By Mike Maharrey

A complex picture.

That’s how Metals Focus described the silver market.

This complexity is obvious simply by analyzing recent silver price movements.

Objectively, silver has had a fantastic year. The price has surged by over 30 percent. Most investors would kill for a 30 percent return.

But while gold seems to make new highs on a weekly basis and has eclipsed its record price in inflation-adjusted terms, silver remains well below its high in both nominal and inflation-adjusted terms. Meanwhile, the gold-silver ratio remains historically high – above 80-1. This indicates that silver is historically underpriced compared to gold.

Due to these factors, many investors view silver as a laggard despite its strong returns. We often hear people ask, “What’s wrong with silver?”

Metals Focus is right. It’s complicated.

During the recent LBMA/LPPM Global Precious Metals Conference in Miami, Metals Focus attempted to assess the health of the U.S. silver market. Conference attendees characterized it as a market with “notable resilience and marked weakness.”

The global supply and demand dynamics support silver. Robust demand and lagging silver mine output have resulted in market deficits for three straight years, with demand expected to outstrip supply again this year.

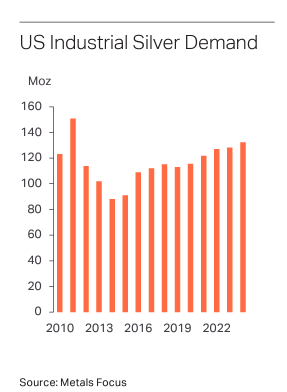

Industrial demand is also the primary driver in the U.S. silver market, but the picture isn't simple.

Industrial Silver Demand

Globally, industrial offtake has been the bedrock of silver demand over the last couple of years. Industrial demand set a record of over 654 million ounces in 2023, and it's expected to break that record again in 2024.

According to Metals Focus, U.S. industrial silver demand is on pace for a record year as well, with the exception of one sector – solar energy. According to Metals Focus, the U.S. has lost market share in photovoltaics due to the long-running trade war with China.

Even with the drag on PV demand in the U.S., other tech and industrial sectors are taking up the slack.

Metals Focus notes that many established market segments can no longer thrift and substitute silver in a meaningful way. That makes silver offtake more a matter of GDP growth along with non-price developments in specific sectors. Metals Focus cites the health of the local mining and energy industries as an example. It is driving “robust sales of brazing alloys for those sectors.” The installation of 5G infrastructure and general electrification are also supportive of silver demand.

But even the industrial demand picture is complex. Metals Focus said that some of its research contacts reported scaled-back orders. Instead of purchasing silver, these customers were running down existing stocks, some of which had become “excessive.” Automotive end-use was cited as an example.

“Vehicle production in North America may have risen by 2 percent y/y to end-September (and by 0.5 percent globally), but the various tiers of suppliers had built inventories to cope with higher expected levels of vehicle sales. This is particularly true for those hoping for a bonanza from battery electric vehicles (BEVs), which carry a much higher silver loading than internal combustion rivals, even if BEV production in North America was up by 19% to end-September (+8 percent globally).”

Higher silver content per unit helped mitigate lower vehicle sales.

According to Metals Focus, most of its contacts were still bullish about industrial silver demand in the U.S. Rebuilding after hurricanes Debby and Milton will likely support silver demand as it feeds through the supply chain in three to six months.

Meanwhile, supply chain inventories are normalizing.

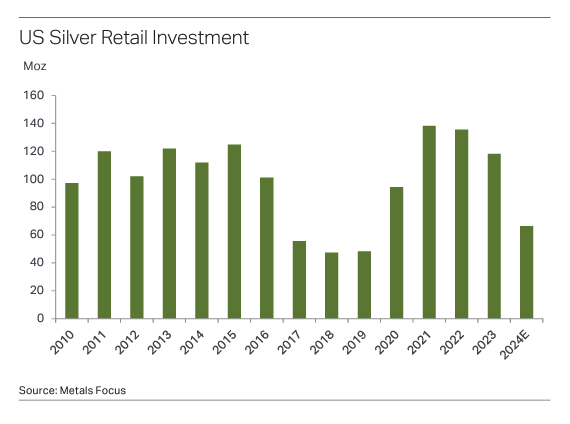

Silver Investment Demand

On the investment side of the coin (pun intended), U.S. retail investment is forecast to drop sharply this year while still holding above the 2017-19 trough.

Metals Focus’s contacts report a surge of individual investors selling coins and bars back. Some dealers reported buybacks outstripping silver coin and bar sales. This is a relatively rare phenomenon.

“Much was felt to have come from lower income groups who had used COVID-era savings and/or government support money to buy silver sub-$20 or in the low $20s and were now selling to fund inflated daily expenses or merely to take profits. The need to sell is highlighted by the fact that some of these investors may not have actually made a profit given the earlier very high premiums which compare with the far more modest by-back prices now being offered by dealers.”

Meanwhile, sales of newly minted coins and bars have lagged.

On a positive investment note, the amount of silver held in IRAs has grown. Advisors have apparently started recommending silver as part of a strong portfolio.

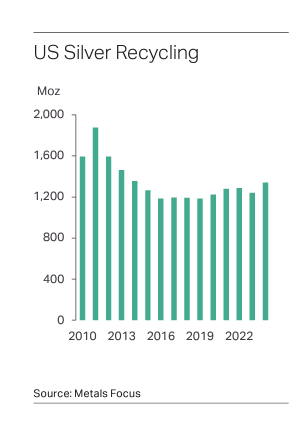

Silver Supply Factors

On the supply side, most analysts tend to focus on mine output, which has essentially plateaued since its all-time high in 2016. But scrap is also a significant source of silver.

Metals Focus called the scrap situation in the U.S. “complex,” with some contacts reporting stable volumes and others “heady gains.”

“Key to this is the mix of sources and of the suppliers to those sectors. For instance, industrial scrap (outside of ethylene oxide catalysts) looks to have risen a fraction, but that is more due to non-price factors such as a greater pool of product. Photographic scrap also continues its slow, steady retreat due to structural factors, while jewelry recycling remains quiet. Sources feel that you would have to see much higher prices and/or a worse economic backdrop, both of which might trigger remelt by manufacturers and distributors of unsold or slow selling inventory.”

Meanwhile, the meltdown of silverware has boomed in the U.S., with some refineries reporting double-digit gains. Money Metals called this “a surprise.”

“Many sources have long reported that depleted near-market stocks mean we would be unlikely to see much of a surge in the event of a price rally, especially one that failed to achieve record nominal highs.”

There has also been a boom in coin scrap.

Considering these factors, U.S. silver recycling is expected to grow by about 8 percent this year.

With so many factors playing into silver demand, it is sometimes difficult to forecast price movements – particularly in the short term. Nevertheless, at its core, silver is money, and it tends to track with gold over time. In fact, silver has historically outperformed gold in a gold bull market.

With the Federal Reserve back in the inflation business and apparently intent on lowering interest rates, the environment seems friendly to monetary metals. If you are bullish on gold, you should probably be even more bullish on silver.