Monday Sept. 2

Tuesday Sept. 3

Wednesday Sept. 4

Thursday Sept. 5

Friday Sept. 6

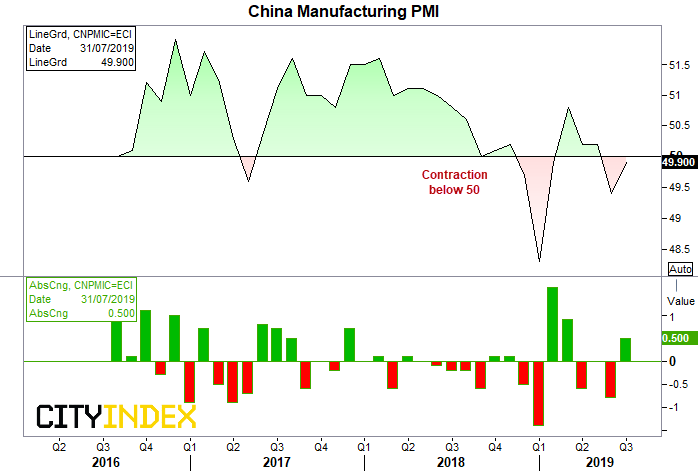

Chinese Manufacturing PMI: USD/CNH, AUD, NZD and JPY pairs, Copper, China A50, Hang Seng

China’s manufacturing sector has contracted two consecutive months, adding to the chorus of calls for a global slowdown. That said, the rate of contraction slowed in July, and if PMI is to climb back above 50, we’d expect a bout of risk-on for the session. AUD pairs are particularly sensitive to the data as they’re key trade partners, but Chinese indices and copper also make decent markets to monitor around the data’s release.

RBA Cash Rate Decision and Q3 GDP: AUD pairs, ASX200

At time of writing, the RBA rate indicator expects just an 11% chance of a 25 cut on Tuesday. This moves to 74% for a cut in October and a 115% cut (ie fully priced in) for November. This is no major surprise, given they cut by 25 bps in June and July and their August minutes provided a ‘steady as she goes’ approach, whilst emphasising external risks such as the trade war. Moreover, GDP data is out on Wednesday and they’d likely want this data on hand before easing further. Yet this still could be a high volatility event if there is a notable shift in tone with their statement.

As for GDP, RBA expect growth to average around 2.5% this year. With Q1 GDP hitting 1.8%, it’s not off to a great start and, with ANZ expecting it to drop to 1.1% in Q2 and the consensus at 1.4%, economists seem doubtful that RBA are on track to achieve their 2019 growth target. Expect AUD to remain under pressure and bring forward easing expectation should it hit 1.3% YoY or less.

BoC Rate Decision

It’s unlikely BoC will change policy next week, given inflation remains around 2% has not ‘dipped’ as expected. Moreover, the 1-month OIS suggests less than a 20% chance of a cut at their next meeting. Still, markets suspect the next direction will be a cut, with 6-month OIS pricing in around 74% chance and a 25bps cut being bullish priced in by April next year. So we’ll keep a close eye on the statement to see if there is a dovish twist, although chances are it will reiterate their need to monitor the energy sector and the impact of ‘trade conflicts’ whilst remaining optimistic over domestic growth.

US ISM Manufacturing: USD pairs, US indices, WTI, Gold, Silver

Global PMI remain under pressure and traders are waiting to see if manufacturing PMI dips below the 50% threshold to show the sector contracting. It’s an important gauge for markets as it can lead GDP by 6-9 months, so any weakness here will translate to lower growth expectations, earnings for companies and therefor prices.

US and CA Nonfarm payroll: USD and CAD pairs, US indices, WTI, Gold, Silver

Employment is expected to soften to 155k, well below the 1-month average of 187.16 and unemployment is expected to hold steady at 3.7%. With ADP (NASDAQ:ADP) employment released on Thursday, and a 3-month correlation of 0.81, we could see NFP revised if ADP misses expectations. However, average hourly earnings may be the better read to follow as it has been trending notably higher on an annualised basis, so traders use it as an inflationary gauge (and therefor, a better read of how the Fed are likely to react). That said, as the CME FedWatch tool suggests 95.8% chance for Fed to cut 25bps in September, it’s hard to see any such data will remove this almost given event. For that, we’d need to see a solid breakthrough in trade talks which, at present, appear unlikely to appear on the horizon.

Take note that Canada release employment data alongside NFP, which places USD/CAD in the sights of the volatility crossbow. CAD/CHF and CAD/JPY are also pairs to consider, if you want to focus on the Canadian employment side of things.