The PSEi Composite trekked to new highs as buyers were able to keep the ball in their control this week.

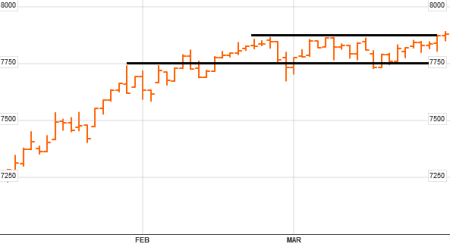

PSEi Daily chart, March 27, 2015 c/o BBG

On Friday, the PSE index hit a 7,889.25 high before closing at a record 7,877.96. There were 69 advancers, 100 decliners, while 52 issues were unchanged.

Key Areas List

The Key Areas list of the PSE index has remained the same.

Key areas to watch:

Resistance: 8,000, 8,500, 9,000

Support: 7,500-7,700, 7,300, 6,800-7,000

The Script

The bulls have been able to maintain control of the index this week.

They followed the bullish script last week and stayed proactive. In fact, they have just been able to break through the recent consolidation (as depicted by the two black lines on the chart). This is not a ‘true’ consolidation or range since there have been price breaks or violation through the lower line (especially in late-Feb and mid-March), but the idea is that, for the most part, price has traded within those two black lines.

The index closed right at the range high (upper black line: the resistance). This could indicate a possible range break is happening, so we need to see a follow-through move for confirmation. This could happen in the form of a few bullish days, followed by a bearish day (testing the resistance), and continuation higher. Or it could be a new bullish week, followed by a bearish week, then another bullish week.

There is no confirmation if the index fails to make new highs in the new week, and moves back inside the range.

We need the 7,700-7,750 area to remain supportive in the coming weeks until we see a break of the key 8,000 level. Again, there is no need to rush through 8,000.

March is nearing its close. Let’s see how the bears will react by month-end.