Investing.com’s stocks of the week

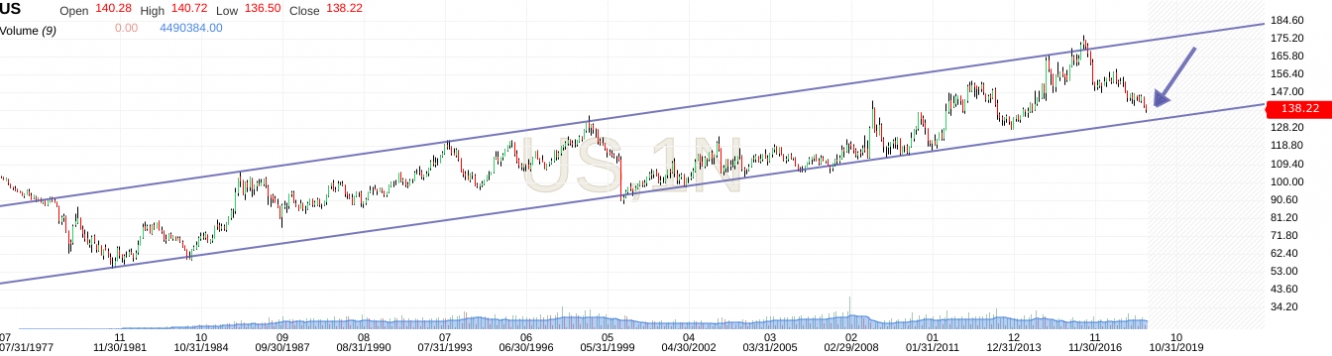

I recently saw a post about the US 30Y T-Bond getting closer to its lower channel trend line. This channel goes back to the 1980s as seen here.

Bonds have been in a bearish trend since the Federal Reserve began raising interest rates in December 2015, so I didn't think much of this chart, at first. The Fed has $2.5 Trillion in UST bonds, so if they want interest rates to rise, they can sell them, and make it happen. No news there.

However, I was later reading a different forum and someone pointed out a pattern in Gold called a 'Bump and Run'. To summarize a 'Bump and Run;, there is a price 'lead-in' that creates a trend (at a 30-45 degree angle), and then a 'bump up' which doubles the incline of the trend for a short period of time (45-60 degree angle), a brief consolidation and roll-over period, and then the trend line is broken in a 'run' phase. The level where the trend line is broken often becomes overhead resistance.

This pattern reminded me of the Bond chart I had seen earlier and so I put together this chart.

On this chart, you can see the purple lead-in, the green bump-up (doubling the angle), and then the potential for a trend break, and run phase.

Conclusion

Fundamentally, the Fed is committed to raising interest rates cautiously, but if this trend is broken in the upcoming months, the slow demolition of the Bond bull market could turn very quickly into a cascade of the bond market. Adjust accordingly.

*I have no positions in the markets mentioned in this analysis. It is for educational purposes only.