Many of you know that I haven’t been exactly bullish on the U.S. housing market – especially the construction stocks. That’s why in early March I wrote about and recommended betting against the home builders (you can read that here).

I specifically made bets against KB Homes (NYSE:KBH) because they target first-time home buyers. And I believed the lofty expectations from out-of-touch economists would fall flat (which they have).

Since then, news after news has come out showing that the housing market is faltering. For instance – August was the fifth straight month that annual price gains in the 20-City Index (top 20 cities in the U.S.) decelerated.

This alone isn’t worth getting anxious over – but all the other housing data is coming in ugly as well. . .Estimates show that for the first time in nearly 10 years, residential investment is set to subtract from annual U.S. GDP growth. And that the August ‘sales of existing homes’ missed analyst projections, as well as ‘new-home sales’ fell three months straight – the weakest pace in nine months.

But the real crisis here is that the housing markets stalling out from buyers shying away from the higher prices and higher mortgage rates (the 30-year fixed mortgage is the highest it’s been since 2011).

This is the real demand-side problem. . .

Many economists and mainstream pundits are baffled by this. The Trump tax cuts, a multi-decade low in unemployment, and an 18 year high in consumer confidence should have home prices and sales surging – right? Yet they aren’t – so what gives?

Many who’ve studied the texts of the late Austrian economist – F.A. Hayek – knew that this weaker housing market was inevitable after the high growth years (browse through our Palisade Recommended Reading List to see his best work).

Because of the housing bust and financial meltdown of 2008, the Federal Reserve engaged in ZIRP (zero interest rate policy) and money printing via QE to subsidize mortgage lenders, housing construction, and home prices. The low rates allowed many deep in debt (including corporations) to refinance, and it also kept home prices from declining.

Not too mention the increase in rent prices over the last decade (as hedge funds gobbled up homes to rent out) spurred a boom in apartment construction. I live in Scottsdale and I see it every day – endless rows of freshly built and over priced apartments that are pretty much empty.

This ‘boom’ though caused supply to soar. But demand hasn’t matched it.

Everyone that needed to refinance their mortgage already has – and won’t again at these higher rates. And incoming new home buyers are being priced out.

Remember investing 101 tells us that high prices demand higher prices. But eventually, prices get too high that no new money comes in.

And that’s what we’re starting to see. The upward trend in housing over the last few years is now stalling out – hitting a peak – and soon will reverse downwards as prices drop.

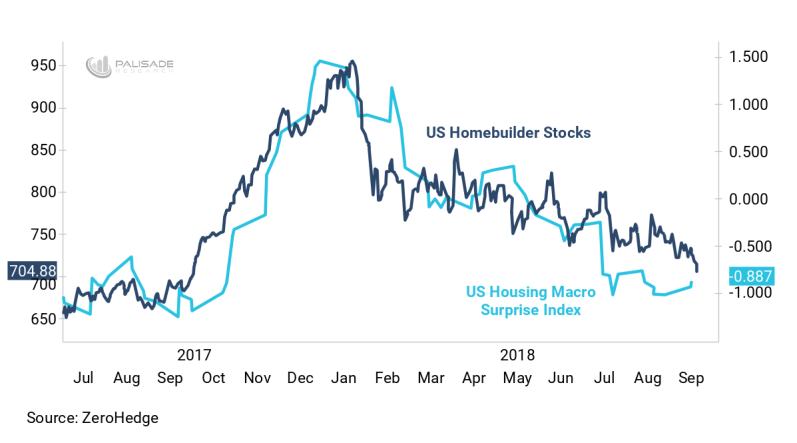

Just look at U.S. Housing Macro Surprise Index and U.S. Homebuilder Stocks Index – it’s declined tremendously this year. The S&P Supercomposite Homebuilding Index is down 21% year-to-date and on pace to be the largest annual drop since 2008.

Some loony economists claim that rising home prices are from a lack of new homes built. Meaning many aren’t selling even though many want to buy. But if that were the case, then home builders would be doing very well.

Yet they’re not. So – like I wrote above – it comes down to demand side problems.

I expect the housing sector to continue weakening. Especially as the Fed continues their tightening and balance sheet unwinding.

Home prices have outpaced ‘real’ (after inflation) wages by many fold for years. This means debt’s needed to keep things going. And don’t expect people to easily afford the higher borrowing costs from the Fed’s rate hikes.

The last time rates got up too high, debtors couldn’t manage their interest payments and home prices fell. Taking down the entire global economy with it.

So as long as the Fed keeps hiking rates – expect the housing market to become increasingly fragile.