary Policy Decision and Statement

See the “Fed and BOJ Keep the Central Bank Party Rolling” section above for more information.

2000 GMT – RBNZ Interest Rate Decision and Statement

Traders are split on whether the RBNZ will cut interest rates or hold off for another month. Arguably the most important factor the central bank is watching is the value of the kiwi, which Finance Minister Bill English recently noted had adjusted enough. That said, if the kiwi continues to rally, the RBNZ will likely be forced to talk it down or cut rates in the coming months.

Thursday, October 29

1230 GMT – US Advanced GDP

US economic growth rose at a disappointing 2.3% annualized rate last quarter, and based on the current economic indicators, another subdued reading is possible this week. The analyst consensus for growth is around 2.1%, but according to the Atlanta Fed’s GDPNow forecast, growth could come in closer to 0.9%. If the true number is anywhere near 1%, it would likely kick any prospect of a Fed rate hike into 2016, with predictable negative implications for the greenback.

Friday, October 30

TBD – BOJ Monetary Policy Decision and Statement

See the “Fed and BOJ Keep the Central Bank Party Rolling” section above for more information.

1230 GMT – Canadian GDP

For whatever reason, Canada releases its GDP figures on a monthly basis, so this datapoint will relate to the month of August. The last two months’ figures have beat consensus estimates at 0.3% and 0.4%, but the weakness in oil prices in August could prevent a three-peat of stronger-than-expected GDP readings.