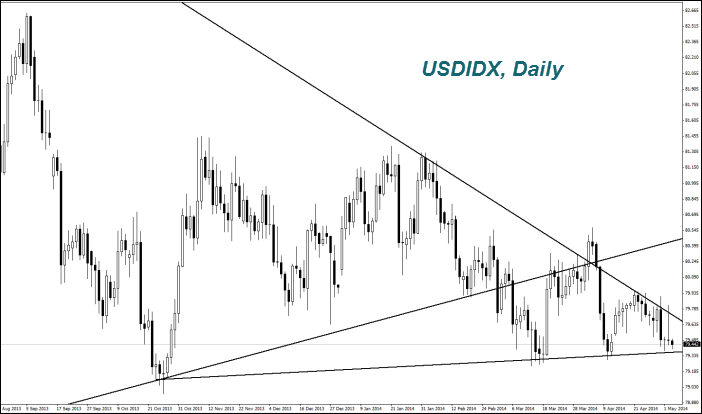

There were strong price fluctuations observed on Friday, but the US Dollar Index was almost unchanged by the results of the day. The U.S. economic data proved to be very positive and moderately negative.

The unemployment rate fell in April to a minimum of 5.5 years and amounted to 6.3%. Jobs in the agricultural sector (Nonfarm payrolls) appeared to be at their maximum in January 2012 and amounted to 288 thousand people. This has caused a short-term growth in the U.S. Dollar index. The good data like that are still not able to reverse the trend upwards because of the second component of the day, such as increase in industrial orders for March that turned out much weaker than expected and was only 1.1%. In general, investors are still pessimistic about the U.S. currency. Only 7% of economists expect the growth in U.S. interest rates this year. Nevertheless, investor perceptions about the U.S. Dollar are gradually changing for the better. According to the latest CFTC report, the net short on the U.S.Dollar fell to $686 million from $1.58B a week earlier. Today at 14-00 CET, we will see the business activity index in the service sector (ISM) for April. The outlook is positive.

Note that the 3-month volatility index from Deutsche Bank, which is calculated on the basis of nine major currency pairs, began to rise slightly from its lowest level since July 2007. This could mean stronger price fluctuations or even a new trend formation.

The Australian Dollar (AUD/USD) showed a slight weakening. It looks like a price decrease. The Australian property market data for March were weak. Since the number of new building permits was declined. An additional negative factor was the lowering in Chinese (PMI) from HSBC for April to 48.1 points which is more significant than expected. China is a major buyer of raw materials from Australia. Note that if the PMI is below 50, it means a production decline. The official index value for April is also 50.4 points, which is much higher than the independent indicator of HSBC. The Australian Dollar Movement was not too strong in anticipation of tomorrow's RBA meeting and its press conference at 3-30 CET.

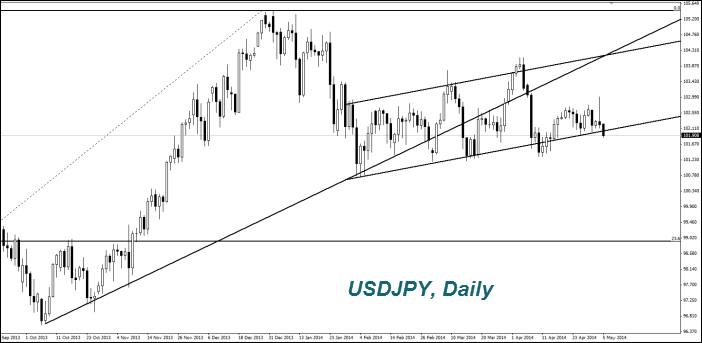

Lowering in the business activity index (PMI) in China from HSBC in April contributed to the Japanese Yen (USD/JPY) strengthening and had a negative impact on the bunch of commodity futures. The BOJ President, Haruhiko Kuroda said that the Japanese economy is on a recovery path. Market participants decided that it reduces the likelihood of increasing the monetary emission volume in the near future. Japanese financial markets are closed for today and tomorrow because of the holiday.

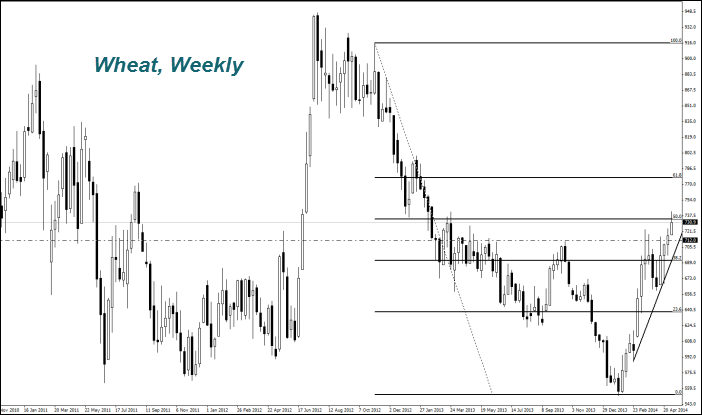

The (London Wheat) increased to a maximum of 11 months. Consumers fear the yield decrease due to possible drought in the United States. The temperature in the southern Great Plains rose to 32,2-37,8 degrees Celsius. The second factor was the unrest in Odessa Ukraine, where more than forty died. Market participants do not rule out disruptions in the Ukrainian wheat export via sea shipments. Odessa carries about 87% of wheat exports. The remaining food futures got cheaper because of possible Chinese economic slowdown and the lower PMI.

The Copper has risen to its 8 weeks maximum. According to the CFTC, market participants have formed the Copper net long for the first time. The premium between the prices per ton on the Chinese physical and futures markets reached its highest level of three years and was $250 (1570 yuan).