Were any of you surprised by the decline in the Philippine Stock Exchange Index (PSEi Composite)? I’m sure you weren’t, if you’ve read the blog last week.

Kidding aside, the PSE index closed the week with new milestones: a new record high and new record close were seen on Wednesday, ahead of the 2-day decline which jeopardized the month’s northward push.

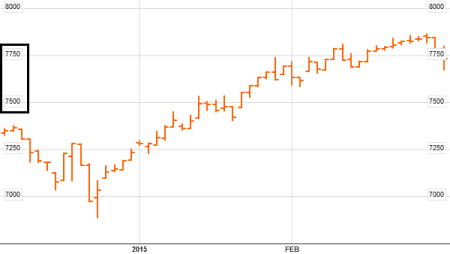

On Friday, the PSEi closed at 7,730.57 as it eased 0.44% or -33.82 points. There were 77 winners, 103 losers, and 47 issues unchanged, with a total value turnover of P12.15 billion.

PSEi Daily chart, Feb. 27, 2015 Credit: BBG

Key Areas List

The Key Areas list of the PSE index has remained the same.

Key areas to watch:

Resistance: 8,000, 8,500, 9,000

Support: 7,700, 7,400-7,500, 6,800-7,000

The Script

The index fulfilled the script I mentioned last week, and gave in nearly 200 points this week. This forced February to close nearly unchanged.

It’s interesting that February closed right at the 7,700-7,750 area mentioned (7,730.57). Does this mean the bulls are still in control? Maybe, but the bears made a month-end “statement” that is hard to ignore.

I would continue to monitor the highlighted area in the chart above (7,500 to 7,700) because it remains at risk of bearish attacks. Let me emphasize that initial declines this March are healthy for the market, in my view. It’s been overdue, in fact. Declines back to 7,200-7,300 are still expected at this point, but I would rather see 7,500 hold well.