To say that precious metals investors should watch the US Dollar Index, is an understatement. After all, gold and pretty much everything else, is priced in the dollars, so what has the key world currency been doing lately?

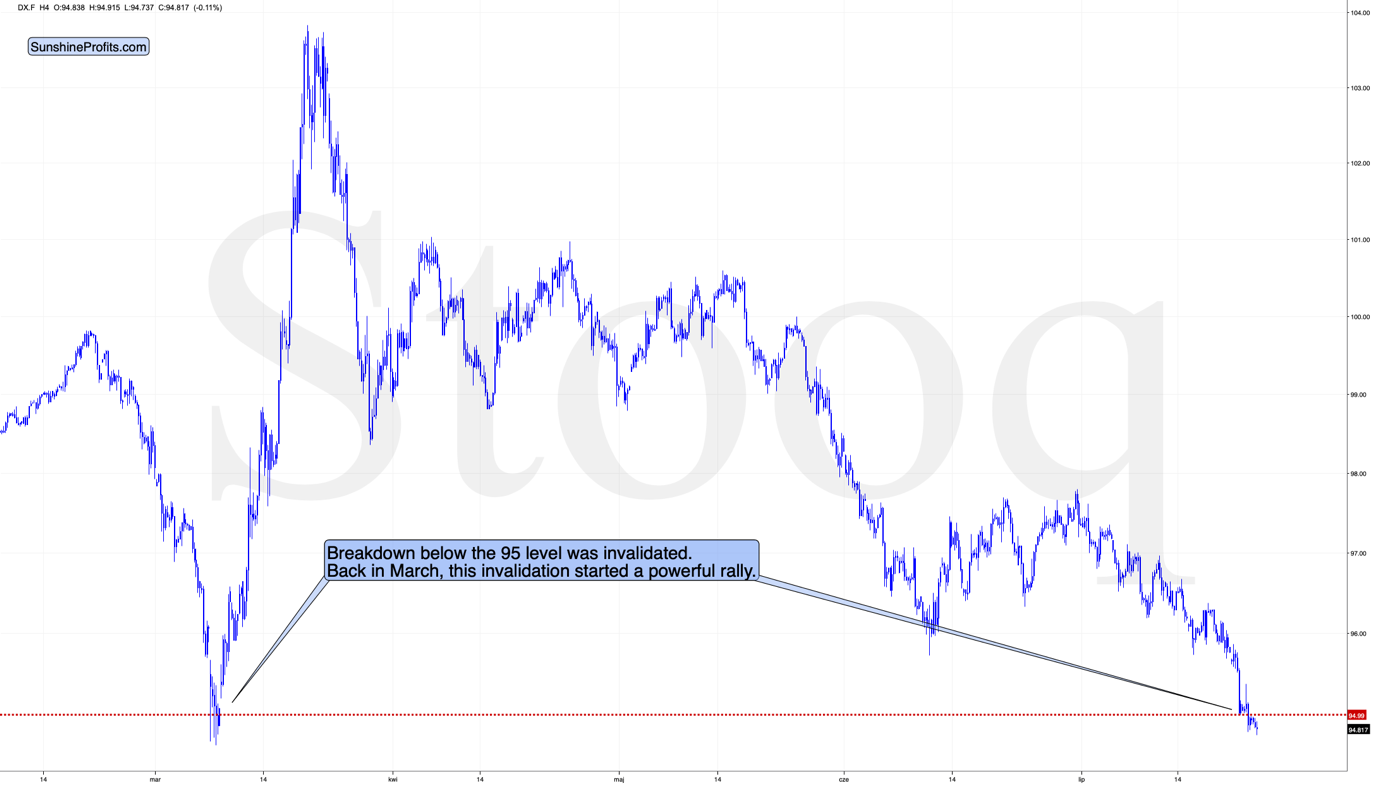

It moved slightly below the 95 level and it's been moving back and forth below this level, which is exactly what it did when it bottomed out in March.

The invalidation of the breakdown below the 95 level is what launched the massive March rally, so once the USD Index rallies from here—after forming a broad bottom as we saw in March—we might also see a more visible upswing.

Such a rally would likely translate into a big decline in gold. Did gold top out yet? Given today's pre-market move to $1,887.70, it might have, but we might still see a move to about $1,900, which would then be followed by a sharp drop. In both cases, the likely possible upside for mining stocks is very limited as they are already barely reacting to gold's gains.