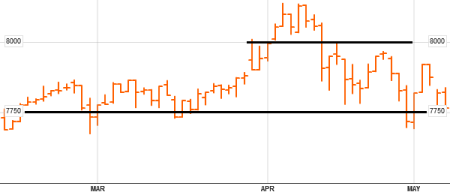

The Philippine Stock Exchange Index (symbol: PSEi) continues to struggle in staying close to the 8,000 major level, piling up the case for a significant Edownside move in the coming weeks.

The index closed Friday at 7,763.21, yet another weak weekly close.

PSEi Daily chart, May 8, 2015 c/o BBG

Key Areas List

The Key Areas list of the PSE index has not changed.

Key areas to watch:

Resistance: 8,000, 8,500, 9,000

Support: 7,500-7,700, 7,300

The Script

The chart above shows the PSE index gravitating towards the lower part of the range (lower horizontal line), keeping pressure on the downside.

Again, what we want to see is the opposite: price moving close to the 8,000 level and keeping pressure on that level.

Further consolidation can happen but I’d prefer to see the index spend more time higher, otherwise the bearish script would get fulfilled.

Continue to monitor the index and try to reduce your positions. Last week’s advice remains applicable.