Risk-taking was back with a vengeance in the last couple of weeks of 2012 buoyed not just by improving US economic data, but also by the Fed’s decision to expand monetary policy stimulus, coupled with heightened expectations that Congress would come to an agreement to avert the fiscal cliff — which it eventually did at the eleventh hour.

Little surprise then that the US dollar ended the year on a rather soft note. But the world’s reserve currency has ample room for a rebound in the coming weeks. The two-month postponement of sequestration and the upcoming debt-ceiling debate promise some heated arguments in a hugely divided Congress, something that’s likely to rattle markets.

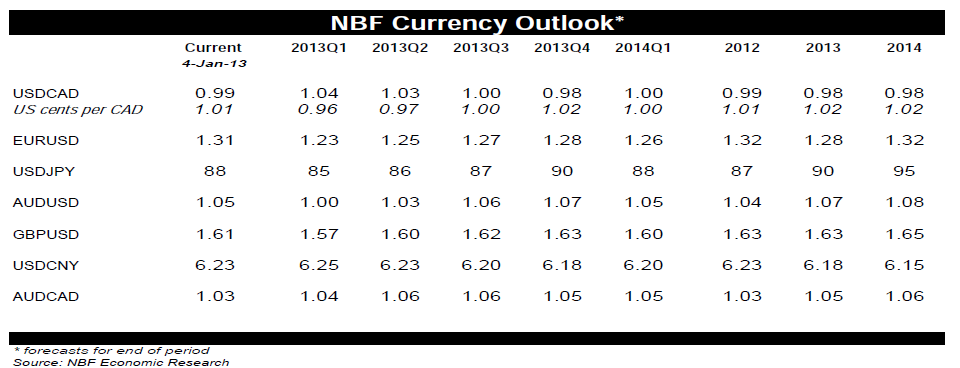

We’re accordingly sticking with our $1.23 end-of-Q1 target for the euro. Once risk aversion makes a comeback, expect attention to revert to the zone’s awful economic fundamentals. Also, speculators have recently turned bullish on the euro — positive net spec position for the first time since last summer — on the premise that the Federal Reserve would continue its Treasury purchase program indefinitely. Such bets may need to be pared down following the latest Fed minutes which showed that several FOMC members are wary of continuing QE after 2013.

The greenback’s likely rebound partly explains why we’re leaving unchanged our 1.04 USD/CAD end-of-Q1 target. The Canadian dollar is pricing an 80% probability of a rate hike by the Bank of Canada this year, something which we view as excessive given the further widening of the output gap after dismal economic growth last year.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The USD Has Ample Room For A Rebound In The Near-Term

Published 01/14/2013, 02:30 AM

Updated 05/14/2017, 06:45 AM

The USD Has Ample Room For A Rebound In The Near-Term

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.