Reading Chinese economic figures can be a complicated process for even the most seasoned of analysts as the black-box economy exhibits only limited transparency when it comes to reporting data. The overnight GDP release from the National Bureau of Statistics of China provides few answers and just raises more questions about the true state of the economy. Certain economic metrics like import and export figures cannot be fudged because the data can be corroborated with figures from other global ports, making it very complicated to massage the figures. However, when it comes to more critical data used to evaluate an economy such as gross domestic product, industrial and manufacturing production, and housing, the figures are often subject to greater manipulation that skews the top-down view of the economy. Although the economy may not be in the dire straits that some talking heads have concluded, today’s headline GDP number leaves ample room for speculation that growth may be substantially below reported levels.

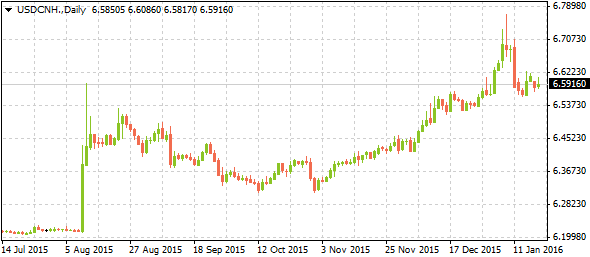

The monetary and fiscal policy measures of 2015 reeked of desperation and lack of control as policymakers sought to control the narrative amid the chaotic transition from a completely planned economy towards increased liberalization and market-based reforms. The strategy of evolving from a purely export-oriented economy and embracing consumption is not an easy alteration to implement over a short period of time. The economic makeover has also proved costly at a time when globe trade appears to be shrinking and efforts to improve competitiveness have only experienced mediocre results. In 2015 alone, Chinese foreign currency reserves fell from over $3.80 trillion to just over $3.33 trillion as policymakers worked to devalue the yuan and inject liquidity into troubled financial markets. These confidence boosting measures did little stem the pace of capital outflows which continues apace despite growing controls. Unless China is able to effectively increase transparency and reverse outflows, 2016 is bound to be another rocky year for Central Planners as they try to orchestrate a massive economic modification. Another ugly year of below trend growth is likely despite the best efforts to instill a rosy outlook amongst investors.