If you could know one thing about stocks in the coming year, it would be what to expect from corporate earnings. The Q4 2013 reports will provide a preview, with attention starting this week.

Has the improvement in economic strength translated into higher corporate profits?

Last Week Recap

Last week I suggested that with the return of the A-Teams from vacation, we would learn more about how the market would react to news. Would "good news" finally be treated as good? With Fed policy better defined, there was no longer a reason to translate each event into a possible motivation for a change from the Fed.

This proved to be a major news theme during the week, although the old "Fed habit" dies hard. In general, positive economic news led to a positive reaction. The Friday jobs report was treated as negative for stocks (Dow futures were up 70 or so before the report) and positive for bonds. For the moment, this seems to be the new market mind set.

This Week's Theme

The focus on earnings is a clear choice for this week's theme, and it will probably persist for another week or two. There is plenty of disagreement about the role of earnings in the 2013 market rally. Can earnings improve enough to power stocks higher in 2014?

There have been two schools of thought:

- Corporate profit estimates are too high – based upon peak profit margins, optimistic forecasts, and low interest rates. As these underlying factors revert to the mean, actual earnings will decline.

- Various factors sustain current profit margins, including foreign sales and low labor costs. Margins will decline gradually, accompanied by an increase in economic activity and revenues. This means that gross profits and overall earnings may not suffer.

I have my own guess, while I will offer in the conclusion. First, let us do our regular update of the last week's news and data. Readers, especially those new to this series, will benefit from reading the background information.

Last Week's Data

Each week I break down events into good and bad. Often there is "ugly" and on rare occasions something really good. My working definition of "good" has two components:

- The news is market-friendly. Our personal policy preferences are not relevant for this test. And especially -- no politics.

- It is better than expectations.

The Good

Most of the important recent news was good.

- Democrats willing to compromise on emergency unemployment benefits. As usual, the most market-friendly result recognizes the current economic weakness, but moves toward an end to extraordinary policy. (The Hill).

- Stanley Fischer was officially nominated to be Fed Vice-Chair. He has extraordinary credentials and is expected to help in unwinding QE, improving understanding of foreign markets, and increasing credibility. Most see it as great balance. New Chair Janet Yellen welcomes the appointment. [Reader quiz: Can you imagine even a committed Fed basher not liking this appointment, suggesting that Fischer is actually too good, and would represent competition for Yellen? Answer in the conclusion.]

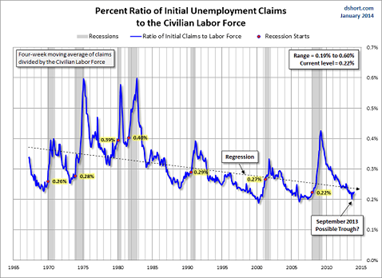

- Initial jobless claims moved lower to 330K, beating expectations. Job losses are only half of the story, since we also need job creation, but initial claims are a weekly market focus. Doug Short does his typical job of adding value, adjusting the claims for the changing size of the labor force. The result is a chart that you will not see anywhere else. Could there now be a trough in the claims improvement?

- Congress compromises on budget extension. This will avoid an imminent shutdown debate. While there is still plenty of partisan controversy, the room for compromise has clearly improved. (The Hill).

- Major improvement in trade data implies much stronger Q4 GDP. (Steven Perlberg at Business Insider). Steven Hansen sees a more mixed picture.

- ADP private jobs growth was strong. Many evaluate this report as a prediction of the "official" BLS announcement. This is a mistake. It is a different and independent method and a helpful yardstick for evaluating employment changes. While the market emphasizes the monthly government report, most investors should be more interested in actual economic progress – whatever the measure. I explained in more detail here.

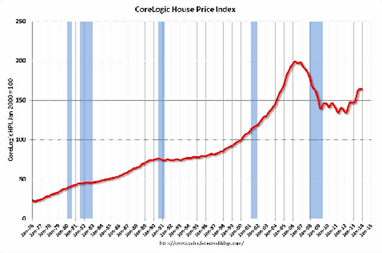

- Home prices up 11.8% year-over-year via CoreLogic. (Calculated Risk).

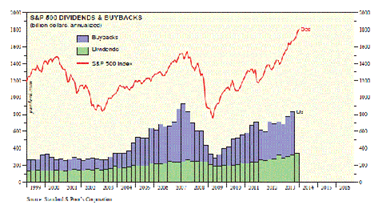

Equity inflows and stock buybacks continue to support stocks. Dr. Ed Yardeni sees melt-up potential.

The Bad

Some of the bad news was really, really bad.

- Record cold weather could mean as much as a $5 billion drag on the economy. Some of this might represent delayed expenditures, but some is lost forever – trips, shopping, and restaurant meals that will not happen.

- ISM services disappointed on the headline number. The internals were also weak. See Steven Hansen for full analysis and charts.

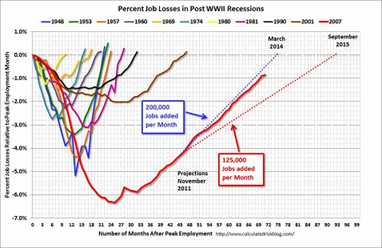

- The employment report, showing a net growth in payrolls of only 74K and yet another decline in the labor force participation rate. Nearly everyone realizes that the decline in the popular headline, the unemployment rate, is misleading. There were many good reviews (as well as some bad ones). I'll cite several of the best.

- Do not be deceived by the lower unemployment rate. (Wonkblog).

- The weak report will not alter Fed plans, according to economists in a Bloomberg survey.

- Weather creates even more noise in a data series that is already noisy. (Felix Salmon).

- Don't blame the weather for the decline in labor force participation. If there had been no decline in the labor force over the last year, unemployment would be at 7.9%. (James Pethokoukis).

- And best of all, don't take it too seriously. The BLS tries each month to count all of the jobs in a 150 million person workforce. The market incorrectly places substantial weight on modest changes projected by this method. It is much better to look at longer trends. (See the full analysis from Barry Ritholtz).

- Employment is on course to reach pre-recession levels in mid-2014 (Calculated Risk).

The Ugly

Income inequality. Even the dollar stores are getting too expensive for many? So says Family Dollar Stores Inc, (FDO) CEO Howard Levine. See the full story from Matt Phillips:

For the last several quarters, we've discussed the economic challenges our customers are facing. Over the last two years, I think we've seen a growing bifurcation in households. Higher-income households who have benefited from market gains, better employment opportunities, or improvements in the housing markets have become more comfortable and confident in their financial situation. But our core lower-income customers have faced high unemployment levels, higher payroll taxes, and more recently reductions in government-assistance programs.

Runner up is Sears (SHLD) which, after last week's earnings report, is in a death spiral according to this Jeff Macke piece. Just as aggressive is this article, which advises Sears's workers to quit their jobs.

Quant Corner

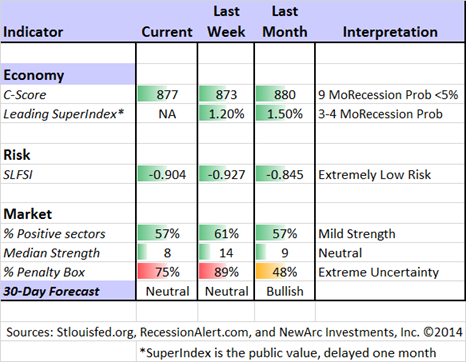

Whether a trader or an investor, you need to understand risk. I monitor many quantitative reports and highlight the best methods in this weekly update. For more information on each source, check here.

Recent Expert Commentary on the Economy

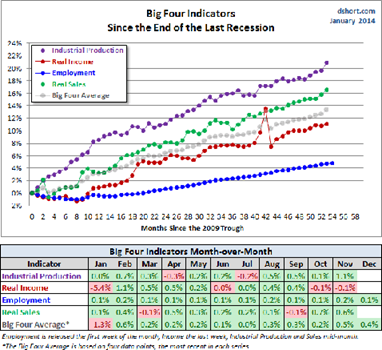

Doug Short: The regular update of the "Big Four" indicators used by the NBER to identify recessions.

Georg Vrba: Takes a look at potential stock returns through 2020, using the 5-year Shiller CAPE. He also discusses some other popular analyses, and the potential for a rocky path.

RecessionAlert: A threatening seasonal period coming soon, with several helpful charts and comparisons.

Is it different now? See more analysis and charts from Tom McClellan.

The Week Ahead

This is another big week for news and data.

The "A List" includes the following:

- Initial jobless claims (Th). Best fresh data on employment, more important than ever after last week.

- Retail sales (T). Extra significance for the December numbers and mixed reviews from private reports.

- Building permits and housing starts (F). Housing is vital for the economy and permits are a good leading indicator.

- Michigan sentiment (F). Good concurrent indicator for job creation, income, and spending.

The "B List" includes:

- Beige Book (W). Anecdotal evidence that will augment deliberations at the next FOMC meeting.

- Industrial production (F). December data – modest expectations.

- PPI (W). Still tame. Not very important until and unless we see a few higher values.

- CPI (Th). See PPI

I am not very interested in the regional Fed reports and some other lesser data. It is a big week for Fed speeches, the quiet time between meetings. Some of these will explicitly discuss the policy issues when rates are at the lower bound, including San Francisco Fed President John Williams on Thursday.

Mostly, the market will focus on earnings.

How to Use the Weekly Data Updates

In the WTWA series I try to share what I am thinking as I prepare for the coming week. I write each post as if I were speaking directly to one of my clients. Each client is different, so I have five different programs ranging from very conservative bond ladders to very aggressive trading programs. It is not a "one size fits all" approach.

To get the maximum benefit from my updates you need to have a self-assessment of your objectives. Are you most interested in preserving wealth? Or like most of us, do you still need to create wealth? How much risk is right for your temperament and circumstances?

My weekly insights often suggest a different course of action depending upon your objectives and time frames. They also accurately describe what I am doing in the programs I manage.

Insight for Traders

Felix has remained in neutral, but we are still fully invested in the top three sectors. Felix's ratings have been in a fairly narrow range for several months. The rapid news-driven shifts are not the ideal conditions for Felix's three-week horizon. The ratings are slightly positive, and many sectors in the penalty box.

Insight for Investors

I review the themes here each week and refresh when needed. For investors, as we would expect, the key ideas may stay on the list longer than the updates for traders. This is the "actionable investment advice" summarized here. I will also have my regular annual preview next week.

I am trying to find something special for the individual investor each week. These are items that you might not see unless you read hundreds of posts. The articles do not always imply an immediate trade, but each is worth a few minutes of your time.

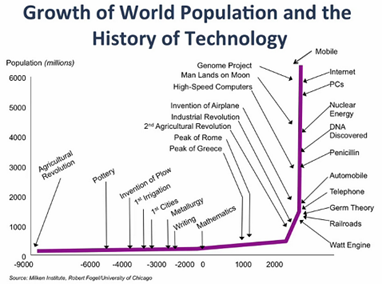

This week's highlight is the difficulty we all have in appreciating future prospects. It is so easy to see what is wrong or disappearing – jobs, technology, etc. It is much more difficult to imagine where the new opportunities might be.

Henry Blodget illustrates the problem with a wonderful picture of an IBM hard drive circa 1955 – 5 megabytes and 2000 pounds. Check the article for comparison with a current iPhone specs. What you need to remember was that this was state of the art, representing a major improvement over alternatives.

Going into more detail is a very fine article by Ben Carlson (HT Barry Ritholtz's recommended reading). He cites a variety of sources about recent progress and future prospects. The key point is that it is difficult to visualize what is about to happen. One idea is that 2013 might have been the best year ever….

Here is a key chart.

This week's warnings come from Jason Zweig, whom you should join me in following on Twitter. He is on a mission, finding excellent research that has implications for your investing:

- How investors get taken in by spam recommendations.

- The danger of giving yourself too much credit for success.

And finally, we have collected some of our recent recommendations in a new investor resource page -- a starting point for the long-term investor. (Comments and suggestions welcome. I am trying to be helpful and I love feedback).

Final Thought

Despite the employment report, the overall trend of economic data has been positive. Cardiff Garcia has an excellent summary that explains why mainstream thinking sees economic improvement in 2014.

This analysis shows why we should also expect improvement in corporate earnings. The big news this week is in the financial stocks, where earnings growth of 21% YoY is expected, despite a decrease in revenues. To understand how, see the full story from earnings expert Brian Gilmartin.

The Pop Quiz

The award for creativity in Fed bashing -- too good is actually bad – goes to Rick Santelli and Jim Bianco. You have to see it to believe it.