Markets were a bit slow getting out of the blocks Monday morning, hindered by the fact that Asian and European markets were still out on holiday, but trading activity will no doubt pick up Tuesday. Those traders who took a long 4-day weekend will come back to see that the dollar’s dominance suffered a bit of a setback on Friday, a theme that’s affecting both the G10 currency pairs, like EUR/USD, and EM currencies as well.

Indeed, many major EM currencies have been strengthening against the world’s reserve currency for the past couple of weeks now. For example, USD/TRY, USD/MXN and USD/ZAR all peaked in early March and are now on the verge of breaking below their mid-March lows. While all of these moves have been impressive, the Russian ruble has actually been one of the strongest EM currencies since late January, as strange as it may seem.

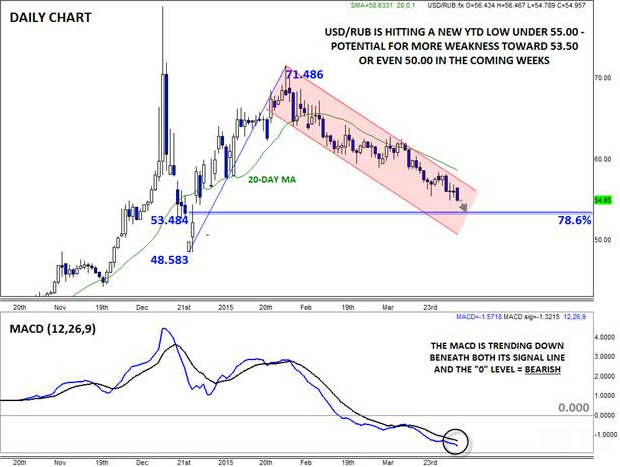

Pair in Play: USD/RUB

By now, we all know that USD/RUB rocketed up to near 80.00 in mid-December, but few realize that the pair has since unwound much of that move. As we go to press, the pair is inching back below 55.00, and based on the chart, more weakness (ruble strength) could be in store in the coming weeks. The pair remains within a bearish channel off the late-January peak at 71.50 and rates have plenty of room to fall before reaching the bottom. Meanwhile, the MACD indicator continues to trend lower below both its signal line and the “0” level, signaling that bears are still gaining steam.

As long as USD/RUB remains within its bearish channel and below 20-day MA resistance (currently near 57.00), the path of least resistance will remain to the downside. From here, bears may look to target the 78.6% Fibonacci retracement of the January bounce at 53.45, and if that level gives way, a move down to key psychological support at 50.00 may be seen next.

As always, traders should keep a close eye on the performance of oil prices when watching the ruble as well, given the Russian economy’s dependence on so-called “black gold.” If we see Brent crude break above resistance at $63, the ruble’s rally could gain more steam. For more on the fundamental drivers and current technical outlook for oil, see our free special report, “Why Oil is Off the Boil.”

Source: FOREX.com

For more intraday analysis and market updates, follow us on twitter (@MWellerFX and @FOREXcom)