I seem to be writing only negative commentary on the USA economy. This past week we published our July economic outlook, which remains around the zero growth mark largely thanks to slowing government spending year-over-year.

Follow up:

Being negative is not my style - but being realistic is. I delve into most economic data releases - even though I may not publish a review. I want the USA and global economies to thrive. Yet, I see literally no evidence anywhere of potential acceleration of growth.

The key word always used by forecasters is "uncertainty". My newsflash is that there was always uncertainty - but uncertainty is a big deal when you have a snail's pace of economic growth, as any wobble will send the economy spinning off course.

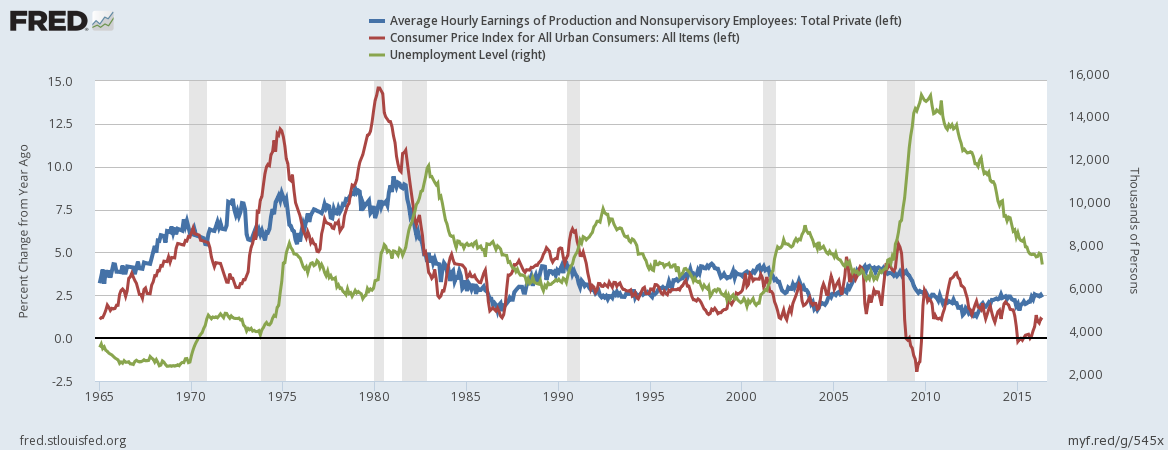

I continue to hear knowledgeable pundits say the USA is nearing full employment - and how inflation will take off soon. I have news for pundits - wage growth correlates to inflation and not employment. In the graph below, average hourly earnings' year-over-year growth rate percentage (blue line) moves in generally close correlation with inflation (red line).

What you will not see is a significant degree of correlation to the unemployment rate (green line) - sometimes wages rise when unemployment falls, sometimes wages fall when unemployment falls.

The question is whether wages cause inflation or vice versa. The relationship could even be symbiotic. If the Federal Reserve wants inflation, a good experiment would be to achieve full employment where accelerated wage growth was triggered.

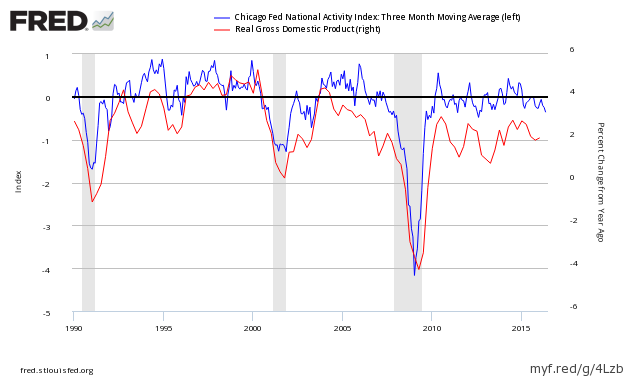

You do not have to spend your life sifting through economic data to understand the economy. THE quantified USA data summary to understand the state of the economy is the Chicago Fed National Activity Index (CFNAI).

This index puts the entire month's economic releases into their proper perspective, almost in real time. It is published in monthly chunks - and at times leads the publishing of GDP by three months.

When using this index, it is trend direction which is important - not necessarily the value. When the index is above -0.7, the historical boundary between expansion and contraction, the country overall is in expansion.

The index is quite noisy, and the only way to view the data is to use the 3-month moving average. This index IS NOT accurate in real time - and it did miss the start of the 2007 recession. As this index is never set in concrete, each month a good portion of the data is backwardly revised slightly. The most significant revision is in the data released in the last year or so due to revisions of the 85 indices which are embodied into the CFNAI.

Even the 3-month moving average has over time significant backward revision. This is due both to changing methodology and backward revisions of this index's data sources.

As a trends person, I believe trends continue until they do not. As the CFNAI is published relatively close to real time - it is a good assumption that the current CFNAI trend is the future economic trend. The CFNAI is far from perfect, but significantly better than pulling an economic forecast out of an orifice.

Based on the CFNAI, the economic forecast is a slowing economy.

Other Economic News this Week

The Econintersect Economic Index for July 2016 continues marginally in contraction but insignificantly improved. The index is slightly above the lowest value since the end of the Great Recession.

Although Econintersect does not buy into the proposition that Brexit is bad for the global economy, the financial markets do - and their reaction may cause a recessionary dynamic. Those alive in 1973 will remember that the oil embargo triggered a recession. Global events do indeed impact the USA economy.

Bankruptcies this Week: Privately-held John Q. Hammons Hotels & Resorts, Triangle USA Petroleum, Hong Kong-based China Fishery Group Limited.

Click here to view the scorecard table below with active hyperlinks.

Weekly Economic Release Scorecard: