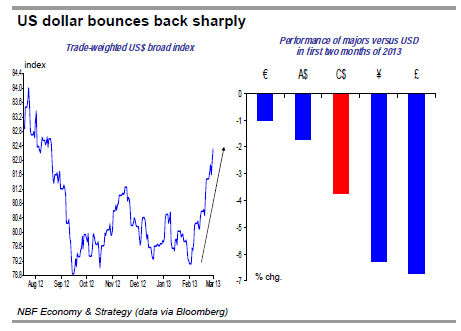

The US dollar has just had its best month since May 2012. While last May's concerns about the European sovereign debt crisis lifted the greenback, this time it was politics that prompted flows towards the world’s reserve currency. Congress failed to avert the automatic spending cuts, something which raised doubts about the US economic outlook this year. European politics also curbed investor enthusiasm with Italian elections yielding no clear winner and setting the stage for enhanced political instability, a clear negative for the euro. The greenback has room to run further given that European woes are far from over, and that other major central banks such as the Bank of Japan and the Bank of England remain in printing mode.

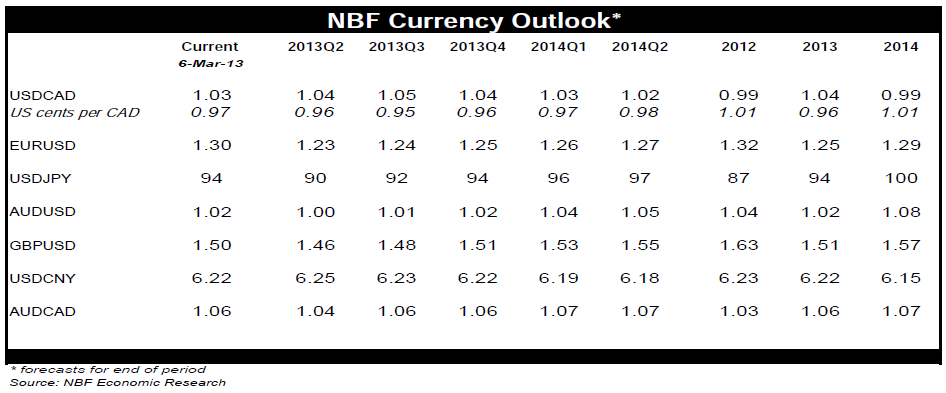

The loonie offered little resistence to the USD’s February push, with souring domestic economic data hammering the currency further. With the Canadian dollar sinking faster than we had expected, we have made some room to allow for further loonie depreciation over the near term, raising our USD/CAD Q3 target to 1.05. And with inflation data surprising to the downside, we’ve pushed by two quarters to 2014Q3 the timeline for when we expect the Bank of Canada to resume rate hikes. We have accordingly allowed for C$ weakness to persist for longer over our forecast horizon, expecting the loonie to remain on the weaker side of parity with USD through mid-2014.

US dollar finds support

The US dollar has potential for a rebound. That’s exactly what we got last month with the greenback soaring 3.5% on a trade-weighted basis, the biggest monthly advance since May 2012, with none of the other majors being spared by the USD’s rebound.

While last May concerns about the European sovereign debt crisis lifted the greenback, this time it was politics that prompted flows towards the world’s reserve currency. In the US, Congress failed to avert the sequester that started on March 1st, which immediately raised doubts about the economic outlook this year. European politics also curbed investor enthusiasm with Italian elections yielding no clear winner amid yet more concerns about whether Italy can stick to its austerity plan. Speculators increased their net USD longs to the highest since September 2012.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The USD Has Rebound Potential

Published 03/07/2013, 08:06 AM

Updated 05/14/2017, 06:45 AM

The USD Has Rebound Potential

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.