Revised Q3 GDP numbers for the U.S. indicate that the economy was 1.4% bigger (in nominal dollars) than the prior quarter and 4.2% bigger than it was on Sept 30, 2011. U.S. GDP has grown by about 4% per year from $13.9 trillion in mid-2009 to $15.8 trillion today. At the same time, the U.S. money supply has grown from $8.4 to $10.1 trillion. A 20% growth rate in the money supply compared to a 14% growth rate in nominal GDP poses a challenge.

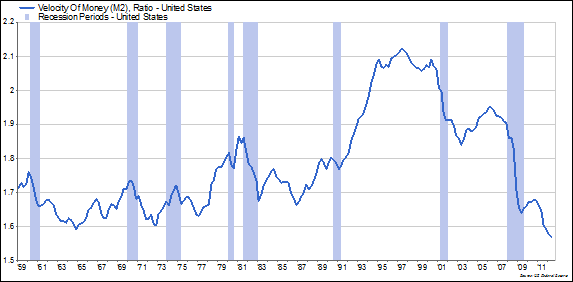

Economists refer to how many times the same dollar gets spent each year as the ‘velocity of money’. In the U.S., a $15.8 trillion economy rests on a money base of $10.1 trillion. The chart below illustrates how significantly this ratio has changed.

Its current level, 1.57x, is the lowest in over 50 years. How significant is this? To put it into perspective, US economic activity would have to jump by 35% overnight to return velocity to the levels of the late 1990’s.

We know that the increase in the money supply over the last five years is a result of the bailouts that began under the Bush Administration (TARP etc.) and then continued with the Quantitative Easing programs of the Obama Administration.

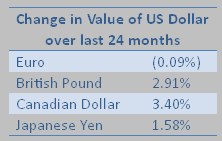

There is a common “sky is falling” argument that the Fed’s money-printing is bad policy and erodes the value of the dollar. And this would be the case, if the U.S. Treasury were the only ones doing it.

But the U.S. is not alone in this. Most other major countries have conducted similar monetary policies and thus exchange rates have been relatively stable.

Most commodity prices including silver, oil and even the Goldman Sachs Commodity Index are essentially unchanged over the last two years. Gold stands out as one of the few commodity winners -- having appreciated in value by about 20% - slightly faster than the growth in the money supply over the same period.

So if all of this extra money is not devaluing the US dollar relative to its peers -- and is not creating commodity price inflation, where is this expansionary monetary policy having an effect?

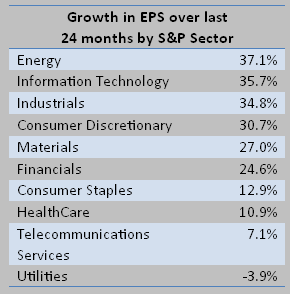

Corporate profits represent a small share of GDP, but seem to be getting all of the benefits of the stimulus, having grown 25% over the past two years -- more than the growth in the money supply and the price of gold.

Perhaps surprisingly, owning companies has become one of the best hedges against an expansionary monetary policy, and the less regulated the industry, the better.

No doubt, stock prices have lagged earnings as many investors have chosen to lend money to governments to avoid stock price volatility rather than own profitable companies. As stock price volatility has subsided to its pre-financial crisis levels, we expect to see some of that money move back into stocks and push stock prices up in 2013.

This month, the financial press will be obsessed with politics -- not business. The fiscal cliff -- that looming combination of specific tax hikes, spending cuts and debt ceiling increases -- will be averted with different spending cuts, tax hikes and increasing the debt ceiling. We expect a deal. It will be unpopular with special interest groups and will thus allow each party to blame the other for its shortcomings.

The sky isn’t falling.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The U.S. Economy: Why The Sky Isn't Falling

Published 12/05/2012, 12:08 PM

Updated 07/09/2023, 06:31 AM

The U.S. Economy: Why The Sky Isn't Falling

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.