With global growth returning, the U.S. economy surging to a 3% growth rate, and U.S. rates on the rise, one would think the dollar would remain strong in 2020. However, that may not be the case because interest rate spreads are contracting, and that may result in the U.S. dollar sinking in 2020.

The Dollar Index

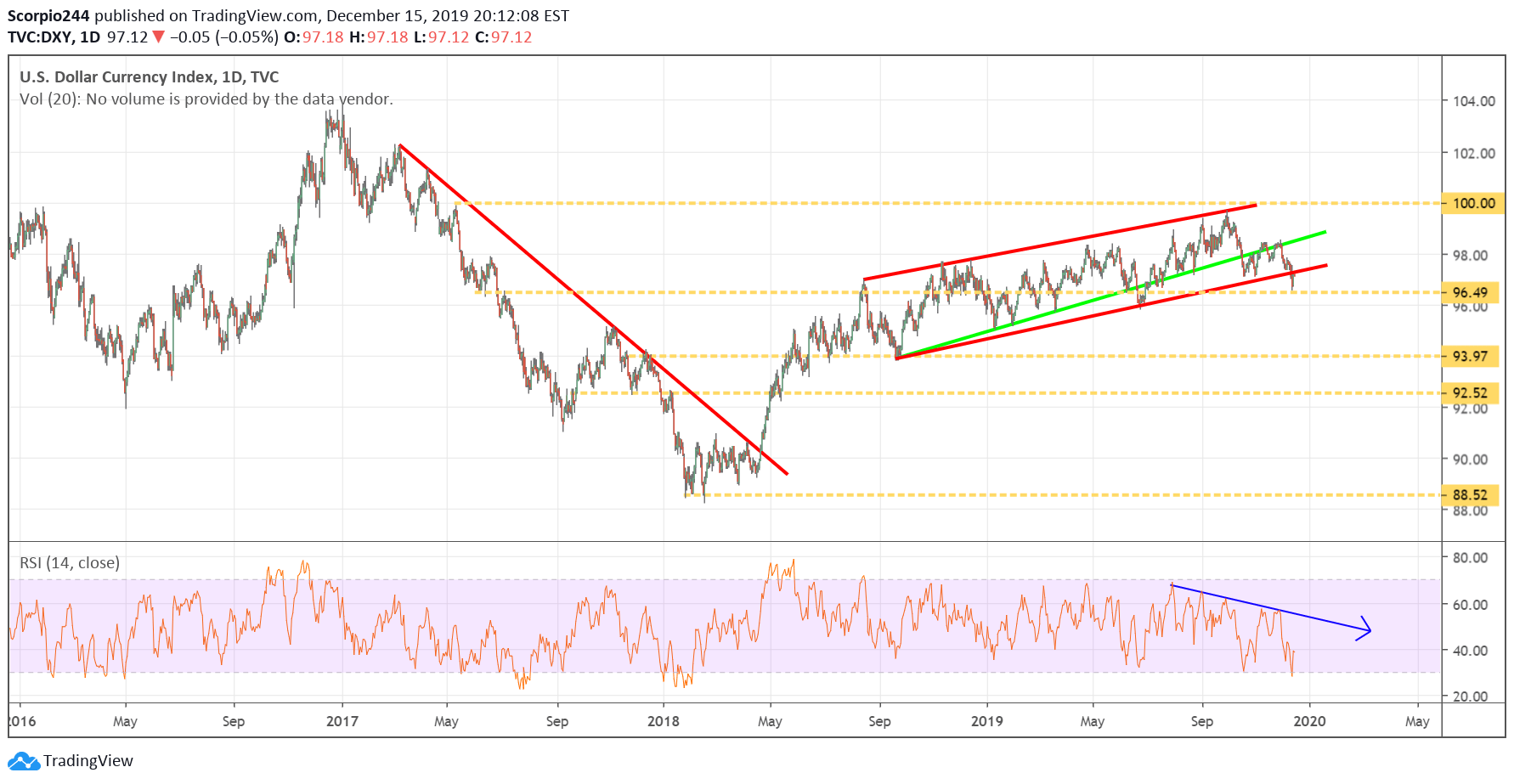

The dollar is on the cusp of a significant break down as 2019 comes to a close. The dollar index, which measures the U.S. dollar against a basket of currencies, is nearing a level of support at 96.50. Should the dollar index break down and fall below that level of support, it could results in the dollar index plunging to around 94 and potentially to as low as 92.50. The relative strength index is also signaling a bearish warning sign. The RSI has been steadily trending lower since July, despite the index making several new 52-week highs. This pattern is known as a bearish divergence and signals that the dollar index is due to fall longer-term.

Spreads

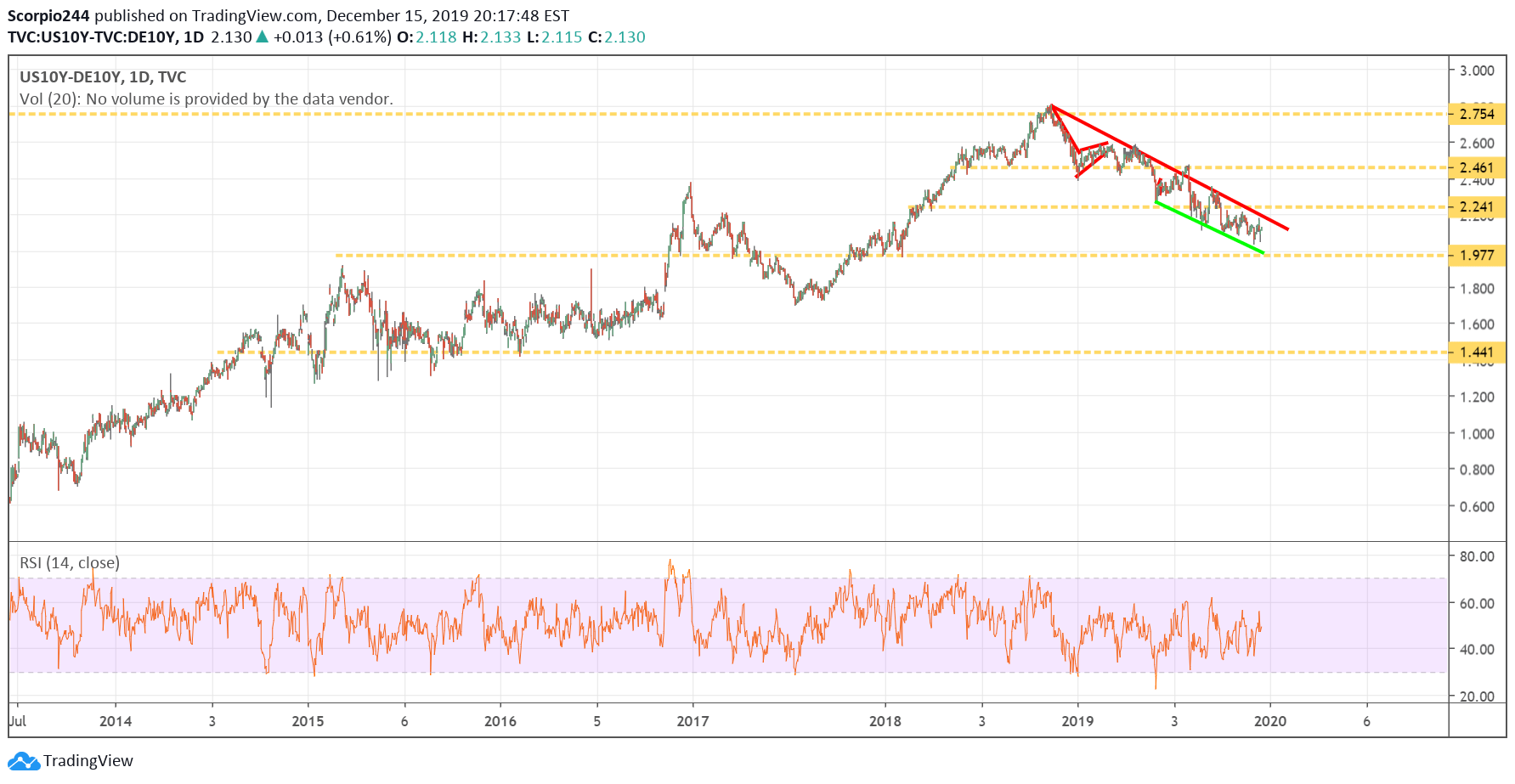

Another reason why the dollar may be due to fall in 2020, is because the spreads between U.S. and international bonds have contracted dramatically since peaking in 2018.

The spread on German and U.S. 10-year rates have contracted by almost 75 basis points since peaking at nearly 2.8% in November 2018. Now that same spread is just 2.05%. It tells us that U.S. bonds yields have fallen at a much faster pace then compared to the pace German Yields have declined.

Euro

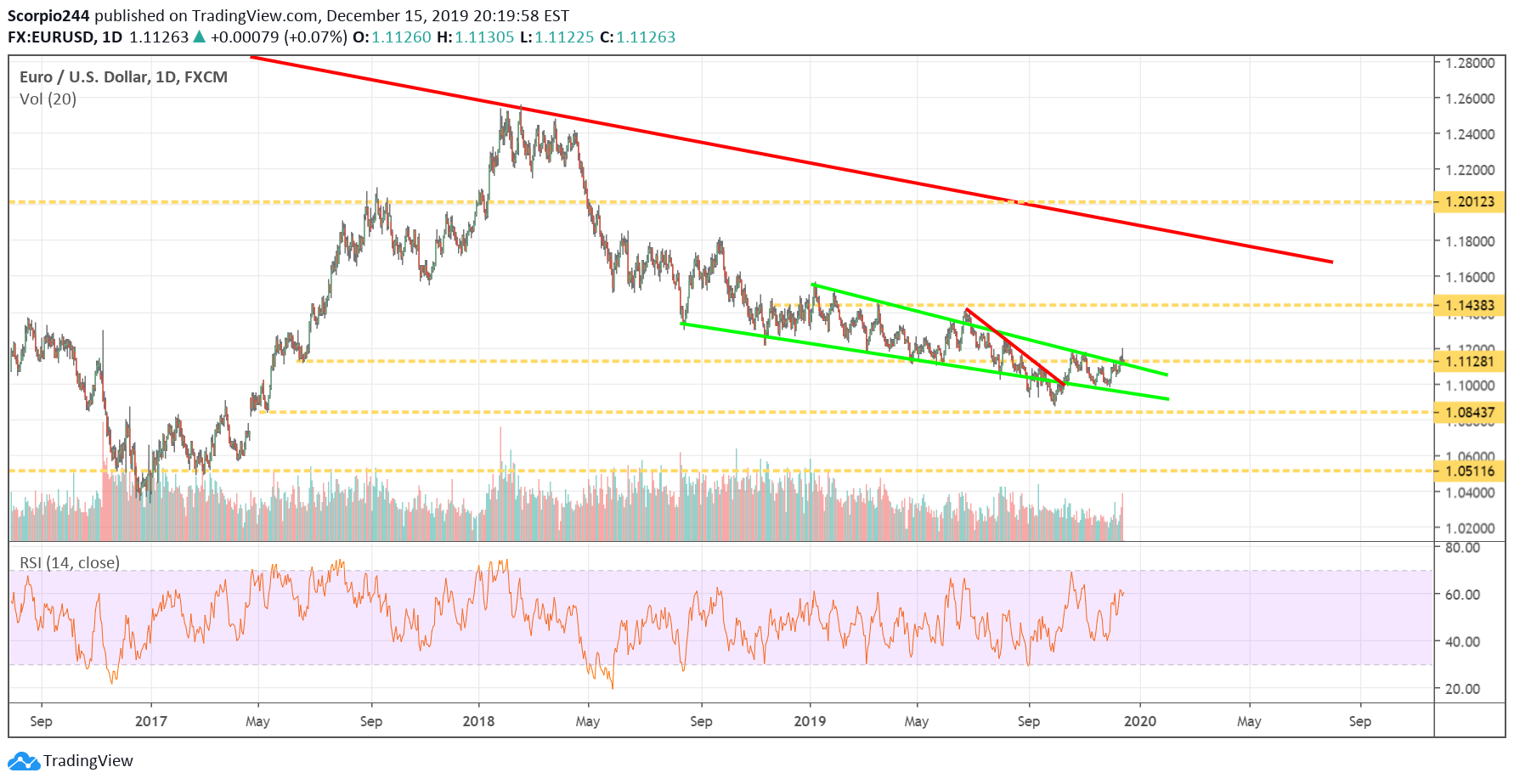

Additionally, the euro is showing signs of strength as it breaks free of a downtrend, and a falling wedge, a bullish reversal pattern. The chart suggests the euro may rise to around 1.145 to the dollar.

The signs for a weaker dollar in 2020 are there, the question is what will come with a weaker dollar.