The Census Bureau released its estimates for November US trade. It was yet another debacle for the FOMC narrative about an economy poised to overheat. November was the month in between the two FOMC meetings where they first declared (October) risks diminished and then (December) recovery conditions fully met. Instead, both exports and imports in that interim shrunk considerably, casting very real doubt as to what the FOMC is actually using as a basis for economic assumptions. We know already, as the Committee has rather plainly implied, that they cast aside actual market data but increasingly it looks to be their full approach with estimates of all types.

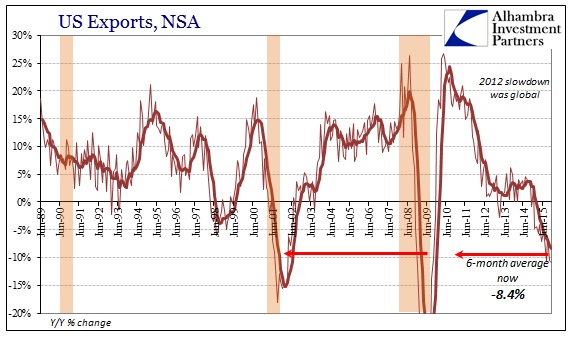

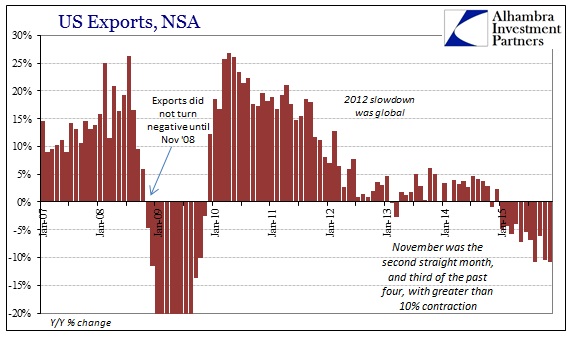

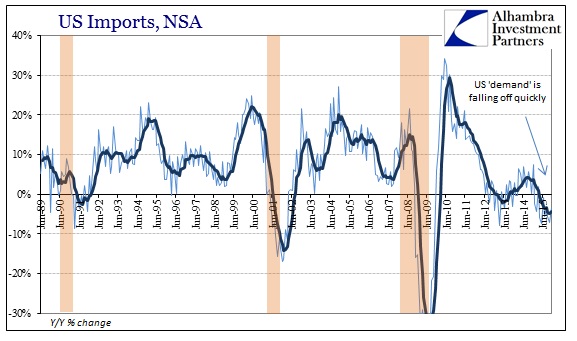

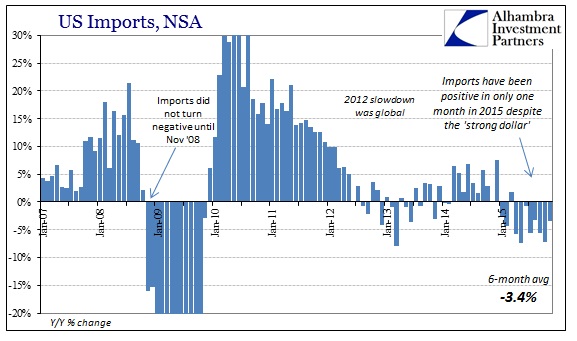

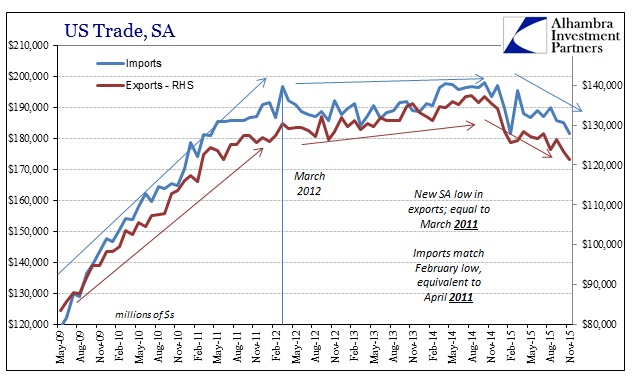

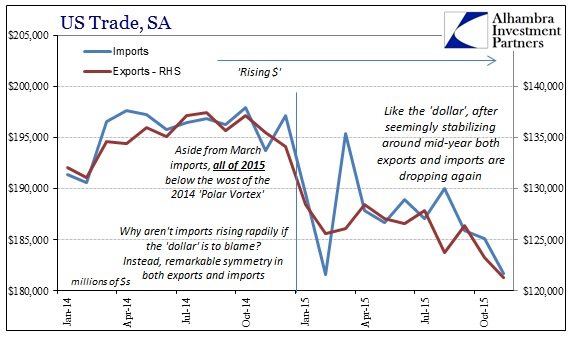

US exports fell by more than 10% for the second straight month, and for the third time in the past four. That much was expected, at least in the direction if not the intensity, by orthodox economists who consider overseas turmoil the primary economic thorn. However, imports likewise declined for the eighth straight month, leaving only one positive number for all of 2015 with which to suggest robust US demand.

It was perhaps the seasonally-adjusted series that indicated more forcefully the dreadful state of US trade on both sides. If there is US consumer demand driving the economy to the precipice of overheating, it is conspicuously absent from these figures. That would be highly confusing since consumer demand is likewise absent from domestic production as well. Seasonally-adjusted, US imports in November matched the rout in February, hitting again the lowest level since early 2011. Similarly, exports fell to just $121 billion, which was the same amount of export trade recorded in March 2011.

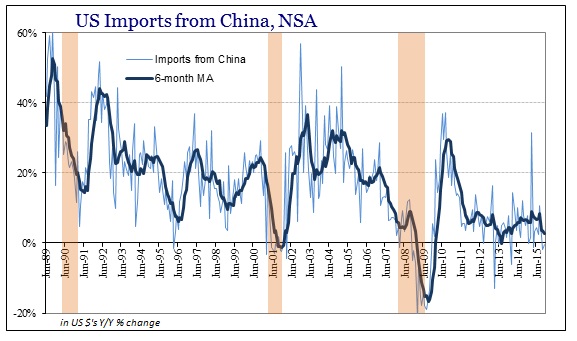

The Chinese are in no position for more bad news so they will have to cope with US imports declining again for the second straight month, though I suspect in economic terms they already knew that was the case (and a good reason why the “dollar” has been so disruptive yet again). Their industrial capacity is trained for actual US overheating, which to them looks more like regular 15-30% growth and nothing like the increasing frequency of near-zero and even negative months. Since China is our largest external source of feeding US consumer demand, their stumbles and growing disaster reflect directly upon our own economy.

All of which leaves the FOMC suspiciously uncovered as to actually finding the economy they claim is about to become so strong it needs active restraint. From a trade perspective, that just isn’t the case as the US economy is taking the very unfortunate task of restraining itself way past QE’s 3 and 4 and all the way back to 2011 and the failed ends of QE2.